Advance Auto Parts 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 33

against the Company on July 28, 1998, for wrongful death relating to an

automobile accident involving a team member of the Company. This matter

has since been settled with no impact to the Company’s financial position

or results of operations.

In October 2000, a vendor repudiated a long-term purchase agreement

entered into with the Company in January 2000. The Company filed suit

against the vendor in November of fiscal 2000 to recover monetary

damages. Based on consultation with the Company’s legal counsel,

management believed the purchase agreement was entered into in good

faith and it was highly probable that the Company would prevail in its suit.

Therefore, the Company recorded a gain of $3,300, which represented

actual damages incurred through December 30, 2000, as a reduction of

cost of sales in the accompanying consolidated statement of operations for

the year ended December 30, 2000. Related income taxes and legal fees of

$1,300 were also recorded in the accompanying consolidated statement of

operations for the year ended December 30, 2000. During the first quarter

of fiscal 2001, the Company reached a settlement with this vendor and

recorded a net gain of $8,300 as a reduction to cost of sales in the

accompanying consolidated statement of operations for the year ended

December 29, 2001.

The Company is also involved in various other claims and lawsuits

arising in the normal course of business. The damages claimed against the

Company in some of these proceedings are substantial. Although the final

outcome of these legal matters cannot be determined, based on the facts

presently known, it is management’s opinion that the final outcome of such

claims and lawsuits will not have a material adverse effect on the

Company’s financial position or results of operations.

The Company is self-insured with respect to workers’ compensation

and health care claims for eligible active team members. In addition, the

Company is self-insured for general and automobile liability claims. The

Company maintains certain levels of stop-loss insurance coverage for these

claims through an independent insurance provider. The cost of self-

insurance claims is accrued based on actual claims reported plus an

estimate for claims incurred but not reported. These estimates are based on

historical information along with certain assumptions about future events,

and are subject to change as additional information becomes available.

The Company has entered into employment agreements with certain

team members that provide severance pay benefits under certain

circumstances after a change in control of the Company or upon termination

of the team member by the Company. The maximum contingent liability

under these employment agreements is approximately $10,231 and $4,740

at December 29, 2001 and December 30, 2000, respectively.

20. Other Related-party Transactions:

In September 2001, the Company loaned a member of the Board of

Directors $1,300. This loan is evidenced by a full recourse promissory note

bearing interest at prime rate, payable annually, and due in full in five years

from its inception. Payment of the promissory note is secured by a stock

pledge agreement that grants the Company a security interest in all shares

of common stock owned by the board member under the Company’s stock

subscription plan.

Under the terms of a shared services agreement, Sears provided

certain services to the Company, including payroll and payable

processing for Western, among other services through the third quarter

of fiscal year 1999. The Company and Sears have entered into

agreements that provide for the Western stores to continue to purchase,

at normal retail prices, and carry certain Sears branded products during

periods defined in the agreements. The Company purchased directly

from the manufacturers of Sears branded products of approximately

$4,600, $9,200 and $13,500 for the fiscal years ended December 29,

2001, December 30, 2000 and January 1, 2000, respectively. The

Company is also a first-call supplier of certain automotive products to

certain Sears Automotive Group stores. Additionally, Sears arranged to

buy from the Company certain products in bulk for its automotive

centers through January 1999. These transactions are completed at the

Company’s normal retail prices. These amounts are included in net sales

to Sears in the following table and have been negotiated based on the

fair values of the underlying transactions.

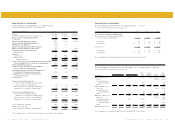

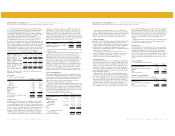

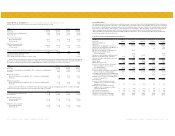

The following table presents the related party transactions with Sears

for fiscal 2001, 2000 and 1999 and as of December 29, 2001 and

December 30, 2000:

Years Ended

December 29, December 30, January1,

2001 2000 2000

Net sales to Sears $ 7,535 $ 7,487 $ 5,326

Shared services revenue - - 2,286

Shared services expense - - 887

Credit card fees expense 339 405 348

December 29, December 30,

2001 2000

Receivables from Sears $ 812 $ 3,160

Payables to Sears 1,220 1,321

21. Benefit Plans:

401(k) Plan

The Company maintains a defined contribution team member benefit plan,

which covers substantially all team members after one year of service. The

plan allows for team member salary deferrals, which are matched at the

Company’s discretion. Company contributions were $5,033 in fiscal 2001,

$5,245 in fiscal 2000, and $4,756 in fiscal 1999.

