Bed, Bath and Beyond 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2007

24

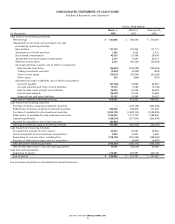

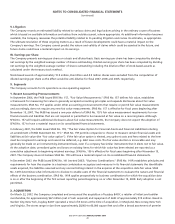

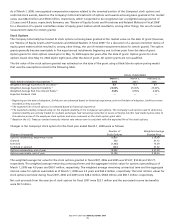

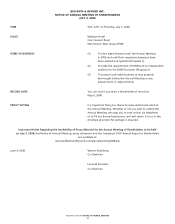

7. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

March 1, March 3, February 25,

(in thousands) 2008 2007 2006

Current:

Federal $ 276,986)$ 375,800)$ 331,930)

State and local 23,123)50,060)36,188)

300,109)425,860)368,118)

Deferred:

Federal 5,483)(81,067) (24,681)

State and local (3,168) (6,158) (1,193)

2,315)(87,225) (25,874)

$ 302,424)$ 338,635)$ 342,244)

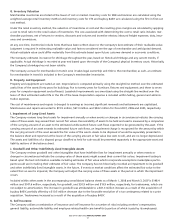

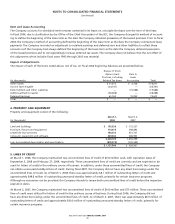

At March 1, 2008 and March 3, 2007, included in other current assets and in other assets is a net current deferred income tax

asset of $137.2 million and $119.4 million, respectively, and a net noncurrent deferred income tax asset of $81.4 million and

$58.5 million, respectively. These amounts represent the net tax effects of temporary differences between the carrying amounts

of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The significant compo-

nents of the Company’s deferred tax assets and liabilities consist of the following:

March 1, March 3,

(in thousands) 2008 2007

Deferred Tax Assets:

Inventories $ 30,074)$ 28,751)

Deferred rent and other rent credits 51,507)42,643)

Insurance 37,899)36,398)

Stock-based compensation 55,511)46,696)

Merchandise credits and gift card liabilities 26,350)42,731)

Accrued expenses 49,508)17,824)

Other 17,211)12,776)

Deferred Tax Liabilities:

Depreciation (22,066) (33,360)

Other (27,361) (16,566)

$ 218,633)$ 177,893)

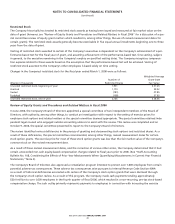

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income, the deductibility of future net deferred tax liabilities and tax

planning strategies.

The Company adopted FIN 48 on March 4, 2007 (“FIN 48 Adoption Date”). FIN 48 addresses the determination of whether tax

benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FIN 48, the

Company may recognize the tax benefit from uncertain tax positions only if it is at least more likely than not that the tax position

will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits

recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater

than fifty percent likelihood of being realized upon settlement with the taxing authorities. FIN 48 also provided guidance

on derecognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased

disclosures.

Upon adoption of FIN 48, the Company recognized a $13.1 million increase to retained earnings to reflect the change to its

liability for gross unrecognized tax benefits as required. The Company also recorded additional gross unrecognized tax benefits,

and corresponding higher deferred tax assets, of $35.6 million as a result of the adoption. At March 4, 2007 the total amount

of gross unrecognized tax benefits was $163.3 million, of which $119.9 million would impact the Company’s effective tax rate.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)