Advance Auto Parts 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 31

the entire principal amount due in five years. As of December 29, 2001 and

December 30, 2000, outstanding stockholder subscription receivables were

$2,676 and $2,364, respectively, and are included as a reduction to

stockholders’ equity in the accompanying consolidated balance sheets.

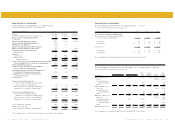

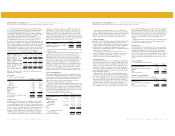

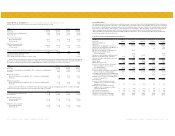

15. Income Taxes:

Provision (benefit) for income taxes for fiscal 2001, fiscal 2000 and fiscal

1999 consists of the following:

Current Deferred Total

2001-

Federal $ 13,822 $ (964) $ 12,858

State 513 (2,059) (1,546)

$ 14,335 $ (3,023) $ 11,312

2000-

Federal $ 8,005 $ 976 $ 8,981

State 1,847 (293) 1,554

$ 9,852 $ 683 $ 10,535

1999-

Federal $ (1,913) $ (6,535) $ (8,448)

State 1,979 (6,115) (4,136)

$ 66 $ (12,650) $ (12,584)

The provision (benefit) for income taxes differed from the amount

computed by applying the federal statutory income tax rate due to:

2001 2000 1999

Income (loss) before extraordinary

items and cumulative effect of a

change in accounting principle

at the statutory U.S. federal

income tax rate $ 9,976 $ 9,507 $(13,269)

State income taxes, net of federal

income tax benefit (1,005) 896 (2,688)

Non-deductible interest &

other expenses 1,067 1,010 1,125

Valuation allowance 44 914 596

Puerto Rico dividend

withholding tax - - 150

Other, net 1,230 (1,792) 1,502

$ 11,312 $ 10,535 $(12,584)

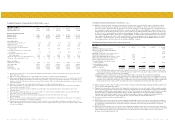

Deferred income taxes are recognized for the tax consequences in future

years of differences between the tax bases of assets and liabilities and their

financial reporting amounts at each period-end, based on enacted tax laws and

statutory income tax rates applicable to the periods in which the differences

are expected to affect taxable income. Deferred income taxes reflect the net

income tax effect of temporary differences between the bases of assets and

liabilities for financial reporting purposes and for income tax reporting

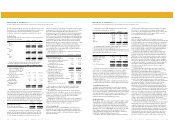

purposes. Net deferred income tax balances are comprised of the following:

December 29, December 30,

2001 2000

Deferred income tax assets $ 70,116 $ 57,378

Deferred income tax liabilities (38,020) (62,121)

Net deferred income tax (liabilities) assets $ 32,096 $ (4,743)

The Company incurred financial reporting and tax losses in 1999

primarily due to integration and interest costs incurred as a result of the

fiscal 1998 Western Merger and the Recapitalization. At December 29,

2001, the Company has cumulative net deferred income tax assets of

$32,096. The gross deferred income tax assets include deferred tax assets

of approximately $33,000 related to the excess tax basis over book value of

the net assets obtained through the Discount acquisition. The gross

deferred income tax assets also include federal and state net operating loss

carryforwards (“NOLs”) of approximately $6,596. These NOLs may be

used to reduce future taxable income and expire periodically through fiscal

year 2020. The Company believes it will realize these tax benefits through

a combination of the reversal of temporary differences, projected future

taxable income during the NOL carryforward periods and available tax

planning strategies. Due to uncertainties related to the realization of certain

deferred tax assets for NOLs in various jurisdictions, the Company

recorded a valuation allowance of $1,554 as of December 29, 2001 and

$1,510 as of December 30, 2000. The amount of deferred income tax

assets realizable, however, could change in the near future if estimates of

future taxable income are changed.

