Bed, Bath and Beyond 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2007

22

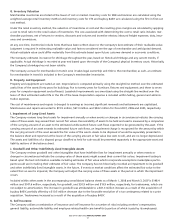

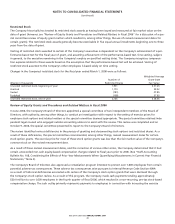

Rent and Lease Accounting

The Company accounts for scheduled rent increases contained in its leases on a straight-line basis over the term of the lease.

In fiscal 2004, due to clarification by the Office of the Chief Accountant of the SEC, the Company changed its method of account-

ing to define the beginning of the lease term as the date the Company obtained possession of the leased premises. Prior to fiscal

2004, the Company’s method of accounting defined the beginning of the lease term as the date the Company commenced lease

payments. The Company recorded an adjustment to retained earnings and deferred rent and other liabilities to reflect these

accounts as if the Company had always defined the beginning of the lease term as the date the Company obtained possession

of the leased premises and to correspondingly increase deferred tax assets. The Company does not believe that the net effect of

this adjustment which includes fiscal years 1993 through 2003 was material.

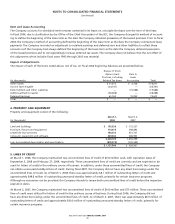

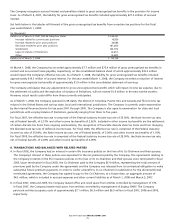

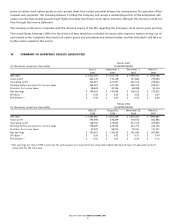

Impact of Adjustments

The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are presented below:

Review of Stock

Option Grant Rent &

Practices, Including Lease

(in thousands) Related Tax Items Accounting Total

Other Assets $ 11,273)$ 4,738)$ 16,011)

Income Taxes Payable (34,747) —)(34,747)

Deferred Rent and Other Liabilities —)(15,588) (15,588)

Additional Paid-in Capital (38,288) —)(38,288)

Retained Earnings 61,762)10,850)72,612)

Total $—)$—)$—)

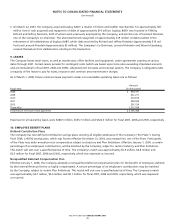

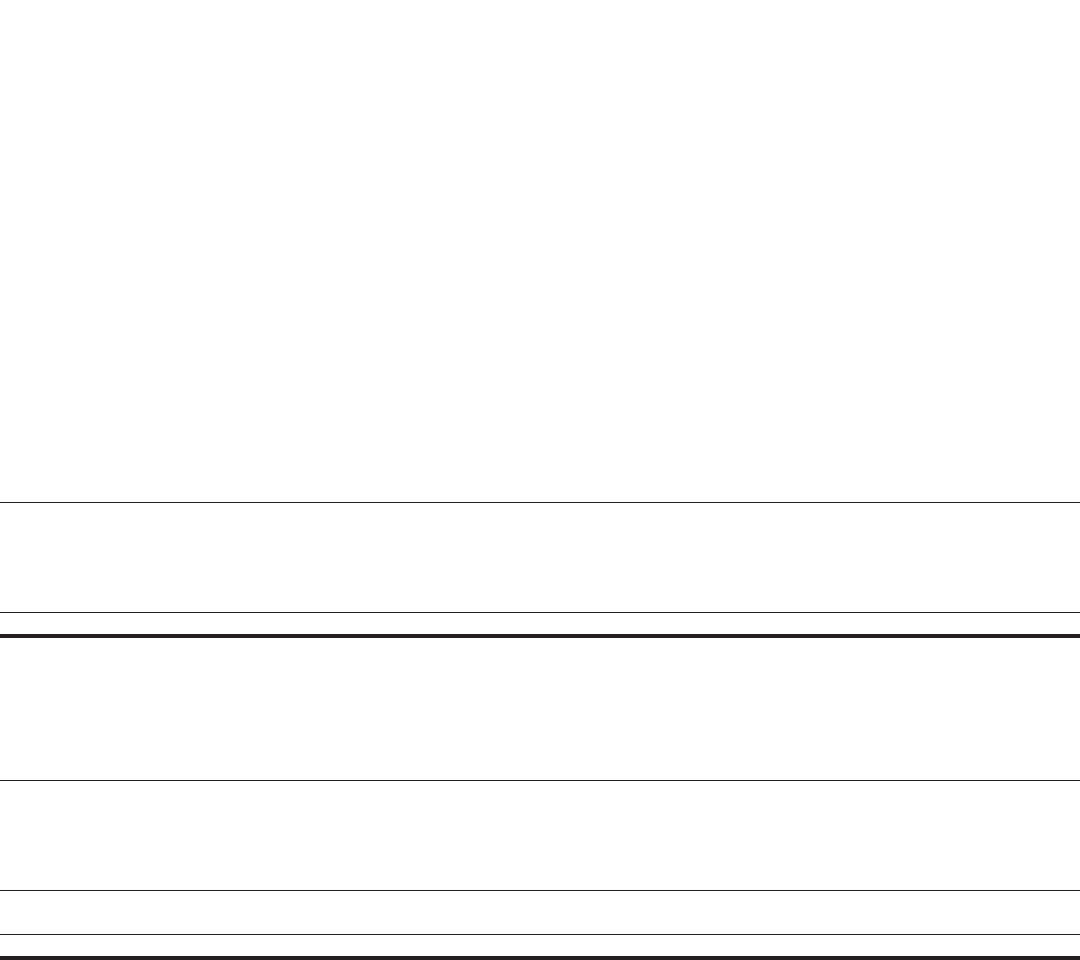

4. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

March 1, March 3,

(in thousands) 2008 2007

Land and buildings $ 195,536)$ 112,527)

Furniture, fixtures and equipment 714,974)598,892)

Leasehold improvements 760,335)651,737)

Computer equipment and software 329,340)286,943)

2,000,185)1,650,099)

Less: Accumulated depreciation and amortization (878,279) (720,592)

$ 1,121,906)$ 929,507)

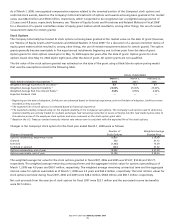

5. LINES OF CREDIT

At March 1, 2008, the Company maintained two uncommitted lines of credit of $100 million each, with expiration dates of

September 3, 2008 and February 27, 2009, respectively. These uncommitted lines of credit are currently and are expected to be

used for letters of credit in the ordinary course of business. In addition, under these uncommitted lines of credit, the Company

can obtain unsecured standby letters of credit. During fiscal 2007, the Company did not have any direct borrowings under the

uncommitted lines of credit. As of March 1, 2008, there was approximately $8.1 million of outstanding letters of credit and

approximately $49.8 million of outstanding unsecured standby letters of credit, primarily for certain insurance programs.

Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit before the respective

expiration dates.

At March 3, 2007, the Company maintained two uncommitted lines of credit of $100 million and $75 million. These uncommitted

lines of credit were utilized for letters of credit in the ordinary course of business. During fiscal 2006, the Company did not

have any direct borrowings under the uncommitted lines of credit. As of March 3, 2007, there was approximately $6.9 million of

outstanding letters of credit and approximately $40.0 million of outstanding unsecured standby letters of credit, primarily for

certain insurance programs.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)