The Company continues to maintain a defined contribution plan

covering substantially all of the Discount team members who have at least

one year of service. The plan allows for team member salary deferrals,

which are matched by the Company based upon the team member’s years

of service. Company contributions were $205 in fiscal 2001. The Company

had no contributions for this plan prior to the Discount acquisition.

The Company also maintains a profit sharing plan covering Western

team members that was frozen prior to the Western Merger on November

2, 1998. This plan covered all full-time team members who had completed

one year of service and had attained the age of 21 on the first day of each

month. All team members covered under this plan were included in the

Company’s plan on December 30, 2000.

Deferred Compensation

The Company maintains an unfunded deferred compensation plan

established for certain key team members of Discount prior to the

acquisition on November 28, 2001. The Company assumed the plan liability

of $1,382 through the Discount acquisition. The Company anticipates

terminating this plan in May of 2002 and has reflected this liability in

accrued expenses in the accompanying consolidated balance sheets.

The Company maintains an unfunded deferred compensation plan

established for certain key team members of Western prior to the fiscal

1998 Western Merger. The Company assumed the plan liability of $15,253

through the Western Merger. The plan was frozen at the date of the Western

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

Merger. As of December 29, 2001 and December 30, 2000, $4,291 and

$5,359, respectively was accrued with the current portion included in

accrued expenses and the long-term portion in other long-term liabilities in

the accompanying consolidated balance sheets.

Postretirement Plan

The Company provides certain health care and life insurance benefits for

eligible retired team members. Team members retiring from the Company

with 20 consecutive years of service after age 40 are eligible for these

benefits, subject to deductibles, co-payment provisions and other limitations.

The estimated cost of retiree health and life insurance benefits is

recognized over the years that the team members render service as required

by SFAS No. 106, “Employers Accounting for Postretirement Benefits

Other Than Pensions.” The initial accumulated liability, measured as of

January 1, 1995, the date the Company adopted SFAS No. 106, is being

recognized over a 20-year amortization period.

In connection with the Western Merger, the Company assumed

Western’s benefit obligation under its postretirement health care plan. This

plan was merged into the Company’s plan effective July 1, 1999.

The Company maintains the existing plan and the assumed plan covering

Western team members. Financial information related to the plans was

determined by the Company’s independent actuaries as of December 29,

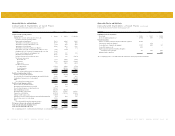

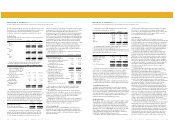

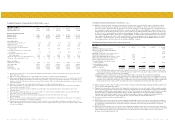

2001 and December 30, 2000. The following provides a reconciliation of the

accrued benefit obligation included in other long-term liabilities in the

accompanying consolidated balance sheets and the funded status of the plan.

2001 2000

Change in benefit obligation:

Benefit obligation at beginning of the year $ 22,082 $ 22,095

Service cost 326 451

Interest cost 1,584 1,532

Benefits paid (2,842) (2,826)

Actuarial (gain) loss (3,790) 830

Benefit obligation at end of the year 17,360 22,082

Change in plan assets:

Fair value of plan assets at beginning of the year - -

Employer contributions 2,842 2,826

Benefits paid (2,842) (2,826)

Fair value of plan assets at end of year - -

Reconciliation of funded status:

Funded status (17,360) (22,082)

Unrecognized transition obligation 752 810

Unrecognized actuarial (gain) loss (3,260) 530

Accrued postretirement benefit cost $ (19,868) $ (20,742)