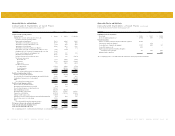

Temporary differences which give rise to significant deferred income

tax assets (liabilities) are as follows:

December 29, December 30,

2001 2000

Current deferred income taxes-

Inventory valuation differences $ (18,783) $ (36,051)

Accrued medical and workers compensation 7,233 2,319

Accrued expenses not currently

deductible for tax 26,753 16,391

Net operating loss carryforwards 3,916 7,124

Minimum tax credit

carryforward (no expiration) 5,599 0

Total current deferred income taxes $ 24,718 $ (10,217)

Long-term deferred income taxes-

Property and equipment $ (19,237) $ (24,571)

Postretirement benefit obligation 8,013 8,254

Amortization of bond discount 12,076 8,184

Net operating loss carryforwards 2,680 9,807

Minimum tax credit carryforward (no expiration) 0 6,809

Valuation allowance (1,554) (1,510)

Other, net 5,400 (1,499)

Total long-term deferred income taxes $ 7,378 $ 5,474

These amounts are recorded in other current assets, other current

liabilities and other assets in the accompanying consolidated balance

sheets, as appropriate.

The Company currently has four years that are open to audit by the

Internal Revenue Service. In addition, various state and foreign income tax

returns for several years are open to audit. In management’s opinion, any

amounts assessed will not have a material effect on the Company’s

financial position or results of operations.

Additionally, the Company has certain periods open to examination by

taxing authorities in various states for sales and use tax. In management’s

opinion, any amounts assessed will not have a material effect on the

Company’s financial position or results of operations.

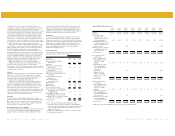

16. Lease Commitments:

The Company leases store locations, distribution centers, office space,

equipment and vehicles under lease arrangements that extend through

2010, some of which are with related parties. Certain terms of the related-

party leases are more favorable to the landlord than those contained in

leases with non-affiliates.

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

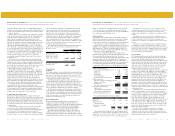

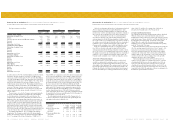

At December 29, 2001, future minimum lease payments due under

non-cancelable operating leases are as follows:

Related

Other (a) Parties (b) Total

2002 $ 133,704 $ 3,677 $ 137,381

2003 123,114 3,447 126,561

2004 109,275 2,537 111,812

2005 92,276 2,240 94,516

2006 75,608 1,764 77,372

Thereafter 337,858 447 338,305

$ 871,835 $ 14,112 $ 885,947

(a) The Other and Related Parties columns include stores closed as a

result of the Company’s restructuring plans (See Note 4).

At December 29, 2001, future minimum sub-lease income to be received

under non-cancelable operating leases is $8,935. Net rent expense for fiscal

2001, fiscal 2000 and fiscal 1999 was as follows:

2001 2000 1999

Minimum facility rentals $ 122,512 $ 112,768 $ 103,807

Contingent facility rentals 811 1,391 2,086

Equipment rentals 2,341 1,875 3,831

Vehicle rentals 6,339 6,709 4,281

132,003 122,743 114,005

Less: Sub-lease income (2,558) (1,747) (1,085)

$ 129,445 $ 120,996 $ 112,920

Contingent facility rentals are determined on the basis of a percentage

of sales in excess of stipulated minimums for certain store facilities.

Most of the leases provide that the Company pay taxes, maintenance,

insurance and certain other expenses applicable to the leased premises

and include options to renew. Certain leases contain rent escalation

clauses, which are recorded on a straight-line basis. Management expects

that, in the normal course of business, leases that expire will be renewed

or replaced by other leases.

Rental payments to related parties of approximately $3,824 in fiscal 2001,

$3,921 in fiscal 2000 and $3,998 in fiscal 1999 are included in net rent expense.

