Blackberry 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

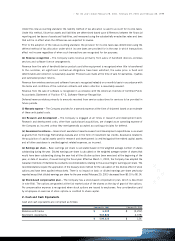

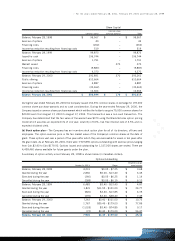

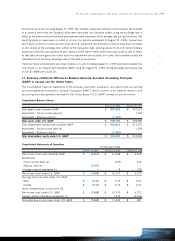

>For the years ended February 28, 2001, February 29, 2000 and February 28, 1999

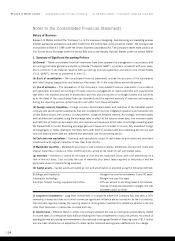

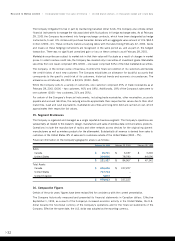

(b) Capital assets –The Company received $2,585 in government assistance towards the cost of capital assets

used in research and development activities (2000 –$2,177).

The Company was in compliance with all terms and conditions in respect to its two project development

agreements with TPC as at February 28, 2001 and February 29, 2000.

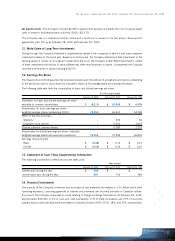

11. Write-Down of Long-Term Investments

During the year, the Company undertook a comprehensive review of the companies in which it had made long-term

investments earlier in the fiscal year. Based upon that review, the Company determined that impairment in the

carrying values of certain of its long-term investments did occur; the Company further determined that for certain

of these investments the decline in value suffered was other than temporary in nature. Consequently the Company

recorded a write-down in values totalling $14,750.

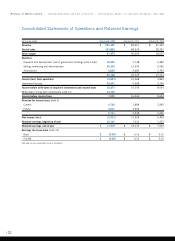

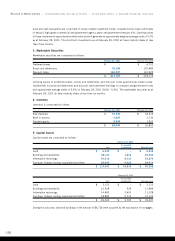

12. Earnings Per Share

The treasury stock method assumes that proceeds received upon the exercise of all warrants and options outstanding

in the period are used to repurchase the Company’s shares at the average share price during the period.

The following table sets forth the computation of basic and diluted earnings per share.

For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Numerator for basic and diluted earnings per share

available to common stockholders $ (6,211) $ 10,498 $ 6,409

Denominator for basic earnings per share –

weighted average shares outstanding (000’s) 73,555 66,613 64,148

Effect of dilutive securities:

Warrants –180 64

Employee stock options –6,203 2,643

Dilutive potential common shares: –6,383 2,707

Denominator for diluted earnings per share –adjusted

weighted average shares and assumed conversions 73,555 72,996 66,855

Earnings (loss) per share

Basic $ (0.08) $ 0.16 $ 0.10

Diluted $ (0.08) $ 0.14 $ 0.10

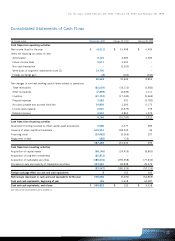

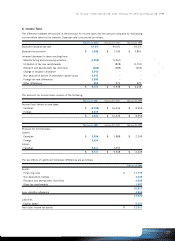

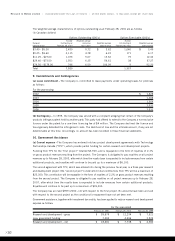

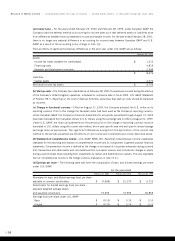

13. Statement of Cash Flows Supplemental Information

The following summarizes interest and income taxes paid:

Year ended

February 28, 2001 February 29, 2000 February 28, 1999

Interest paid during the year $ 456 $ – $ –

Income taxes paid during the year 897 756 389

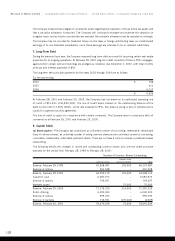

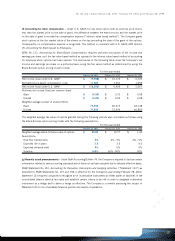

14. Financial Instruments

The majority of the Company’s revenues and purchases of raw materials are realized in U.S. dollars while other

operating expenses, consisting generally of salaries and overhead, are incurred primarily in Canadian dollars.

As a result, the Company is exposed to a risk relating to foreign exchange fluctuations. At February 28, 2001,

approximately $16,426 or 3% of cash and cash equivalents, 11% of trade receivables and 27% of accounts

payable and accrued liabilities are denominated in Canadian dollars (2000–157%, 18%, and 25%, respectively). >

>31