Advance Auto Parts 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

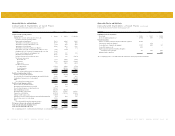

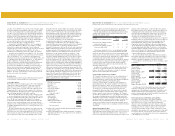

20 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 21

Advance Auto Parts, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

For the Years Ended December 29, 2001, December 30, 2000 and January 1, 2000

(in thousands) 2001 2000 1999

Cash flows from operating activities:

Net income (loss) $ 11,442 $ 19,559 $ (25,326)

Adjustments to reconcile net income (loss) to net cash

provided by (used in) operating activities:

Depreciation and amortization 71,231 66,826 58,147

Amortization of stock option compensation 11,735 729 1,082

Amortization of deferred debt issuance costs 3,121 3,276 3,478

Amortization of bond discount 11,468 9,853 8,700

Amortization of interest on capital lease obligation - 42 201

Extraordinary loss (gain) on extinguishment of debt, net of tax 3,682 (2,933) -

Cumulative effect of a change in accounting principle, net of tax 2,065 - -

Losses on sales of property and equipment, net 2,027 885 119

Impairment of assets held for sale 12,300 856 -

Provision (benefit) for deferred income taxes (3,023) 683 (12,650)

Net decrease (increase) in:

Receivables, net 3,073 19,676 (8,128)

Inventories 13,101 (39,467) (23,090)

Other assets 172 14,921 (4,817)

Net increase (decrease) in:

Accounts payable (17,663) 46,664 (5,721)

Accrued expenses (5,106) (29,540) (21,958)

Other liabilities (16,089) (8,079) 8,987

Net cash provided by (used in) operating activities 103,536 103,951 (20,976)

Cash flows from investing activities:

Purchases of property and equipment (63,695) (70,566) (105,017)

Proceeds from sales of property and equipment and assets held for sale 2,640 5,626 3,130

Acquisition of businesses, net of cash acquired (389,953) - (13,028)

Other - - 1,091

Net cash used in investing activities (451,008) (64,940) (113,824)

Cash flows from financing activities:

Increase (decrease) in bank overdrafts 5,679 1,884 (8,688)

Borrowings (repayments) under notes payable (784) 784 -

Proceeds from the issuance of subordinated notes 185,604 - -

Early extinguishment of debt (270,299) (24,990) -

Borrowings under credit facilities 697,500 278,100 465,000

Payments on credit facilities (254,701) (306,100) (339,500)

Payment of debt issuance costs (17,984) - (972)

(Repurchases of) proceeds from stock transactions under subscription plan (550) 1,602 423

Proceeds from exercise of stock options 2,381 - -

Other 734 5,141 4,999

Net cash provided by (used in) financing activities 347,580 (43,579) 121,262

Net increase (decrease) in cash and cash equivalents 108 (4,568) (13,538)

Cash and cash equivalents, beginning of year 18,009 22,577 36,115

Cash and cash equivalents, end of year $ 18,117 $ 18,009 $ 22,577

The accompanying notes to consolidated financial statements are an integral part of these statements.

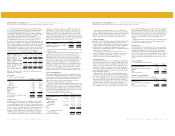

Advance Auto Parts, Inc. and Subsidiaries

Consolidated Statements of Cash Flows (continued)

For the Years Ended December 29, 2001, December 30, 2000 and January 1, 2000

(in thousands) 2001 2000 1999

Supplemental cash flow information:

Interest paid $ 41,480 $ 51,831 $ 46,264

Income tax refunds (payments), net (15,452) 6,175 (3,792)

Noncash transactions:

Issuance of common stock and stock options - Discount acquisition 107,129 - -

Conversion of capital lease obligation - 3,509 -

Accrued purchases of property and equipment 10,725 9,299 543

Accrued debt issuances costs 2,156 - -

Equity transactions under the stockholder subscription

and employee stock option plan 411 1,281 1,660

Obligations under capital lease - - 3,266

The accompanying notes to consolidated financial statements are an integral part of these statements.