Bed, Bath and Beyond 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH& BEYOND ANNUAL REPORT 2007

9

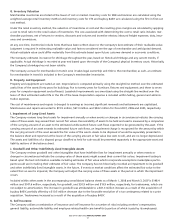

REVIEW OF EQUITY GRANTS AND PROCEDURES AND RELATED MATTERS IN FISCAL 2006

As a result of revised measurement dates for certain stock option grants, and the correction of various other errors, the Company

determined that it had certain unrecorded non-cash equity-based compensation charges of $61.8 million, including related tax

items related to fiscal years prior to 2006. In accordance with the provisions of Staff Accounting Bulletin (“SAB”) No. 108,

“Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,”

the Company decreased beginning Retained earnings for fiscal 2006 by $61.8 million within the accompanying Consolidated

Financial Statements.

The Company’s Board of Directors also approved a remediation program intended to protect over 1,600 employees from certain

potential adverse tax consequences. These adverse tax consequences arise pursuant to Internal Revenue Code Section 409A as

a result of historical deficiencies associated with certain of the Company’s stock option grants that were disclosed through

the Company’s stock option review. As a result of this program, the Company made cash payments totaling approximately

$30.0 million to over 1,600 employees in the fourth quarter of fiscal 2006, which resulted in a non-recurring, pre-tax stock-based

compensation charge. The cash outlay primarily represented payments to employees in connection with increasing the exercise

prices on certain stock option grants so as to protect them from certain potential adverse tax consequences. No executive officer

received such payments. The Company believes it is likely the Company will recoup a substantial portion of the anticipated cash

outlay over the next several years through higher proceeds from future stock option exercises, although this recovery would not

flow through the income statement.

The Company also filed a Form 8-K dated December 28, 2006 which provides further details regarding the remediation program.

The Company continues to cooperate with the inquiry of the SEC regarding the Company’s stock option grant practices.

The United States Attorney’s Office for the District of New Jersey concluded its inquiry with respect to matters arising out of

and related to the Company’s historical stock option grants and procedures and related matters and has indicated it will take no

further action related to this matter.

CRITICAL ACCOUNTING POLICIES

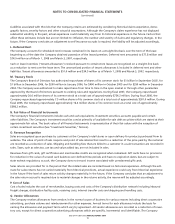

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires the

Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported

amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical experience and

on other assumptions that it believes to be relevant under the circumstances, the results of which form the basis for making judg-

ments about the carrying value of assets and liabilities that are not readily apparent from other sources. In particular, judgment

is used in areas such as inventory valuation, impairment of long-lived assets, goodwill and other indefinitely lived intangible

assets, accruals for self insurance, litigation, store opening, expansion, relocation and closing costs, stock-based compensation

and income taxes. Actual results could differ from these estimates.

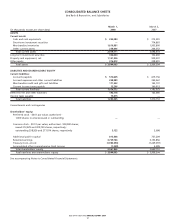

Inventory Valuation: Merchandise inventories are stated at the lower of cost or market. Inventory costs for BBB and Harmon are

calculated using the weighted average retail inventory method and inventory costs for CTS and buybuy BABY are calculated using

the first in first out cost method.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are calculated by applying

a cost to retail ratio to the retail values of inventories. The cost associated with determining the cost to retail ratio includes:

merchandise purchases, net of returns to vendors, discounts and volume and incentive rebates; inbound freight expenses; duty,

insurance and commissions.

At any one time, inventories include items that have been written down to the Company’s best estimate of their realizable value.

Judgment is required in estimating realizable value and factors considered are the age of merchandise and anticipated demand.

Actual realizable value could differ materially from this estimate based upon future customer demand or economic conditions.

The Company estimates its reserve for shrinkage throughout the year, based on historical shrinkage and any current trends, if

applicable. Actual shrinkage is recorded at year end based upon the results of the Company’s physical inventory count. Historically,

the Company’s shrinkage has not been volatile.

The Company accrues for merchandise in transit once it takes legal ownership and title to the merchandise; as such, an estimate

for merchandise in transit is included in the Company’s merchandise inventories.