Bed, Bath and Beyond 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH& BEYOND ANNUAL REPORT 2007

27

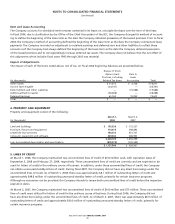

Defined Benefit Plan

The Company has a non-contributory defined benefit pension plan for the CTS employees, hired on or before July 31, 2003,

who meet specified age and length-of-service requirements. The benefits are based on years of service and the employee’s com-

pensation near retirement. The Company utilizes a December 31 measurement date for this plan. In fiscal 2006, the Company

adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an Amendment of

FASB Statements No. 87, 88, 106 and 132(R),” on a prospective basis. SFAS No. 158 requires an employer to recognize the over-

funded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of financial position

and recognize changes in the funded status in the year in which the changes occur. For the years ended March 1, 2008 and March

3, 2007, the net periodic pension cost was not material to the Company’s results of operations. The Company has a $0.7 million

and $1.1 million liability, which is included in deferred rent and other liabilities as of March 1, 2008 and March 3, 2007, respective-

ly. In addition, as of March 1, 2008 and March 3, 2007, the Company recognized $3.6 million, net of the related tax benefit of

$2.2 million, and $4.4 million, net of the related tax benefit of $2.6 million, respectively, within accumulated other comprehensive

(loss) income.

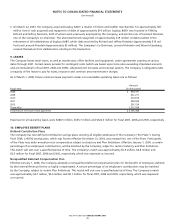

11. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its Co-Chairmen, which extend through June 2010. The agreements

provide for a base salary (which may be increased by the Board of Directors), termination payments, post-retirement benefits

and other terms and conditions of employment. In addition, the Company maintains employment agreements with other

executives which provide for severance pay and, in some instances, certain other supplemental retirement benefits.

The Company is involved in various claims and legal actions arising in the ordinary course of business. In the opinion of manage-

ment, the ultimate disposition of these matters will not have a material adverse effect on the Company’s consolidated financial

position, results of operations or liquidity.

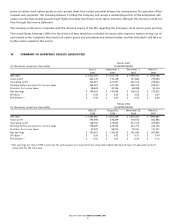

12. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $359.9 million, $388.4 million and $338.7 million in fiscal 2007, 2006 and 2005, respectively.

The Company recorded an accrual for capital expenditures of $36.6 million, $53.9 million and $49.6 million as of March 1, 2008,

March 3, 2007 and February 25, 2006, respectively.

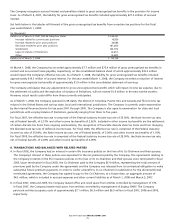

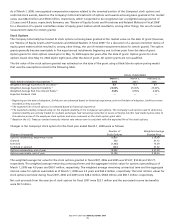

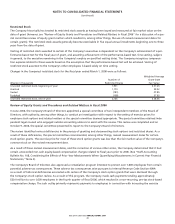

13. STOCK-BASED COMPENSATION

The Company records stock-based compensation under the provisions of SFAS No. 123R which requires companies to measure

all employee stock-based compensation awards using a fair value method and record such expense in its consolidated financial

statements. The Company adopted SFAS No. 123R on August 28, 2005 (the “date of adoption”) under the modified prospective

application. Under this application, the Company records stock-based compensation expense for all awards granted on or after

the date of adoption and for the portion of previously granted awards that remained unvested at the date of adoption. Currently,

the Company’s stock-based compensation relates to restricted stock awards and stock options. The Company’s restricted stock

awards are considered nonvested share awards as defined under SFAS No. 123R.

Prior to the third quarter of fiscal 2005, the Company applied the provisions of APB No. 25 as permitted under SFAS No. 148.

During the first half of fiscal 2005, which ended on August 27, 2005, the Company recognized compensation expense for restrict-

ed stock awards over the service period, but did not recognize compensation expense for stock options, since the Company

historically has treated its stock options as having been granted at fair market value on the date of grant (however, see “Review

of Equity Grants and Procedures and Related Matters in Fiscal 2006” for a discussion of a special committee review of equity grant

matters which resulted in, among other things, the use of revised measurement dates for certain grants).