Advance Auto Parts 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 29

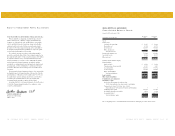

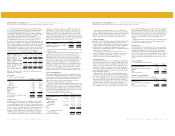

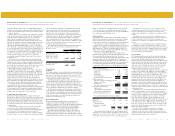

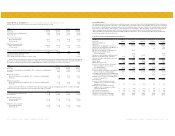

13. Long-term Debt:

Long-term debt consists of the following:

December 29, December 30,

2001 2000

Senior Debt:

Tranche A, Senior Secured Term Loan at variable interest rates

(5.44% at December 29, 2001), due November 2006 $ 180,000 $ -

Tranche B, Senior Secured Term Loan at variable interest rates

(7.00% at December 29, 2001), due November 2007 305,000 -

Revolving facility at variable interest rates (5.44% at December 29, 2001), due November 2006 10,000 -

McDuffie County Authority taxable industrial development revenue bonds,

issued December 31,1997, interest due monthly at an adjustable rate established

by the Remarketing Agent (2.10% at December 29, 2001), principal due on November 1, 2002 10,000 10,000

Deferred term loan at variable interest rates (9.25% at December 30, 2000), repaid - 90,000

Delayed draw facilities at variable interest rates, (8.47% at December 30, 2000), repaid - 94,000

Revolving facility at variable interest rates (8.50% at December 30, 2000), repaid - 15,000

Tranche B facility at variable interest rates (9.19% at December 30, 2000), repaid - 123,500

Other - 784

Subordinated Debt:

Subordinated notes payable, interest due semi-annually at 10.25%, due April 2008 169,450 169,450

Subordinated notes payable, interest due semi-annually at 10.25%, due April 2008,

face amount of $200,000 less unamortized discount of $14,087 at December 29, 2001 185,913 -

Discount debentures, interest at 12.875%, due April 2009, face amount of $112,000

less unamortized discount of $16,626 and $27,785 at December 29, 2001 and

December 30, 2000, respectively (subordinate to substantially all other liabilities) 95,374 84,215

Total long-term debt 955,737 586,949

Less: Current portion of long-term debt (23,715) (9,985)

Long-term debt, excluding current portion $ 932,022 $ 576,964

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

Senior Debt:

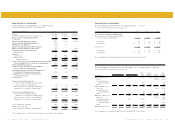

During 2001, Advance Stores Company, Incorporated (“Stores”), a wholly

owned subsidiary of the Company, entered into a new senior bank credit

facility, or the senior credit facility, with a syndicate of banks which

provided for (1) $485,000 in term loans, consisting of a $180,000 tranche

A term loan facility with a maturity of five years and a $305,000 tranche B

term loan facility with a maturity of six years and (2) $160,000 under a

revolving credit facility (which provides for the issuance of letters of credit

with a sublimit of $35,000) with a maturity of five years. A portion of the

proceeds was used to repay the Company’s outstanding borrowing under

the previous credit facility of $270,299 and to finance the Discount

acquisition (Note 3). As a result of the repayment of this debt the Company

recorded an extraordinary loss related to the write-off of deferred financing

costs in the fourth quarter of fiscal 2001 of $3,682, net of $2,424 income

taxes. As of December 29, 2001 the Company has borrowed approximately

$10,000 under the revolving credit facility and has $17,445 in letters of

credit outstanding, which has reduced availability under the credit facility

to approximately $132,555.

The tranche A term loan requires scheduled repayments of $11,000 to

$24,500 semi-annually beginning November 2002 through November 2006

at which point it will be fully repaid. The tranche B term loan requires

scheduled repayments of $2,500 semi-annually beginning November 2002

through May 2007 at which time the Company will be required to pay the

remaining balance at maturity in November 2007.

