Bed, Bath and Beyond 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2007

8

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally higher in August,

November and December, and generally lower in February and April.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year. There can

be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

RECENT ACCOUNTING PRONOUNCEMENTS

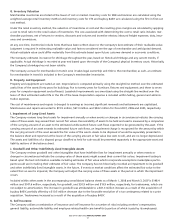

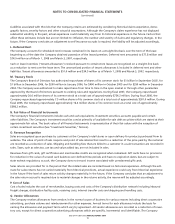

In June 2006, the FASB issued FIN 48. FIN 48 addresses the determination of whether tax benefits claimed or expected to be

claimed on a tax return should be recorded in the financial statements. Under FIN 48, a company may recognize the tax benefit

from uncertain tax positions only if it is at least more likely than not that the tax position will be sustained on examination by the

taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such

a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon

settlement with the taxing authorities. FIN 48 also provided guidance on derecognition, classification, interest and penalties on

income taxes, accounting in interim periods and requires increased disclosures.

On March 4, 2007, the Company adopted FIN 48 and recognized a $13.1 million increase to Retained earnings to reflect the

change to its liability for unrecognized tax benefits as required. The Company also recorded additional unrecognized tax benefits,

and corresponding higher deferred tax assets, of $35.6 million as a result of the adoption.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.”

SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and

expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require or

permit fair value measurements and accordingly, does not require any new fair value measurements. SFAS No. 157 is effective for

fiscal years beginning after November 15, 2007. The FASB has issued a one-year deferral of SFAS No. 157’s fair value measurement

requirements for non-financial assets and liabilities that are not required or permitted to be measured at fair value on a recurring

basis. Although SFAS No. 157 will require additional disclosures about fair value measurements, the Company does not expect the

adoption of SFAS No. 157 to have a material impact on its consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-Including an

amendment of FASB Statement No. 115.” SFAS No. 159 permits companies to choose to measure certain financial assets and liabili-

ties at fair value (the “fair value option”). If the fair value option is elected, any upfront costs and fees related to the item must

be recognized in earnings and cannot be deferred, e.g. debt issue costs. The fair value election is irrevocable and may generally be

made on an instrument-by-instrument basis, even if a company has similar instruments that it elects not to fair value. At the adop-

tion date, unrealized gains and losses on existing items for which fair value has been elected are reported as a cumulative adjust-

ment to beginning retained earnings. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company

does not believe the adoption of SFAS No. 159 will have a material impact on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations.” SFAS No. 141R establishes principles and

requirements for how the acquirer in a business combination recognizes and measures in its financial statements the identifiable

assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at the acquisition date fair value. SFAS No.

141R determines what information to disclose to enable users of the financial statements to evaluate the nature and financial

effects of the business combination. SFAS No. 141R applies prospectively to business combinations for which the acquisition date is

on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Early adoption is not per-

mitted.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)