Bed, Bath and Beyond 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND PROXY STATEMENT

42

RATIFICATION OF APPOINTMENT OF AUDITORS (PROPOSAL 2)

Who has been appointed as the Auditors?

The Audit Committee has appointed KPMG LLP to serve as our independent auditors for fiscal 2008, subject to ratification by

our shareholders. Representatives of KPMG LLP will be present at the Annual Meeting to answer questions. They will also have

the opportunity to make a statement if they desire to do so. If the proposal to ratify their appointment is not approved, other

certified public accountants will be considered by the Audit Committee. Even if the proposal is approved, the Audit Committee,

in its discretion, may direct the appointment of new independent auditors at any time during the year if it believes that such a

change would be in the best interest of the Company and its shareholders.

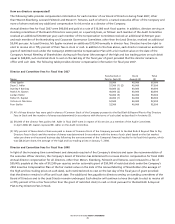

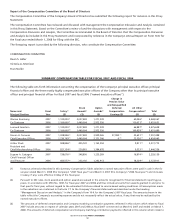

What were the fees incurred by the Company for professional services rendered by KPMG LLP?

The fees incurred by the Company for professional services rendered by KPMG LLP for fiscal 2007 and 2006 were as follows:

2007 2006

Audit Fees $ 1,510,060 $ 1,694,675

Audit-Related Fees 105,000 583,644

Tax Fees 521,982 106,096

$ 2,137,042 $ 2,384,415

In fiscal 2007 and fiscal 2006, audit fees included fees associated with the annual audit of the Company’s financial statements,

the assessment of the Company’s internal control over financial reporting as integrated with the annual audit of the Company’s

financial statements and the quarterly reviews of the financial statements included in its Form 10-Q filings. In fiscal 2007 and 2006,

audit-related fees included fees associated with respect to the setting of exercise prices for employee stock options and related

matters. In fiscal 2007, tax fees included fees associated with tax planning, tax compliance (including review of tax returns)

and tax advice (including tax audit assistance). In fiscal 2006, tax fees included fees associated with tax compliance (including

review of tax returns) and tax advice (including tax audit assistance). The Audit Committee has concluded that the provision of

the foregoing services is compatible with maintaining KPMG LLP’s independence.

In accordance with the Audit Committee charter, the Audit Committee must pre-approve all audit and non-audit services provided

to the Company by its outside auditor. To the extent permitted by applicable laws, regulations and NASDAQ rules, the Committee

may delegate pre-approval of audit and non-audit services to one or more members of the Committee. Such member(s) must then

report to the full Committee at its next scheduled meeting if such member(s) pre-approved any audit or non-audit services.

In fiscal 2007 and fiscal 2006, all (100%) audit-related and tax services were pre-approved in accordance with the Audit Committee

charter.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE RATIFICATION

OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT AUDITORS FOR FISCAL 2008.

AUDIT COMMITTEE REPORT

The Board of Directors has determined that the membership of the Audit Committee meets the SEC and NASDAQ independence

and experience requirements. The Board of Directors has also determined that Mr. Heller qualifies as an “Audit Committee

Financial Expert.”

In each case as then constituted: the Audit Committee discussed the auditors’ review of quarterly financial information with the

auditors prior to the release of that information and the filing of the Company’s quarterly reports with the SEC; the Audit

Committee also met and held discussions with management and the independent auditors with respect to the audited year end

financial statements. Further, the Committee discussed with the independent auditors the matters required to be discussed by

statement on Auditing Standards No. 61, as amended (Communication with Audit Committees), received the written disclosures

and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence

Discussions with Audit Committees) and discussed with the auditors the auditors’ independence. The Committee also discussed

with the auditors and the Company’s financial management matters related to the Company’s internal control over financial