Blackberry 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

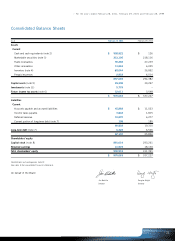

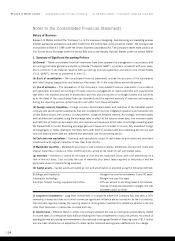

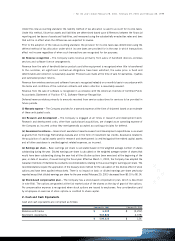

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

Cash and cash equivalents are comprised of money market investment funds, corporate bonds, bank certificates

of deposit, high grade commercial and government agency paper and government treasury bills. Carrying values

of these investments approximate market value and will generate an approximate weighted average yield of 5.3%

as at February 28, 2001. The short-term investments as at February 28, 2001 all have maturity dates of less

than three months.

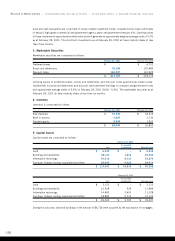

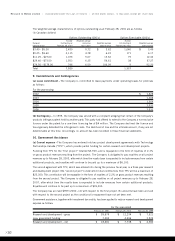

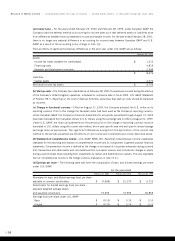

3. Marketable Securities

Marketable securities are comprised as follows:

February 28, 2001 February 29, 2000

Preferred shares $ –$ 4,702

Bonds and debentures 32,168 102,489

Discount notes 180,937 110,925

$ 213,105 $ 218,116

Carrying values of preferred shares, bonds and debentures and discount notes approximate market value.

Investments in bonds and debentures and discount notes represent holdings in corporate and government notes

with approximate average yields of 5.6% on February 28, 2001 (2000 –5.4%). The marketable securities as at

February 28, 2001 all have maturity dates of less than six months.

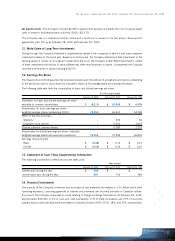

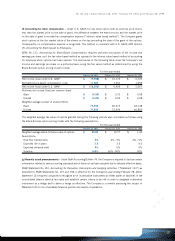

4. Inventory

Inventory is comprised as follows:

February 28, 2001 February 29, 2000

Raw materials $ 51,535 $ 32,616

Work in process 6,665 2,733

Finished goods 9,844 1,503

$ 68,044 $ 36,852

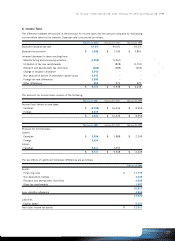

5. Capital Assets

Capital assets are comprised as follows:

February 28, 2001

Accumulated

Cost amortization Net book value

Land $ 6,845 $ –$ 6,845

Buildings and leaseholds 26,741 1,276 25,465

Information technology 41,410 8,131 33,279

Furniture, fixtures, tooling, equipment and other 39,045 9,426 29,619

$ 114,041 $ 18,833 $ 95,208

February 29, 2000

Accumulated

Cost amortization Net book value

Land $ 3,110 $ –$3,110

Buildings and leaseholds 12,528 539 11,989

Information technology 14,481 3,453 11,028

Furniture, fixtures, tooling, equipment and other 18,883 5,713 13,170

$ 49,002 $ 9,705 $ 39,297

During the prior year, land and buildings in the amount of $6,726 were acquired by the assumption of mortgages.

>26