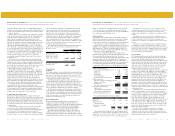

Net periodic postretirement benefit cost is as follows:

2001 2000 1999

Service cost $ 326 $ 451 $ 336

Interest cost 1,584 1,532 1,401

Amortization of the

transition obligation 58 58 58

Amortization of recognized

net losses - - 43

$ 1,968 $ 2,041 $ 1,838

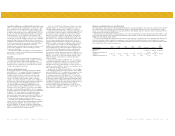

The postretirement benefit obligation was computed using an assumed

discount rate of 7.5% in 2001 and 2000. The health care cost trend rate was

assumed to be 8.5% for 2001, 8.0% for 2002, 7.5% for 2003, 7.0% for 2004,

6.5% for 2005, 6.0% for 2006, and 5.0% to 5.5% for 2007 and thereafter.

If the health care cost were increased 1% for all future years the

accumulated postretirement benefit obligation would have increased by

$2,296 as of December 29, 2001. The effect of this change on the

combined service and interest cost would have been an increase of $185

for 2001.

If the health care cost were decreased 1% for all future years the

accumulated postretirement benefit obligation would have decreased by

$1,996 as of December 29, 2001. The effect of this change on the

combined service and interest cost would have been a decrease of $160

for 2001.

The Company reserves the right to change or terminate the benefits

or contributions at any time. The Company also continues to evaluate

ways in which it can better manage these benefits and control costs. Any

changes in the plan or revisions to assumptions that affect the amount of

expected future benefits may have a significant impact on the amount of

the reported obligation and annual expense.

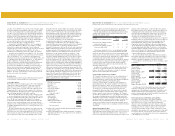

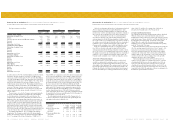

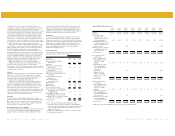

22. Stock Options:

The Company maintains a senior executive stock option plan and an

executive stock option plan (the “Option Plans”) for key team members

of the Company. The Option Plans provide for the granting of non-

qualified stock options. All options terminate on the seventh anniversary

of the grant date. Shares authorized for grant under the senior executive

and the executive stock option plans are 1,710 and 3,600, respectively,

at December 29, 2001. Subsequent to December 29, 2001, the Board

of Directors approved for the grant of 532 options to purchase the

Company’s common stock at an exercise price of $42.00.

The Company has historically maintained three types of option plans;

Fixed Price Service Options (“Fixed Options”), Performance Options

(“Performance Options”) and Variable Option plans (“Variable Options”).

The Fixed Options vest over a three-year period in three equal

installments beginning on the first anniversary of the grant date. During

the fourth quarter of fiscal 2001, the board of directors approved an

amendment to the Performance Options and the Variable Options. The

amendment accelerated the vesting of the Performance Options by

removing the variable provisions under the plan and established a fixed

exercise price of $18.00 per share for the Variable Options. As a result of

the increase in the Company’s stock price and the above amendment, the

Company recorded a one-time expense of $8,611 to record the associated

compensation expense.

Additionally, as a result of the Discount acquisition, the Company

converted all outstanding stock options of Discount with an exercise

price greater than $15.00 per share to options to purchase the Company’s

common stock. The Company converted 575 options from the executive

stock option plan at a weighted-average exercise price of $38.89 per

share. These options will terminate on the tenth anniversary of the

original option agreement between Discount and the team member and as

of December 29, 2001 had a weighted-average contractual life of five

years. At December 29, 2001, all Discount shares were exercisable and

had a range of exercise prices of $17.46 to $59.18. The fair value of the

options to purchase the Company’s common stock was included in the

purchase price of Discount (Note 3).

As a result of the recapitalization in fiscal 1998 an existing

stockholder received stock options to purchase up to 500 shares of

common stock. The stock options are fully vested, nonforfeitable and

provide for a $10.00 per share exercise price, increasing $2.00 per share

annually, through the expiration date of April 2005.

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)