Borrowings under the senior credit facility are required to be prepaid,

subject to certain exceptions, with (1) 50% of the Excess Cash Flow (as

defined in the senior credit facility) unless the Company’s Leverage Ratio

at the end of any fiscal year is 2.0 or less, in which case 25% of Excess

Cash Flow for such fiscal year will be required to be repaid, (2) 100% of

the net cash proceeds of all asset sales or other dispositions of property by

the Company and its subsidiaries, subject to certain exceptions (including

exceptions for reinvestment of certain asset sale proceeds within 270 days

of such sale and certain sale-leaseback transactions), and (3) 100% of the

net proceeds of certain issuances of debt or equity by the Company and its

subsidiaries. The Company is required to make an Excess Cash Flow

prepayment of $228 in first quarter of fiscal 2002 under the current credit

facility and made a $6,244 mandatory prepayment under the prior credit

agreement for fiscal 2000 in fiscal 2001.

Voluntary prepayments and voluntary reductions of the unutilized

portion of the revolving credit facility are permitted in whole or in part, at

the Company’s option, in minimum principal amounts specified in the

senior credit facility, without premium or penalty, subject to reimbursement

of the lenders’ redeployment costs in the case of a prepayment of adjusted

LIBOR borrowings other than on the last day of the relevant interest period.

Voluntary prepayments under the tranche A term loan facility and the

tranche B term loan facility will (1) generally be allocated among those

facilities on a pro rata basis (based on the then outstanding principal amount

of the loans under each facility) and (2) within each such facility, be applied

to the installments under the amortization schedule within the following 12

months under such facility and all remaining amounts will be applied pro

rata to the remaining amortization payments under such facility.

The interest rate on the tranche A term loan facility and the revolving

credit facility is based, at the Company’s option, on either an adjusted

LIBOR rate, plus a margin, or an alternate base rate, plus a margin. From

July 14, 2002, the interest rates under the tranche A term loan facility and

the revolving credit facility will be subject to adjustment according to a

pricing grid based upon the Company’s Leverage Ratio (as defined in the

senior credit facility). The initial margins are 3.50% and 2.50% for the

adjusted LIBOR rate and alternate base rate borrowings, respectively, and

can step down incrementally to 2.25% and 1.25%, respectively, if the

Company’s Leverage Ratio is less than 2.00 to 1.00. The interest rate on the

tranche B term loan is based, at the Company’s option, on either an

adjusted LIBOR rate plus 4.00% per annum with a floor of 3.00%, or an

alternate base rate plus 3.00% per annum. A commitment fee of 0.50% per

annum will be charged on the unused portion of the revolving credit

facility, payable quarterly in arrears.

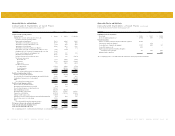

The senior credit facility is guaranteed by the Company and by each of

it’s existing domestic subsidiaries and will be guaranteed by all future

domestic subsidiaries. The senior credit facility is secured by a first priority

lien on substantially all, subject to certain exceptions, of the Company’s

properties and assets and the properties and assets of its existing domestic

subsidiaries (including Discount and its subsidiaries) and will be secured

by the properties and assets of our future domestic subsidiaries. The senior

credit facility contains covenants restricting the ability of the Company and

its subsidiaries to, among other things, (1) declare dividends or redeem or

repurchase capital stock, (2) prepay, redeem or purchase debt, (3) incur

liens or engage in sale-leaseback transactions, (4) make loans and

investments, (5) incur additional debt (including hedging arrangements),

(6) engage in certain mergers, acquisitions and asset sales, (7) engage in

transactions with affiliates, (8) change the nature of our business and the

business conducted by our subsidiaries and (9) change the holding

company status of Advance. The Company is required to comply with

financial covenants with respect to a maximum leverage ratio, a minimum

interest coverage ratio, a minimum current assets to funded senior debt

ratio and maximum limits on capital expenditures.

On December 31, 1997, the Company entered into an agreement with

McDuffie County Authority under which bond proceeds of $10,000 were

issued to construct a distribution center. Proceeds of the bond offering were

fully expended during fiscal 1999. These industrial development revenue

bonds currently bear interest at a variable rate, with a one-time option to

convert to a fixed rate, and are secured by a letter of credit.

Subordinated Debt:

The $169,450 Senior Subordinated Notes (the “Notes”) and the $185,913

Senior Subordinated Notes (the “New Notes”) are both unsecured and are

subordinate in right of payment to all existing and future Senior Debt. The

Notes and New Notes are redeemable at the option of the Company, in

whole or in part, at any time on or after April 15, 2003. The new notes

accrete at an effective yield of 11.875% less cash interest of 10.250%

through maturity in April 2008. As of December 29, 2001, the New Notes

have been accreted by $309.

