Blackberry 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

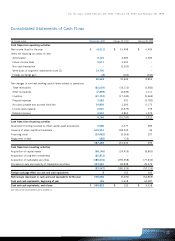

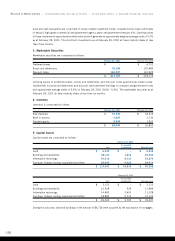

Cash flow from financing activities equalled $587.5 million for the year, including net proceeds after costs of

$580.2 million from the public offering of six million common shares compared to $186.9 million in the prior

year, primarily attributable to the issue of 6,081,913 common shares.

Cash flow used in investing activities equalled $83.9 million for the year ended February 28, 2001, including

capital expenditures of $68.1 million and the acquisition of long-term investments of $20.8 million. Capital

expenditures in the prior year amounted to $24.4 million.

Cash, cash equivalents and marketable securities increased by $503.7 million to $721.9 million at February

28, 2001 compared to $218.2 million at February 29, 2000 due primarily to the net proceeds of $580.2 million

with respect to the public offering of six million common shares completed in the third quarter of fiscal 2001.

Cash, cash equivalents and marketable securities accounted for 74% of total assets at February 28, 2001 compared

to 65% in the prior year.

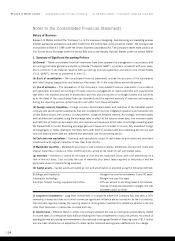

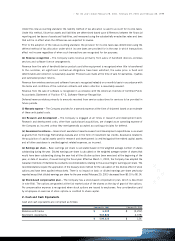

Market Risk of Financial Instruments

The Company is engaged in operational and financing activities that generate risk in generally three primary areas:

Foreign Exchange

The majority of the Company’s revenues and purchases of raw materials are denominated in U.S. dollars while

other operating expenses, consisting primarily of salaries and overhead expenses, are incurred primarily in

Canadian dollars. As a result, the Company is exposed to a risk relating to foreign exchange fluctuations in

the relationship between the Canadian and U.S. dollar. The Company employs forward contracts to manage its

exposure to fluctuations in foreign currency exchange rates. As at February 28, 2001 the Company has entered

into foreign exchange contracts to sell U.S. dollars and purchase Canadian dollars with an aggregate notional

value amount of U.S. $44.5 million. These contracts mature at varying dates with the latest being February 22,

2002. The fair value of the contracts approximates the notional value as at February 28, 2001.

The majority of the Company’s cash, cash equivalents and marketable securities are denominated in U.S. dollars.

The remaining Canadian dollar amount as at February 28, 2001 will be utilized during the first quarter of fiscal

2002 for Canadian dollar payroll, operating expense and capital expenditure purposes.

Interest Rate

Cash, cash equivalents and marketable securities are invested in certain instruments of varying short maturities;

consequently the Company is exposed to fluctuations in interest rates.

Marketable securities are subject to market risk in that their value will fluctuate as a result of changes in

market prices. The Company intends to hold all marketable securities investments until maturity and not realize

any trading gains or losses. In order to reduce credit risk, the Company has invested only in securities of investment

grade. Marketable securities from one issuer comprised 14% of the total marketable securities.

When its cash equivalents and marketable securities investments mature and are then rolled over at lower

interest rates during the first six months of 2002, the Company expects its average yield to decline significantly

from the average yields realized during the fourth quarter of fiscal 2001, as a result of recent declines in the

U.S. prime interest rate.

Credit and Customer Concentration

The Company is undergoing significant external sales growth and the resulting growth in its customer base in

terms of both numbers and increased credit limits on some occasions. The Company, in the normal course of

business, monitors the financial condition of its customers and reviews the credit history of each new customer.

The Company establishes an allowance for doubtful accounts that corresponds to the specific credit risk of

its customers, historical trends and economic circumstances. The Company also places insurance coverage

for a portion of its foreign trade receivables with Export Development Corporation.

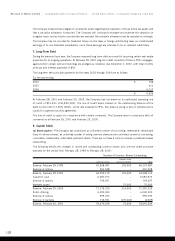

While the Company sells to a variety of customers, at February 28, 2001 one customer comprised 25% of

trade receivables. In addition, sales to the Company’s one major customer accounted for 18% of total sales.

Approximately 8% of sales are to customers outside of the United States. The Company expects its percentage

of total sales outside of the United States to increase in fiscal 2002 as a result of executing its planned

expansion of its revenue base into the U.K. and continental Europe.

>18

Research In Motion Limited >2001 Annual Report