Bed, Bath and Beyond 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH& BEYOND PROXY STATEMENT

47

Accordingly, beginning with its 2005 fiscal year, the Company changed its overall approach to equity compensation and has, since

that time, made equity awards comprised of a combination of stock options and restricted stock to all executive officers, including

the named executive officers, and a small number of other officers. Commencing in fiscal 2007, these grants are made on May 10

of each year (or the following trading day should such date fall on a weekend or holiday). Consistent with the Company’s historic

practice, the stock options vest over time, subject, in general, to the named executive officers remaining employed by the

Company on specified vesting dates. Vesting of the restricted stock awarded to these named executive officers is dependent on (i)

the Company’s achievement of a performance-based test for the fiscal year in which the grant is made, and (ii) assuming achieve-

ment of the performance-based test, time vesting, subject, in general, to the executive remaining in the Company’s employ on the

specified vesting dates. The performance-based test requires that the Company’s net income in the fiscal year exceed the

Company’s net income in the prior fiscal year or that the Company’s net income as a percentage of sales place it in the top half of

the companies in the S&P Retailing Index with respect to such measurement. Net income is adjusted for such purpose to reflect (i)

mergers, acquisitions, consolidations or dispositions, (ii) changes in accounting methods, and (iii) extraordinary items, as defined in

APB 30, or stock repurchase or dividend activity. The Company believes that this performance-based test meets the standard for

performance-based compensation under the Internal Revenue Code, so that the restricted stock awards will be deductible com-

pensation for certain executives if their annual compensation exceeds $1 million. For fiscal 2007, the performance-based test was

satisfied in that the Company’s net income as a percentage of sales for the prior fiscal year placed it in the top half of the S&P

Retailing Index (the Company placed 6th with respect to such measurement out of the 31 companies in such Index, which consist-

ed of Abercrombie & Fitch, Amazon.com, AutoNation, AutoZone, Best Buy, Big Lots, Circuit City, Dillards, Expedia, Family Dollar,

Gamestop, Gap, Genuine Parts, Home Depot, IAC InterActive, J.C. Penney, Kohl’s, Limited Brands, Lowe’s, Macy’s, Nordstrom,

Office Depot, Office Max, Radio Shack, Sears, Sherwin-Williams, Staples, Target, Tiffany & Co. and TJX Companies).

All executives (other than those discussed in the preceding paragraph) and associates awarded incentive compensation receive

grants consisting solely of restricted stock. Vesting of restricted stock awarded to these employees is based solely on time-vesting

with no performance-based test.

All awards of restricted stock and stock options are made under the Company’s 2004 Incentive Compensation Plan, approved

by the Company’s shareholders, which is the only equity incentive plan under which the Company can currently make awards of

equity compensation.

Senior Executive Compensation

In addition to considering the Company’s compensation policies generally, the Compensation Committee reviews executive

compensation and concentrates on the compensation packages for the Company’s named executive officers, namely, the Co-

Chairmen (Warren Eisenberg and Leonard Feinstein, who are the Company’s Co-Founders) and the Chief Executive Officer

(Steven H. Temares), believing that these three named executive officers are the most important and influential in determining

the continued success of the Company. The Company has enjoyed considerable success in the 16 years it has been a public compa-

ny, with, until the challenging economic environment encountered in the latter part of fiscal 2007, revenue and comparable store

sales growth in each quarter (and each year) since its initial public offering in 1992 and record earnings.

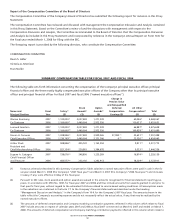

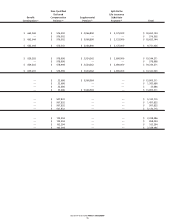

Cash compensation of the three senior executives has been held to comparatively modest levels when compared with companies

of comparable size and earnings. The base salaries of the Co-Chairmen for fiscal 2008 are $1,100,000, the same as they were for

the prior three years. The base salary of the Chief Executive Officer has been increased in annual increments of $100,000 during

the prior three years and in fiscal 2008 was increased by $150,000 to $1,500,000. No cash bonuses are paid.

In each of fiscal years 2005, 2006 and 2007, the Compensation Committee awarded stock options (in addition to restricted stock)

to the named executive officers since stock options reward the named executive officers only if shareholder values are increased.

In each such year, the stock option awards were 200,000 shares to the Chief Executive Officer and 100,000 shares to each of the

Co-Chairmen. In making the awards in these number of shares, the Committee considered the fair value of these options deter-

mined in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation” or SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”). In addition, in each such year, the

Compensation Committee awarded shares of restricted stock having a market value on the date of grant of $2,400,000 to each of

the Chief Executive Officer and the Co-Chairmen.