Blackberry 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

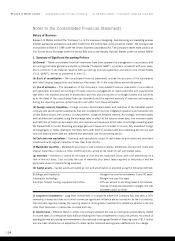

Write-Down of Long-Term Investments

The Company made several strategic long-term investments in certain technology companies in fiscal 2001,

generally representing convertible equity ownership positions of less than 10%. The Company did not exercise

significant influence with respect to any of these investees during the year. The Company undertook a

comprehensive review of these long-term investments and determined that the financial, operational and

strategic circumstances relating to most of these investments were materially and adversely different as at

February 28, 2001 than at the time the investments were originally made.

In its review of these investments for impairment the Company considered the following matters:

•most of the investees required additional funding in the near term but their prospects were limited, both in the

current public and venture capital markets

•in certain cases, the investment was made based upon a business model and/or plan that, in the Company’s

view, is no longer likely to be successfully executed, if at all

•in certain cases actual “cash burn”rates and revised estimated “costs to market”are now well in excess of

business plans, and

•technology being developed is not necessarily proprietary and hence less valuable.

The Company has also declined to participate in proposed additional fundings for certain of these investees

subsequent to initial investments.

Based upon the foregoing review, the Company determined that an impairment in the carrying values of certain

of its long-term investments had occurred during the fourth quarter; and that the decline in value was other than

temporary. Consequently the Company recorded a write-down of its investments in the amount of $14.8 million.

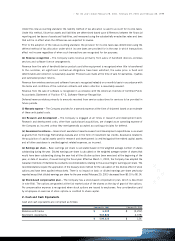

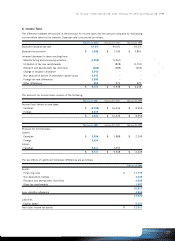

Income Taxes

Effective March 1, 2000 the Company adopted CICA Handbook Section 3465 – Income Taxes on a retroactive

basis without restatement. As a result of adopting the new accounting recommendations, the tax benefit of

previously unrecognized financing costs was reflected as an increase to share capital of $1.1 million.

The Company’s fiscal 2001 consolidated net tax provision and effective tax rate, when compared to its expected

Canadian tax rate after allowing for the manufacturing and processing profits deduction, were materially affected by:

•

the $14.8 million write-down of long-term investments. For tax purposes, this write-down would be characterized as

a capital loss and consequently results in a higher effective rate. Additionally, the Company determined that it should

record a valuation allowance against the tax recovery booked on the capital loss because management

determined

that it was more likely than not that the Company would not be able to utilize this capital loss carryforward, and

•tax rates in different foreign jurisdictions.

The Company expects its fiscal 2002 effective tax rate to be approximately 35%.

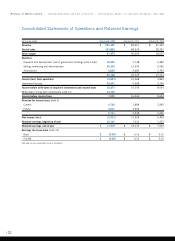

Net Income

Net income for the current year, before the write-down of long-term investments of $14.8 million, equalled $8.5

million compared to $10.5 million for fiscal 2000. This decrease, despite the growth in gross margin, was

primarily due to the increase in selling, marketing and administration and research and development costs,

with these increases being partially offset by the increase in net investment income.

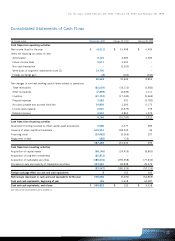

Liquidity and Capital Resources

Cash flow generated from operating activities was $5.1 million in the current fiscal year compared to cash flow

used in operating activities of $15.7 million in the prior year, an improvement of $20.8 million. Significant

increases in accounts receivable and inventory during the 2001 fiscal year, as a result of increased sales volumes,

were partially offset by increases in accounts payable, accrued liabilities and deferred revenue.

>

>17

2001 Annual Report >Research In Motion Limited