Upon the occurrence of a change of control, each holder of the Notes

and the New Notes will have the right to require the Company to

repurchase all or any part of such holder’s Notes and New Notes at an

offering price in cash equal to 101% of the aggregate principal amount

thereof plus accrued and unpaid interest and liquidated damages, if any,

thereon to the date of purchase.

The Notes and the New Notes contain various non-financial restrictive

covenants that limit, among other things, the ability of the Company and its

subsidiaries to issue preferred stock, repurchase stock and incur certain

indebtedness, engage in transactions with affiliates, pay dividends or certain

other distributions, make certain investments and sell stock of subsidiaries.

During fiscal 2000, the Company repurchased on the open market

$30,550 face value of Notes at a price ranging from 81.5 to 82.5 percent of

their face value. Accordingly, the Company recorded a gain related to the

extinguishment of this debt of $2,933, net of $1,759 provided for income

taxes and $868 for the write off of the associated deferred debt issuance costs.

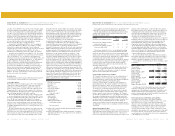

The Discount Debentures (the “Debentures”) accrete at a rate of

12.875%, compounded semi-annually, to an aggregate principal amount of

$112,000 by April 15, 2003. Cash interest will not accrue on the

Debentures prior to April 15, 2003. Commencing April 15, 2003, cash

interest on the Debentures will accrue and be payable, at a rate of 12.875%

per annum, semi-annually in arrears on each April 15 and October 15. As

of December 29, 2001, the Debentures have been accreted by $35,357 with

corresponding interest expense of $11,159, $9,853 and $8,700 recognized

for the years ended December 29, 2001, December 30, 2000 and January

1, 2000, respectively. The Debentures are redeemable at the option of the

Company, in whole or in part, at any time on or after April 15, 2003.

Upon the occurrence of a change of control, each holder of the

Debentures will have the right to require the Company to purchase the

Debentures at a price in cash equal to 101% of the accreted value thereof

plus liquidated damages, if any, thereon in the case of any such purchase

prior to April 15, 2003, or 101% of the aggregate principal amount thereof,

plus accrued and unpaid interest and liquidated damages, if any, thereon to

the date of purchase in the case of any such purchase on or after April 15,

2003. As Advance may not have any significant assets other than capital

stock of Stores (which is pledged to secure Advance’s obligations under the

senior credit facility), the Company’s ability to purchase all or any part of

the Debentures upon the occurrence of a change in control will be

dependent upon the receipt of dividends or other distributions from Stores

or its subsidiaries. The senior credit facility, the Notes and the New Notes

have certain restrictions for Stores with respect to paying dividends and

making any other distributions.

The Debentures are subordinated to substantially all of the Company’s

other liabilities. The Debentures contain certain non-financial restrictive

covenants that are similar to the covenants contained in the Notes and the

New Notes.

As of December 29, 2001, the Company was in compliance with the

covenants of the senior credit facility, the Notes, the New Notes and

Debentures. Substantially all of the net assets of the Company’s

subsidiaries are restricted at December 29, 2001.

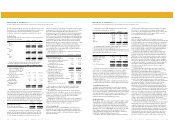

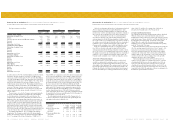

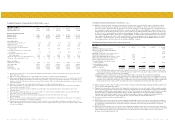

The aggregate future annual maturities of long-term debt, net of the

unamortized discount related to the New Notes and the Debentures, are

as follows:

2002 $ 23,715

2003 32,385

2004 48,578

2005 53,975

2006 63,975

Thereafter 733,109

$ 955,737

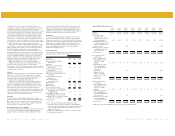

14. Stockholder Subscription Receivables:

The Company established a stock subscription plan in fiscal 1998, which

allows certain directors, officers and key team members of the Company to

purchase shares of common stock. The plan requires that the purchase

price of the stock equal the fair market value at the time of the purchase

and allows fifty percent of the purchase price to be executed through the

delivery of a full recourse promissory note. The notes provide for annual

interest payments, at the prime rate (4.75% at December 29, 2001), with

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)