Blackberry 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

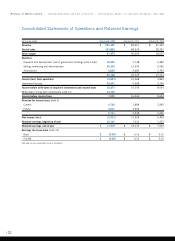

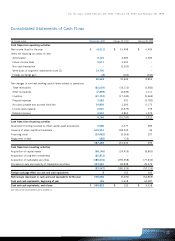

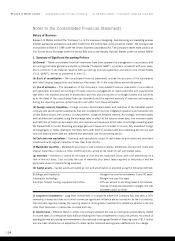

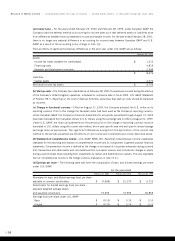

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

The Company believes that a degree of uncertainty exists regarding the realization of those future tax assets and

that a valuation allowance is required. The Company will continue to evaluate and examine the valuation on

a regular basis, and as future uncertainties are resolved, the valuation allowance may be adjusted accordingly.

The Company has not provided for Canadian future income taxes or foreign withholding taxes on undistributed

earnings of its non-Canadian subsidiaries, since these earnings are intended to be re-invested indefinitely.

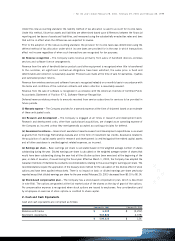

7. Long-Term Debt

During the previous fiscal year, the Company assumed long-term debt as a result of acquiring certain real estate

properties for its ongoing operations. At February 28, 2001 long-term debt consisted of three 6.75% mortgages,

against which certain land and buildings are pledged as collateral, due December 1, 2003, with total monthly

principal and interest payments of $52.

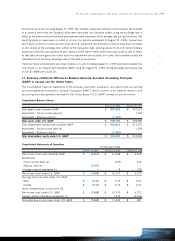

The long-term debt principal payments for the years 2002 through 2004 are as follows:

For the year ending

2002 $ 198

2003 211

2004 6,117

$ 6,526

At February 28, 2001 and February 29, 2000, the Company had not drawn on its authorized operating line

of credit of $13,000 (Cdn.$20,000). The line of credit bears interest on the outstanding balance at the

bank’s prime rate of 7.25% (2000 –prime rate equalled 6.75%). Any balance owing is due on demand and is

subject to a general security agreement.

The line of credit is subject to compliance with certain covenants. The Company was in compliance with all

covenants as at February 28, 2001 and February 29, 2000.

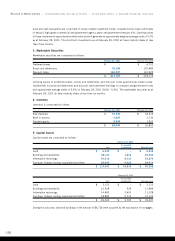

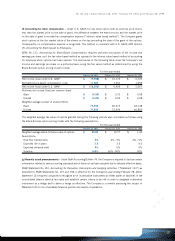

8. Capital Stock

(a) Share capital –The Company has authorized an unlimited number of non-voting, redeemable, retractable

Class A common shares, an unlimited number of voting common shares and an unlimited number of non-voting,

cumulative, redeemable, retractable preferred shares. There are no Class A common shares or preferred shares

outstanding.

The following details the changes in issued and outstanding common shares and common share purchase

warrants for the period from February 28, 1998 to February 28, 2001:

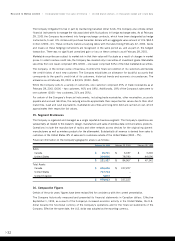

Number of Common Shares Outstanding

Common share

Common shares purchase warrants Total

Balance, February 28, 1998 63,968,087 139,000 64,107,087

Exercise of options 291,028 –291,028

Balance, February 28, 1999 64,259,115 139,000 64,398,115

Issued for cash 6,081,913 –6,081,913

Exercise of options 795,297 –795,297

Warrants issued –75,000 75,000

Balance, February 29, 2000 71,136,325 214,000 71,350,325

Public offering 6,000,000 –6,000,000

Exercise of options 999,793 –999,793

Exercise of warrants 134,391 (139,000) (4,609)

Balance, February 28, 2001 78,270,509 75,000 78,345,509

>28