Advance Auto Parts 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 51

Senior Discount Debentures and Industrial Revenue Bonds. In April

1998, in connection with the recapitalization, we issued $112.0 million

in face amount of senior discount debentures (“the debentures”). The

debentures accrete at a rate of 12.875%, compounded semi-annually, to

an aggregate principal amount of $112.0 million by April 15, 2003. At

December 29, 2001, $95.4 million principal amount was outstanding.

Commencing April 15, 2003, cash interest on the debentures will

accrue and be payable semi-annually at a rate of 12.875% per annum.

The indenture governing the debentures contains certain covenants that,

among other things, limit our ability and the ability of our restricted

subsidiaries to incur indebtedness and issue preferred stock, repurchase

stock and certain indebtedness, engage in transactions with affiliates,

create or incur certain liens, pay dividends or certain other

distributions, make certain investments, enter into new businesses, sell

stock of restricted subsidiaries, sell assets and engage in certain

mergers and consolidations.

Our obligations relating to the industrial revenue bonds include an

interest factor at a variable rate and will require no principal payments

until maturity in November 2002.

Seasonality

Our business is somewhat seasonal in nature, with the highest sales

occurring in the spring and summer months. In addition, our business

can be affected by weather conditions. While unusually heavy

precipitation tends to soften sales as elective maintenance is deferred

during such periods, extremely hot or cold weather tends to enhance

sales by causing automotive parts to fail.

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board (“FASB”)

issued SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities”. This Statement establishes accounting and

reporting standards for derivative instruments, including certain

derivative instruments embedded in other contracts (collectively

referred to as derivatives) and for hedging activities. It requires

companies to recognize all derivatives as either assets or liabilities in

their statements of financial position and measure those instruments at

fair value. In September 1999, the FASB issued SFAS No. 137,

“Accounting for Derivative Instruments and Hedging Activities--

Deferral of the Effective Date of FASB Statement No. 133,” which

delayed the effective date of SFAS No. 133 to fiscal years beginning

after June 15, 2000, the FASB issued SFAS No. 138, “Accounting for

Derivative Instruments and Certain Hedging Activities--an Amendment

of SFAS No. 133,” which amended the accounting and reporting

standards for certain risks related to normal purchases and sales,

interest and foreign currency transactions addressed by SFAS No. 133.

We adopted SFAS No. 133 on December 31, 2000 with no material

impact on our financial position or results of operations.

In September 2000, the FASB issued SFAS No. 140, “Accounting for

Transfers and Servicing Financial Assets and Extinguishment of Liabilities”.

This statement replaces SFAS No. 125, but carries over most of the

provisions of SFAS No. 125 without reconsideration. We implemented

SFAS No. 140 during the first quarter of 2001. The implementation had no

impact on our financial position or results of operations.

In June 2001, the FASB issued Statements of Financial Accounting

Standards (“SFAS”) No. 141, “Business Combinations” and No. 142,

“Goodwill and Other Intangible Assets,”. SFAS No. 141 addresses

accounting and reporting for all business combinations and requires the

use of the purchase method for business combinations. SFAS No. 141

also requires recognition of intangible assets apart from goodwill if

they meet certain criteria. SFAS No. 142 establishes accounting and

reporting standards for acquired goodwill and other intangible assets.

Under SFAS No. 142, goodwill and intangibles with indefinite useful

lives are no longer amortized but are instead subject to at least an

annual assessment for impairment by applying a fair-value based test.

SFAS No. 141 applies to all business combinations initiated after June

30, 2001. SFAS No. 142 is effective for our existing goodwill and

intangible assets beginning on December 30, 2001. SFAS No. 142 is

effective immediately for goodwill and intangibles acquired after June

30, 2001. For 2001, we had amortization expense of approximately

$444 related to existing goodwill of $3,251 at December 29, 2001.

Such amortization will be eliminated upon adoption of SFAS No. 142.

Although we are currently evaluating the impact of other provisions of

SFAS Nos. 141 and 142, we do not expect that the adoption of these

statements will have a material impact on our financial position or

results of operations.

In August 2001, the FASB issued SFAS No. 143, “Accounting for

Asset Retirement Obligations.” SFAS No. 143 establishes accounting

standards for recognition and measurement of an asset retirement

obligation and an associated asset retirement cost and is effective for

2003. We do not expect SFAS No. 143 to have a material impact on our

financial position or results of operations.

In August 2001, the FASB also issued SFAS No. 144, “Accounting

for the Impairment or Disposal of Long-Lived Assets”. This statement

replaces both SFAS No. 121, “Accounting for the Impairment of Long-

Lived Assets and for Long-Lived Assets to Be Disposed Of ” and

Accounting Principles Board (APB) Opinion No. 30, “Reporting the

Results of Operations--Reporting the Effects of Disposal of a Segment

of a Business, and Extraordinary, Unusual and Infrequently Occurring

Events and Transactions.” SFAS 144 retains the basic provisions from

both SFAS 121 and APB 30 but includes changes to improve financial

reporting and comparability among entities. We will adopt the

provisions of SFAS 144 during the first quarter of 2002. We do not

expect the adoption of SFAS No. 144 to have a material impact on our

financial position or results of operations.

Quantitative and Qualitative Disclosures about Market Risks

We currently utilize no material derivative financial instruments that expose us to significant market risk. We are exposed to cash flow and fair value risk

due to changes in interest rates with respect to our long-term debt. While we cannot predict the impact interest rate movements will have on our debt,

exposure to rate changes is managed through the use of fixed and variable rate debt. Our future exposure to interest rate risk decreased during 2001 due to

decreased interest rates and reduced variable rate debt.

Our fixed rate debt consists primarily of outstanding balances on our senior discount debentures and senior subordinated notes. Our variable rate debt

relates to borrowings under the senior credit facility and the industrial revenue bonds. Our variable rate debt is primarily vulnerable to movements in the

LIBOR, Prime, Federal Funds and Base CD rates.

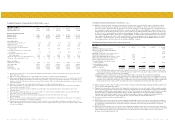

The table below presents principal cash flows and related weighted average interest rates on long-term debt we had outstanding at December 29, 2001,

by expected maturity dates. Expected maturity dates approximate contract terms. Fair values included herein have been determined based on quoted

market prices. Weighted average variable rates are based on implied forward rates in the yield curve at December 29, 2001. Implied forward rates should

not be considered a predictor of actual future interest rates.

Fair

Fiscal Fiscal Fiscal Fiscal Fiscal Market

(dollars in thousands) 2002 2003 2004 2005 2006 Thereafter Total Value

Long-term debt

Fixed rate -----$481,450 $ 481,450 $ 457,804

Weighted average interest rate -----10.9%10.9%

Variable rate $ 23,715 $ 32,385 $ 48,578 $ 53,975 $ 63,975 $ 282,372 $ 505,000 $ 505,000

Weighted average interest rate 5.9% 7.9% 9.1% 9.5% 9.9% 10.3% 8.6%