Bed, Bath and Beyond 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH& BEYOND PROXY STATEMENT

51

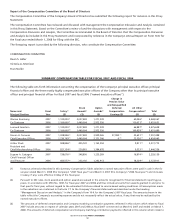

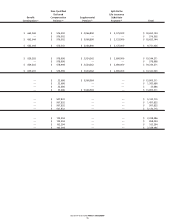

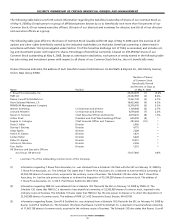

fiscal 2006 include amounts in respect of calendar years 2006 and 2007 as fiscal year 2006 commenced on February 26, 2006 and

ended on March 3, 2007. Thus, certain matching contributions noted below exceed the single calendar year limitation.

(4) For fiscal 2007, Mr. Eisenberg deferred $268,171 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Such amount is also reported in the Deferred Compensation Table below.

(5) For fiscal 2007, includes tax preparation services, car service and car allowance with an incremental cost to the Company of $22,988,

$4,537 and $26,071, respectively, and an employer nonqualified deferred compensation plan matching contribution of $6,750.

(6) For fiscal 2006, Mr. Eisenberg deferred $264,423 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan.

(7) For fiscal 2006, includes tax preparation services, car service and car allowance with an incremental cost to the Company of $22,525,

$55,548 and $25,398, respectively, and an employer nonqualified deferred compensation plan matching contribution of $6,600.

(8) For fiscal 2007, Mr. Feinstein deferred $270,920 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Such amount is also reported in the Deferred Compensation Table below.

(9) For fiscal 2007, includes tax preparation services, car service and car allowance with an incremental cost to the Company of $22,987,

$4,537 and $32,613, respectively, and an employer nonqualified deferred compensation plan matching contribution of $6,750.

(10) For fiscal 2006, Mr. Feinstein deferred $264,423 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan.

(11) For fiscal 2006, includes tax preparation services, car service and car allowance with an incremental cost to the Company of $22,525,

$51,087 and $29,727, respectively, and an employer nonqualified deferred compensation plan matching contribution of $6,600.

(12) For fiscal 2007, Mr. Temares deferred $15,769 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Such amount is also reported in the Deferred Compensation Table below. Mr. Temares contributed

$8,580 of his salary to the Bed Bath & Beyond Inc. 401(k) Savings Plan (the “Company 401(k)”).

(13) The actuarial present value of the benefits payable under the supplemental executive retirement benefit agreement with Mr. Temares

increased from fiscal 2006 to fiscal 2007. See “Potential Payments Upon Termination or Change in Control – Messrs. Temares,

Castagna and Stark” below.

(14) For fiscal 2007, includes car allowance with an incremental cost to the Company of $16,871 and employer 401(k) plan and nonquali-

fied deferred compensation plan matching contributions of $6,750.

(15) For fiscal 2006, Mr. Temares deferred $10,769 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Mr. Temares contributed $9,635 of his salary to the Company 401(k).

(16) The actuarial present value of the benefits payable under the supplemental executive retirement benefit agreement with Mr. Temares

decreased from fiscal 2005 to fiscal 2006.

(17) For fiscal 2006, includes car allowance with an incremental cost to the Company of $15,026 and an employer 401(k) plan and non-

qualified deferred compensation plan matching contributions of $7,500.

(18) For fiscal 2007, Mr. Stark deferred $232,212 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Such amount is also reported in the Deferred Compensation Table below. Mr. Stark contributed $5,000

of his salary to the Company 401(k).

(19) For fiscal 2007, includes car allowance with an incremental cost to the Company of $3,162 and employer 401(k) plan and nonqualified

deferred compensation plan matching contributions of $6,749.

(20) For fiscal 2006, Mr. Stark deferred $205,289 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Mr. Stark contributed $5,000 of his salary to the Company 401(k).

(21) For fiscal 2006, includes car allowance with an incremental cost to the Company of $2,923 and an employer 401(k) plan and nonquali-

fied deferred compensation plan matching contributions of $6,600.

(22) For fiscal 2007, Mr. Castagna deferred $52,827 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Such amount is also reported in the Deferred Compensation Table below. Mr. Castagna contributed

$4,781 of his salary to the Company 401(k).

(23) For fiscal 2007, includes car allowance with an incremental cost to the Company of $10,522 and employer 401(k) plan and nonquali-

fied deferred compensation plan matching contributions of $6,352.

(24) For fiscal 2006, Mr. Castagna deferred $40,673 of his salary reported above pursuant to the terms of the Company’s Nonqualified

Deferred Compensation Plan. Mr. Castagna contributed $8,866 of his salary to the Company 401(k).

(25) For fiscal 2006, includes car allowance with an incremental cost to the Company of $11,114 and an employer 401(k) plan and non-

qualified deferred compensation plan matching contributions of $7,115.