Advance Auto Parts 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

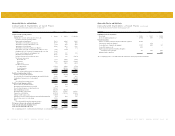

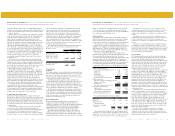

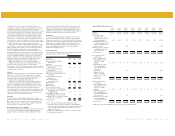

Selected Store Data:

Comparable store sales growth (13) 5.7% 7.8% 10.3% 4.4% 6.2%

Net new stores (14) 165 753 50 112 755

Number of stores, end of period 814 1,567 1,617 1,729 2,484

Stores with commercial delivery program,

end of period 421 532 1,094 1,210 1,370

Total commercial delivery sales, as a percentage

of total sales 7.4% 8.8% 9.0% 13.4% 13.5%

Total retail store square footage, end of

period (in thousands) 5,857 12,084 12,476 13,325 18,717

Average net retail sales per store (in thousands) (15) $ 1,159 $ 1,270 $ 1,267 $ 1,295 $ 1,346

Average net retail sales per square foot (16) $ 161 $ 172 $ 164 $ 168 $ 175

Balance Sheet Data:

Cash and cash equivalents $ 15,463 $ 36,115 $ 22,577 $ 18,009 $ 18,117

Net working capital 121,140 310,113 355,608 318,583 442,099

Total assets 461,257 1,265,355 1,348,629 1,356,360 1,950,615

Total net debt 95,633 485,476 627,467 582,539 972,368

Total stockholders’ equity 143,548 159,091 133,954 156,271 288,571

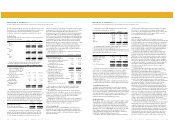

(1) Our fiscal year consists of 52 or 53 weeks ending on the Saturday nearest to December 31. All fiscal years presented are 52 weeks except for 1997,

which consisted of 53 weeks.

(2) Represents restocking and handling fees associated with the return of inventory as a result of our supply chain initiatives.

(3) Selling, general and administrative expenses exclude certain non-recurring charges discussed in notes (4), (5), (6), (7), (8), (9) and (10) below. The 1997

amount includes an unusual medical claim that exceeded our stop loss insurance coverage. The pre-tax amount of this claim, net of related increased

insurance costs, was $882. We increased our stop loss coverage effective January 1, 1998 to a level that would provide insurance coverage for a medical

claim of this magnitude.

(4) Represents costs of relocating certain equipment held at facilities closed as a result of our supply chain initiatives.

(5) Represents the devaluation of certain property held for sale, including the $1.6 million charge taken in the first quarter of 2001 and a $10.7 million

charge taken in the fourth quarter of 2001.

(6) Represents expenses incurred in our 1998 recapitalization related primarily to non-recurring bonuses paid to certain employees and to fees for

professional services.

(7) Represents expenses related primarily to lease costs associated with 31 of our stores closed in overlapping markets in connection with the Western

merger and 27 closed as a result of the Discount acquisition.

(8) Represents certain expenses related to the Western merger and integration, conversion of the Parts America stores and the

Discount acquisition.

(9) Reflects our estimate of expenses eliminated after the recapitalization that related primarily to compensation and other benefits of our chairman,

who prior to our recapitalization was our principal stockholder.

(10) Represents non-cash compensation expenses related to stock options granted to certain of our employees, including a non-recurring charge of $8.6

million in the fourth quarter of 2001 related to variable provisions of our stock option plans that were in place when we were a private company, and that

have since been eliminated.

40 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 41

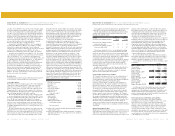

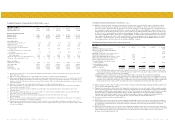

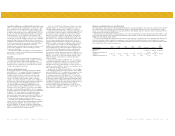

Consolidated Statement of Operations Data for Fiscal Year(1): (continued)

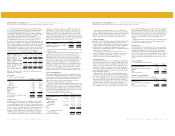

(11) EBITDA, as adjusted, represents operating income plus depreciation and amortization, non-cash and other employee compensation expenses

and certain non-recurring charges as scheduled below, included in operating income. EBITDA, as adjusted, is not intended to represent cash

flow from operations as defined by GAAP, and should not be considered as a substitute for net income as an indicator of operating performance

or as an alternative to cash flow (as measured by GAAP) as a measure of liquidity. We have included EBITDA, as adjusted, herein because our

management believes this information is useful to investors, as such measure provides additional information with respect to our ability to meet

our future debt service, capital expenditures and working capital requirements. In addition, certain covenants in our indentures and credit facility

are based upon an EBITDA calculation. Our method for calculating EBITDA, as adjusted, may differ from similarly titled measures reported by

other companies. Our management believes certain recapitalization expenses, non-recurring charges, private company expenses, non-cash and

other employee compensation expenses, and merger and integration expenses should be eliminated from the EBITDA calculation to evaluate

our operating performance, and we have done so in our calculation of EBITDA, as adjusted.

