Bed, Bath and Beyond 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2007

23

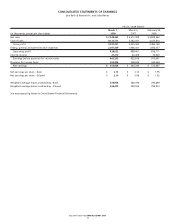

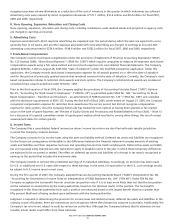

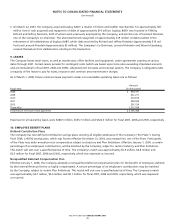

6. INVESTMENT SECURITIES

The Company’s investment securities as of March 1, 2008 and March 3, 2007 are as follows:

March 1, March 3,

(in millions) 2008 2007

Available-for-sale securities:

Short term $— $ 378.0

Long term 319.5 —

319.5 378.0

Trading Securities:

Short term —3.4

Long term 6.4 —

6.4 3.4

Held-to-maturity securities:

Short term —393.5

Long term 0.1 102.7

0.1 496.2

Total investment securities $ 326.0 $ 877.6

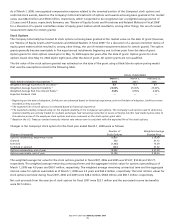

Available-for-sale securities

As of March 1, 2008, the Company had approximately $326.7 million par value of auction rate securities, less a temporary

valuation adjustment of approximately $7.2 million to reflect the current lack of liquidity of these investments. Since this

valuation adjustment is deemed to be temporary, it was recorded in other comprehensive income, net of the related tax benefit

of $2.7 million, and did not affect the Company’s earnings for fiscal 2007. The Company reclassified these investments to long

term investment securities at March 1, 2008 to reflect the current lack of liquidity of these investments. All of these investments

carry triple-A credit ratings from one or more of the major credit rating agencies. Approximately $283.5 million of these securities

at par are invested in preferred shares of closed end municipal bond funds, which are required, pursuant to the Investment

Company Act of 1940, to maintain minimum asset coverage ratios of 200%. The remaining approximate $43.2 million at par are

invested in securities collateralized by student loans which are currently more than 100% collateralized and with approximately

90% of such collateral in the aggregate being guaranteed by the United States government. None of the auction rate securities

held by the Company are mortgage-backed debt obligations.

The Company’s auction rate securities carry interest rates that reset periodically, every 7, 28 or 35 days, through an auction process.

Due to current market conditions, these investments have experienced failed auctions beginning in mid-February 2008. These

failed auctions result in a lack of liquidity in the securities, but do not affect the underlying collateral of the securities. Upon the

auction failures of the securities held by the Company, the interest rates reset based on a predetermined maximum contractual

rate, which is nominally higher than the interest rates earned prior to the auction failures. The Company continues to earn and

receive interest on these securities. The Company’s auction rate securities will continue to be presented for auction every 7, 28

or 35 days until the auction succeeds, the issuer calls the security, or they mature, as in the case of securities collateralized by

student loans.

Trading securities

The Company’s trading securities, which are provided as investment options to the participants of the nonqualified deferred

compensation plan, are stated at fair market value. (See “Employee Benefit Plans,” Note 10).

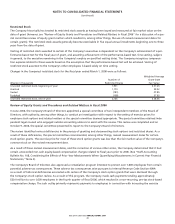

Held-to-maturity securities

As of March 3, 2007, the Company’s held-to-maturity investment securities consisted of U.S. Government Agency debt securities

and municipal debt securities. Actual maturities could differ from contractual maturities because borrowers have the right to call

certain obligations. As of March 3, 2007, the fair value of short term and long term held-to-maturity securities was $393.0 million

and $102.5 million, respectively. As of March 3, 2007, the Company had gross unrecognized holding losses of approximately

$1.3 million, relating to held-to-maturity investment securities with fair values totaling $405.8 million.