Advance Auto Parts 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

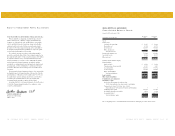

26 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 27

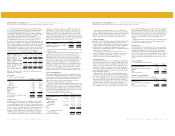

As of the date of the Discount acquisition, management formalized a

plan to close certain Discount Auto Parts stores in overlapping markets or

stores not meeting the Company’s profitability objectives, to relocate

certain Discount administrative functions to the Company’s headquarters

and to terminate certain management, administrative and support team

members of Discount. Additional purchase price liabilities of

approximately $9,066 have been recorded for severance and relocation

costs and approximately $2,331 for store and other exit costs. As of

December 29, 2001, two stores have been closed. The Company expects to

finalize its plan for termination of team members and closure of Discount

Auto Parts stores within one year from the date of the Discount acquisition

and to complete the terminations and closures by the end of fiscal 2002.

Additional liabilities for severance, relocation, store and other facility exit

costs may result in an adjustment to the purchase price. A reconciliation of

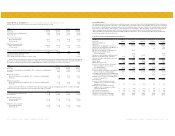

activity with respect to these restructuring accruals is as follows:

Other Exit

Severance Relocation Costs Total

Balance at January 2, 1999 $ 7,738 $ 838 $ 13,732 $ 22,308

Purchase accounting adjustments 3,630 (137) (1,833) 1,660

Reserves utilized (7,858) (701) (4,074) (12,633)

Balance at January 1, 2000 3,510 - 7,825 11,335

Purchase accounting adjustments - - (1,261) (1,261)

Reserves utilized (3,510) - (2,767) (6,277)

Balance at December 30, 2000 - - 3,797 3,797

Purchase accounting adjustments 9,292 611 3,606 13,509

Reserves utilized (837) - (2,500) (3,337)

Balance at December 29, 2001 $ 8,455 $ 611 $ 4,903 $ 13,969

Other exit cost liabilities will be settled over the remaining terms of the

underlying lease agreements.

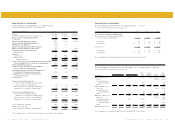

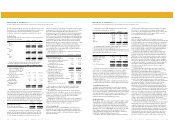

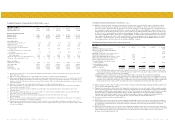

5. Receivables:

Receivables consist of the following:

December 29, December 30,

2001 2000

Trade:

Wholesale $ 8,965 $ 12,202

Retail 19,857 15,666

Vendor (Note 2) 55,179 36,260

Installment (Note 17) 15,430 14,197

Related parties 1,100 3,540

Employees 683 607

Other 2,380 3,127

Total receivables 103,594 85,599

Less: Allowance for doubtful accounts (9,890) (5,021)

Receivables, net $ 93,704 $ 80,578

6. Inventories, net

Inventories are stated at the lower of cost or market. Inventory quantities

are tracked through a perpetual inventory system. The Company uses a

cycle counting program to ensure the accuracy of the perpetual inventory

quantities and establishes reserves for estimated shrink based on historical

accuracy of the cycle counting program. Cost is determined using the last-

in, first-out (“LIFO”) method for approximately 90% of inventories at

December 29, 2001 and December 30, 2000, and the first-in, first-out

(“FIFO”) method for remaining inventories. The Company capitalizes

certain purchasing and warehousing costs into inventory. Purchasing and

warehousing costs included in inventory, at FIFO, at December 29, 2001

and December 30, 2000, were $69,398 and $56,305, respectively. The

nature of the Company’s inventory is such that the risk of obsolescence is

minimal. In addition, the Company has historically been able to return

excess items to the vendor for credit. The Company does provide reserves

where less than full credit will be received for such returns and where the

Company anticipates that items will be sold at retail for prices that are less

than recorded cost. Inventories consist of the following:

December 29, December 30,

2001 2000

Inventories at FIFO, net $ 935,181 $ 779,376

Adjustments to state inventories at LIFO 46,819 9,538

Inventories at LIFO, net $ 982,000 $ 788,914

Replacement cost approximated FIFO cost at December 29, 2001 and

December 30, 2000.

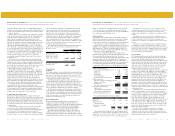

During the fourth quarter of fiscal 2001, the Company recorded a non-

recurring expense of $10,493 ($9,099 in gross profit and $1,394 in

selling, general and administrative expenses) related to the Company’s

supply chain initiatives. These initiatives will reduce the Company’s

overall inventory investment as a result of only offering selective products

in specific store locations or regions. The gross profit charge relates

primarily to restocking and handling fees associated with inventory

identified for return to the Company’s vendors. Additionally, the supply

chain initiative includes a review of the Company’s logistics operations.

The expense recorded in selling, general and administrative expenses

includes cost associated with the relocation of certain equipment from a

distribution facility closed as part of these initiatives (Notes 4 and 9).

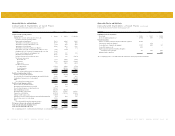

7. Property and Equipment:

Property and equipment are stated at cost, less accumulated depreciation

and amortization. Expenditures for maintenance and repairs are charged

directly to expense when incurred; major improvements are capitalized.

