Blackberry 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

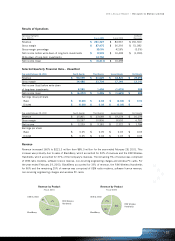

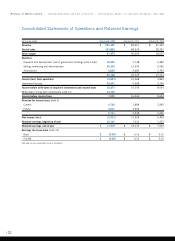

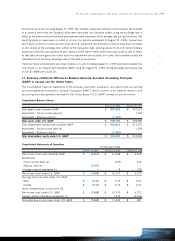

>For the years ended February 28, 2001, February 29, 2000 and February 28, 1999

>

>25

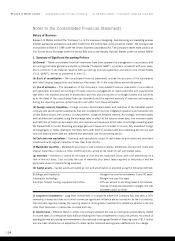

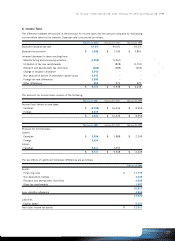

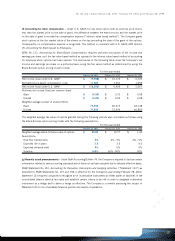

Under this new accounting standard, the liability method of tax allocation is used to account for income taxes.

Under this method, future tax assets and liabilities are determined based upon differences between the financial

reporting and tax bases of assets and liabilities, and measured using the substantially enacted tax rates and laws

that will be in effect when the differences are expected to reverse.

Prior to the adoption of the new accounting standard, the provision for income taxes was determined using the

deferral method of tax allocation under which income taxes are provided for in the year in which transactions

affect net income regardless of when such transactions are recognized for tax purposes.

(k) Revenue recognition –The Company earns revenue primarily from sales of handheld devices, wireless

services and software licence arrangements.

Revenue from the sale of handheld device products and other equipment is recognized when title is transferred

to the customer, all significant contractual obligations have been satisfied, the sales price is fixed and

determinable and collection is reasonably assured. Provisions are made at the time of sale for warranties, royalties

and estimated product returns.

Revenue from wireless services and software licences is recognized rateably on a monthly basis in accordance with

the terms and conditions of the customer contracts and when collection is reasonably assured.

Revenue from the sale of software is recognized in accordance with the American Institute of Certified Public

Accountants Statement of Position 97-2, Software Revenue Recognition.

Deferred revenue relates primarily to amounts received from service subscribers for services to be provided in

future periods.

(l) Warranty expense –The Company provides for a warranty expense at the time of shipment based on an estimate

of these anticipated costs.

(m) Research and development –The Company is engaged at all times in research and development work.

Research and development costs, other than capital asset acquisitions, are charged as an operating expense of

the Company as incurred unless they meet generally accepted accounting principles for deferral.

(n) Government assistance –Government assistance towards research and development expenditures is received

as grants from Technology Partnerships Canada and in the form of investment tax credits. Assistance related to

the acquisition of capital assets used for research and development is credited against the related capital assets

and all other assistance is credited against related expenses, as incurred.

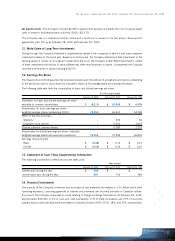

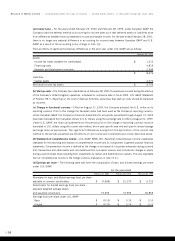

(o) Earnings per share –

Basic earnings per share is calculated based on the weighted average number of shares

outstanding during the year. Diluted earnings per share is calculated on the weighted average number of shares that

would have been outstanding during the year had all the dilutive options been exercised at the beginning of the

year, or date of issuance, if issued during the fiscal year. Effective March 1, 2000, the Company has adopted the

Canadian Institute of Chartered Accountants recommendations relating to the accounting for earnings per share. The

recommendations require the application of the treasury stock method for the calculation of the dilutive effect of stock

options and have been applied retroactively. There is no impact on basic or diluted earnings per share previously

reported except that diluted earnings per share for the year ended February 29, 2000 decreased from $0.15 to $0.14.

(p) Stock-based compensation plan –The Company has a stock-based compensation plan, which is described

in note 8(b). The options are granted at the fair market value of the shares on the day of grant of the options.

No compensation expense is recognized when stock options are issued to employees. Any consideration paid

by employees on exercise of stock options is credited to share capital.

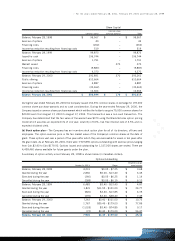

2. Cash and Cash Equivalents

Cash and cash equivalents are comprised as follows:

February 28, 2001 February 29, 2000

Balances with banks $ 6,002 $ (2,252)

Short-term investments 502,820 2,378

$ 508,822 $ 126