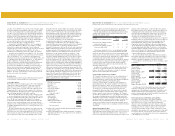

17. Installment Sales Program:

A subsidiary of the Company maintains an in-house finance program,

which offers financing to retail customers (Note 5). Finance charges of

$3,343, $3,063 and $2,662 on the installment sales program are included in

net sales in the accompanying consolidated statements of operations for the

years ended December 29, 2001, December 30, 2000 and January 1, 2000,

respectively. The cost of administering the installment sales program is

included in selling, general and administrative expenses.

18. Subsequent Event:

On November 2, 1998, the Company acquired Western from WAH, a wholly-

owned subsidiary of Sears, Roebuck and Co. (“Sears”), through the issuance

of 11,475 shares of common stock. On February 6, 2002, the Company

engaged in a transaction with Sears in which the Company transferred to

Sears 11,475 shares of the Company’s common stock, in exchange for all the

outstanding common stock of WAH. WAH’s only asset was the 11,475 shares

of the Company’s common stock received on November 2, 1998. The

Company immediately retired the shares of the Company’s common stock

held by WAH and liquidated WAH on February 6, 2002.

On March 6, 2002, the Company’s registration statement on Form S-1

with the Securities and Exchange Commission to register 2,250 primary

shares and 6,750 secondary shares for offering on the public market

became effective. The Company intends to use the net proceeds it receives

to repay outstanding indebtedness. The Company will not receive any

proceeds from the sale of the secondary shares.

19. Contingencies:

In the case of all known contingencies, the Company accrues for an

obligation, including estimated legal costs,when it is probable and the amount

is reasonably estimable. As facts concerning contingencies become known to

the Company, the Company reassesses its position both with respect to gain

contingencies and accrued liabilities and other potential exposures. Estimates

that are particularly sensitive to future change include tax and legal matters,

which are subject to change as events evolve and as additional information

becomes available during the administrative and litigation process.

In March 2000, the Company was notified it has been named in a

lawsuit filed on behalf of independent retailers and jobbers against the

Company and others for various claims under the Robinson-Patman Act.

On October 18, 2001, the court denied, on all but one count, a motion by

the Company and other defendants to dismiss this lawsuit. It is expected

that the discovery phase of the litigation will now commence (including

with respect to the Company); however, determinations as to the discovery

schedule and scope remain to be determined. The Company continues to

believe that the claims are without merit and intends to defend them

vigorously; however, the ultimate outcome of this matter cannot be

ascertained at this time.

In January 1999, the Company was notified by the United States

Environmental Protection Agency (“EPA”) that Western Auto and other

parties may have potential liability under the Comprehensive

Environmental Response Compensation and Liability Act relating to two

battery salvage and recycling sites that were in operation in the 1970s and

1980s. The EPA has indicated the total cleanup for this site will be

approximately $1,600. This matter has since been settled for an amount not

material to the Company’s financial position or results of operations.

Sears has agreed to indemnify the Company for certain other litigation

and environmental matters of Western that existed as of the Western

Merger date. The Company recorded a receivable from Sears of

approximately $2,685 relating to certain environmental matters that had

been accrued by Western as of the Western Merger date. During the first

quarter of 2001, the Company received notification from Sears that certain

of these matters have been settled. Accordingly, the Company reversed

$2,500 of the previously recorded $2,685 receivable due from Sears and

reduced the corresponding environmental liability. Additionally, as of the

Western Merger date, Sears has agreed to indemnify partially the Company

for up to 5 years for certain additional environmental matters that may arise

relating to the period prior to the Western Merger. The Company’s

maximum exposure during the indemnification period for certain matters

covered in the Western Merger agreement is $3,750.

In November 1997 a plaintiff, on behalf of himself and others similarly

situated, filed a class action complaint and motion of class certification

against the Company in the circuit court for Jefferson County, Tennessee,

alleging misconduct in the sale of automobile batteries. The complaint

seeks compensatory and punitive damages. In September 2001, the court

granted the Company’s motion for summary judgement and dismissed all

claims against the Company in this matter. The period for appeal has not

expired. The Company believes it has no liability for such claims and

intends to defend them vigorously. In addition, three lawsuits were filed

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)