When items are sold or retired, the related cost and accumulated

depreciation are removed from the accounts, with any gain or loss

reflected in the consolidated statements of operations.

Depreciation of land improvements, buildings, furniture, fixtures and

equipment, and vehicles is provided over the estimated useful lives, which

range from 2 to 40 years, of the respective assets using the straight-line

method. Amortization of building and leasehold improvements is provided

over the shorter of the estimated useful lives of the respective assets or the

term of the lease using the straight-line method.

Property and equipment consists of the following:

Estimated December 29, December 30,

Useful Lives 2001 2000

Land and land improvements 0 - 10 years $ 170,780 $ 40,371

Buildings 40 years 199,304 79,109

Building and leasehold

improvements 10 - 40 years 91,338 84,658

Furniture, fixtures

and equipment 3 - 12 years 433,518 357,642

Vehicles 2 - 10 years 32,047 30,506

Other 23,499 10,571

950,486 602,857

Less - Accumulated depreciation

and amortization (239,204) (191,897)

Property and equipment, net $ 711,282 $ 410,960

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

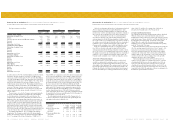

Depreciation and amortization expense was $70,745, $66,826 and

$58,147 for the fiscal years ended 2001, 2000 and 1999, respectively. The

Company capitalized approximately $19,699, $9,400 and $561 in primarily

third party costs incurred in the development of internal use computer

software during fiscal 2001, fiscal 2000 and fiscal 1999, respectively.

8. Carport Acquisition

On April 23, 2001, the Company completed its acquisition of Carport Auto

Parts, Inc. (“Carport”). The acquisition included a net 30 retail stores

located in Alabama and Mississippi, and substantially all of the assets used

in Carport’s operations. The acquisition has been accounted for under the

purchase method of accounting and, accordingly, Carport’s results of

operations have been included in the Company’s consolidated statement of

operations since the acquisition date.

The purchase price, of $21,533, has been allocated to the assets

acquired and the liabilities assumed based on their fair values at the date of

acquisition. This allocation resulted in the recognition of $3,695 in

goodwill, of which $444 was amortized during fiscal 2001.

9. Assets Held for Sale

The Company applies SFAS No. 121, “Accounting for the Impairment of

Long-Lived Assets and for Long-Lived Assets to be Disposed Of,” which

requires that long-lived assets and certain identifiable intangible assets to

be disposed of be reported at the lower of the carrying amount or the fair

market value less selling costs. As of December 29, 2001 and December

30, 2000, the Company’s assets held for sale were $60,512 and $25,077,

respectively, primarily consisting of real property acquired in the Western

Merger and Discount acquisition.

During fiscal 2001, the Company recorded an impairment charge of

$12,300, to reduce the carrying value of certain non-operating facilities to

their estimated fair market value. $4,700 of the charge represents the write-

down of a closed distribution center acquired as part of the Western merger

included in the Wholesale segment. $4,600 represents the reduction in

carrying value of the former Western Auto corporate office also acquired

in the Western merger. The facility, which is held in the Wholesale

segment, consists of excess space not required for the Company’s current

needs. The remaining $3,000 represents a reduction to the carrying value

of a recently closed distribution center in Jeffersonville, Ohio, held in the

Retail segment, that was identified for closure as part of the Company’s

supply chain review. As of December 29, 2001, the carrying value for these

properties included in assets held for sale is $13,800. The reduction in

these book values represents the Company’s best estimate of fair market

value based on recent marketing efforts to attract buyers for these

properties.

During fiscal 2000, the Company also recorded an impairment related

to the Western Auto corporate office space. The impairment charge of

$856 reduced the carrying value to $8,000.

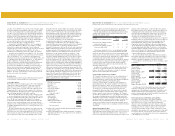

10. Other Assets:

As of December 29, 2001 and December 30, 2000, other assets include

deferred debt issuance costs of $25,790 and $14,843, respectively (net of

accumulated amortization of $3,597 and $8,232, respectively), relating

primarily to the financing in connection with the Discount acquisition

(Notes 3 and 13) and the fiscal 1998 recapitalization. Such costs are being

amortized over the term of the related debt (5 years to 11 years). Other

assets also include the non-current portion of deferred income tax assets

(Note 15).

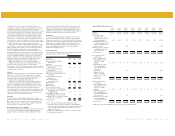

11. Accrued Expenses:

Accrued expenses consist of the following:

December 29, December 30,

2001 2000

Payroll and related benefits $ 58,656 $ 25,507

Restructuring and closed store liabilities 15,879 3,772

Warranty 21,587 18,962

Other 80,096 76,721

Total accrued expenses $ 176,218 $ 124,962

12. Other Long-Term Liabilities:

Other long-term liabilities consist of the following:

December 29, December 30,

2001 2000

Employee benefits $ 22,152 $ 24,625

Restructuring and closed store liabilities 7,733 6,813

Other 6,388 12,495

Total other long-term liabilities $ 36,273 $ 43,933

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)