Bed, Bath and Beyond 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND PROXY STATEMENT

60

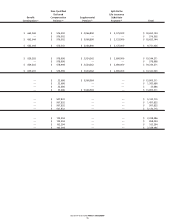

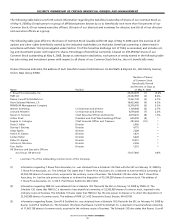

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table below sets forth certain information regarding the beneficial ownership of shares of our Common Stock as

of May 9, 2008 by (i) each person or group of affiliated persons known by us to beneficially own more than five percent of our

Common Stock; (ii) our named executive officers; (iii) each of our directors and nominees for director; and (iv) all of our directors

and executive officers as a group.

The following table gives effect to the shares of Common Stock issuable within 60 days of May 9, 2008 upon the exercise of all

options and other rights beneficially owned by the indicated stockholders on that date. Beneficial ownership is determined in

accordance with Rule 13d-3 promulgated under Section 13 of the Securities Exchange Act of 1934, as amended, and includes vot-

ing and investment power with respect to shares. Percentage of beneficial ownership is based on 259,593,922 shares of our

Common Stock outstanding at May 9, 2008. Except as otherwise noted below, each person or entity named in the following table

has sole voting and investment power with respect to all shares of our Common Stock that he, she or it beneficially owns.

Unless otherwise indicated, the address of each beneficial owner listed below is c/o Bed Bath & Beyond Inc., 650 Liberty Avenue,

Union, New Jersey 07083.

Number of Shares

of Common Stock

Beneficially Owned

and Percent of Class as

Name Position of May 9, 2008

T. Rowe Price Associates, Inc. 35,254,239 (1) 13.6%

FMR LLC 22,342,959 (2) 8.6%

Ruane, Cunniff & Goldfarb Inc. 17,467,138 (3) 6.7%

Davis Selected Advisers, L.P. 16,423,460 (4) 6.3%

PRIMECAP Management Company 13,376,076 (5) 5.2%

Warren Eisenberg Co-Chairman and Director 7,129,948 (6) 2.7%

Leonard Feinstein Co-Chairman and Director 5,679,248 (7) 2.2%

Steven H. Temares Chief Executive Officer and Director 2,679,670 (8) 1.0%

Arthur Stark President and Chief Merchandising Officer 630,309 (9) *

Eugene A. Castagna Chief Financial Officer and Treasurer 297,654 (10) *

Dean S. Adler Director 5,905 *

Stanley F. Barshay Director 4,775 *

Klaus Eppler Director 7,289 *

Patrick R. Gaston Director 1,875 *

Jordan Heller Director 3,626 *

Robert S. Kaplan Director 10,351 *

Victoria A. Morrison Director 2,556 *

Fran Stoller Director 1,552 *

All Directors and Executive Officers

as a Group (14 persons) 17,077,892 6.6%

* Less than 1% of the outstanding common stock of the Company.

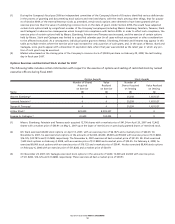

(1) Information regarding T. Rowe Price Associates, Inc. was obtained from a Schedule 13G filed with the SEC on February 13, 2008 by

T. Rowe Price Associates, Inc. The Schedule 13G states that T. Rowe Price Associates, Inc. is deemed to have beneficial ownership of

35,254,239 shares of common stock, acquired in the ordinary course of business. The Schedule 13G also states that T. Rowe Price

Associates, Inc. has the sole power to dispose or to direct the disposition of 35,190,539 shares of common stock. The address of

T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, MD 21202.

(2) Information regarding FMR LLC was obtained from a Schedule 13G filed with the SEC on February 14, 2008 by FMR LLC. The

Schedule 13G states that FMR LLC is deemed to have beneficial ownership of 22,342,959 shares of common stock, acquired in the

ordinary course of business. The Schedule 13G also states that FMR LLC has the sole power to dispose or to direct the disposition of

22,342,959 shares of common stock. The address of FMR LLC is 82 Devonshire Street, Boston, MA 02109.

(3) Information regarding Ruane, Cunniff & Goldfarb Inc. was obtained from a Schedule 13G filed with the SEC on February 14, 2008 by

Ruane, Cunniff & Goldfarb Inc. The Schedule 13G states that Ruane, Cunniff & Goldfarb Inc. is deemed to have beneficial ownership

of 17,467,138 shares of common stock, acquired in the ordinary course of business. The Schedule 13G also states that Ruane, Cunniff