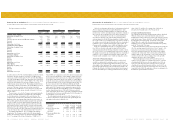

The Following Table Reflects the Effect of These Items for Fiscal Year(1):

(in thousands, except per share and selected store data) 1997 1998 1999 2000 2001

Other Data:

EBITDA(a) $ 65,110 $ 61,793 $ 78,382 $ 159,615 $ 160,344

Supply chain initiatives (see note 2 above) - - - - 9,099

Expenses associated with supply chain initiatives

(see note 4 above) - - - - 1,394

Impairment of assets held for sale (see note 5 above) - - - - 10,700

Recapitalization expenses (see note 6 above) - 14,277 - - -

Merger related restructuring expenses (see note 7 above) - 6,774 - - 3,719

Merger and integration expenses (see note 8 above) - 7,788 41,034 - 1,135

Private company expenses (see note 9 above) 3,056 845 - - -

Non-cash stock option compensation expense

(see note 10 above) - 695 1,082 729 11,735

Non-operating interest expense

on postretirement benefits(b) 195 440 1,401 1,532 1,584

EBITDA, as adjusted(c) $ 68,361 $ 92,612 $ 121,899 $ 161,876 $ 199,710

(a) The 1997 EBITDA amount excludes an unusual medical claim that exceeded our stop-loss insurance coverage. The pre-tax amount of this

claim, net of related increased insurance costs, was $882. We increased our stop-loss coverage effective January 1, 1998 to a level that would

provide insurance coverage for a medical claim of this magnitude.

(b) Represents the interest component of the net periodic postretirement benefit cost associated with our postretirement benefit plan.

(c) EBITDA, as adjusted, for 2000 includes a non-recurring net gain of $3.3 million, which represents a portion of a cash settlement received in

connection with a lawsuit against a supplier. EBITDA, as adjusted, for 2001 includes a non-recurring net gain of $3.2 million, recorded in the

first quarter of 2001, which represents a portion of the cash settlement received in connection with the lawsuit against a supplier, partially offset

by nonrecurring closed store expenses and the $1.6 million write-down of an administrative facility taken in the first quarter of 2001.

(12) Capital expenditures for 2001 exclude $34.1 million for our November 2001 purchase of Discount’s Gallman, Mississippi distribution facility from the

lessor in connection with the Discount acquisition.

(13) Comparable store sales growth is calculated based on the change in net sales starting once a store has been opened for thirteen complete accounting

periods (each period represents four weeks). Relocations are included in comparable store sales from the original date of opening. The Parts America

stores acquired in the Western merger and subsequently converted to Advance Auto Parts stores are included in the comparable store sales calculation

after thirteen complete accounting periods following their physical conversion. Additionally, the stores acquired in the Carport and Discount

acquisitions will be included in the comparable store sales calculation following thirteen complete accounting periods following their system

conversion to the Advance Auto Parts store system. Comparable store sales do not include sales from the Western Auto stores.

(14) Net new stores represent new stores opened and acquired, less

stores closed.

(15) Average net retail sales per store is based on the average of beginning and ending number of stores for the respective period. The 1998 amounts were

calculated giving effect to the Parts America retail net sales and number of stores for the period from November 1, 1998 through January 2, 1999. The

2001 amounts were calculated giving effect to the Discount retail net sales and number of stores for the period from December 2, 2001 through

December 29, 2001.

(16) Average net retail sales per square foot is based on the average of beginning and ending total store square footage for the respective period. The

1998 amounts were calculated giving effect to the Parts America retail net sales and square footage for the period from November 1, 1998 through

January 2, 1999. The 2001 amounts were calculated giving effect to the Discount retail net sales and number of stores for the period from

December 2, 2001 through December 29, 2001.

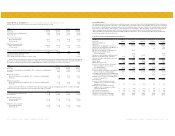

Consolidated Statement of Operations Data for Fiscal Year(1): (continued)

(in thousands, except per share and selected store data) 1997 1998 1999 2000 2001

Other Financial Data:

EBITDA, as adjusted(11) $ 68,361 $ 92,612 $ 121,899 $ 161,876 $ 199,710

Capital expenditures (12) 48,864 65,790 105,017 70,566 63,695

Cash flows provided by (used in):

Operating activities $ 42,478 $ 44,022 $ (20,976) $ 103,951 $ 103,536

Investing activities (48,607) (230,672) (113,824) (64,940) (451,008)

Financing activities 6,759 207,302 121,262 (43,579) 347,580