Advance Auto Parts 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 45

advertising. These restricted cooperative advertising allowances are

recognized as a reduction to selling, general and administrative expenses

as advertising expenditures are incurred. Unrestricted cooperative

advertising revenue, rebates and other miscellaneous incentives are earned

based on purchases and/or the sale of the product. Amounts received or

receivable from vendors that are not yet earned are reflected as deferred

revenue in the consolidated balance sheets included elsewhere in this

prospectus. We record unrestricted cooperative advertising and volume

rebates earned as a reduction of inventory and recognize the incentives as

a reduction to cost of sales as the inventory is sold. Short-term incentives

are recognized as a reduction to cost of sales over the course of the annual

agreement term and are not recorded as reductions to inventory.

We recognize other incentives earned related to long-term agreements

as a reduction to cost of sales over the life of the agreement based on the

timing of purchases. These incentives are not recorded as reductions to

inventory. The amounts earned under long-term arrangements not

recorded as a reduction of inventory are based on our estimate of total

purchases that will be made over the life of the contracts and the amount

of incentives that will be earned. The incentives are generally recognized

based on the cumulative purchases as a percentage of total estimated

purchases over the life of the contract. Our margins could be impacted

positively or negatively if actual purchases or results differ from our

estimates, but over the life of the contract would be the same.

During the fourth quarter of 2001, we changed our method of

accounting for unrestricted cooperative advertising allowances. These

incentives are now treated as a reduction to inventory and the

corresponding cost of sales. Previously, we accounted for these incentives

as a reduction to selling, general and administrative expenses to the extent

advertising expense was incurred.

Inventory

Minimal inventory shrink reserves are recorded related to Advance Auto

Parts stores as a result of our extensive and frequent cycle counting

program. Our estimates related to these shrink reserves depend on the

effectiveness of the cycle counting programs. We evaluate the

effectiveness of these programs on an on-going basis.

Minimal reserves for potentially excess and obsolete inventories are

recorded as well. The nature of our inventory is such that the risk of

obsolescence is minimal. In addition, historically we have been able to

return excess items to the vendor for credit. We provide reserves where

less than full credit will be received for such returns and where we

anticipate that items will be sold at retail prices that are less than recorded

cost. Future changes by vendors in their policies or willingness to accept

returns of excess inventory could require us to revise our estimates of

required reserves for excess and obsolete inventory.

Warranties

We record accruals for future warranty claims related to warranty

programs for batteries, tires, road-side assistance and Craftsman products.

Our accruals are based on current sales of the warranted products and

historical claim experience. If claims experience differs from historical

levels, revisions in our estimates may be required.

Restructuring and Closed Store Liabilities

We recognize a provision for future obligations at the time a decision is made

to close a store location. This provision includes future minimum lease

payments, common area maintenance and taxes. Additionally, we make

certain assumptions related to potential subleases and lease buyouts that

reduce the recorded amount of the accrual. These assumptions are based on

our knowledge of the market and the relevant experience. However, the

inability to enter into the subleases or obtain buyouts within the estimated

timeframe may result in increases or decreases to these reserves.

Contingencies

We accrue for obligations, including estimated legal costs, when it is

probable and the amount is reasonably estimable. As facts concerning

contingencies become known, we reassess our position both with respect

to gain contingencies and accrued liabilities and other potential exposures.

Estimates that are particularly sensitive to future change include tax,

environmental and legal matters, which are subject to change as events

evolve and as additional information becomes available during the

administrative and litigation process.

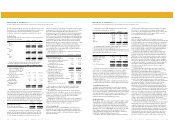

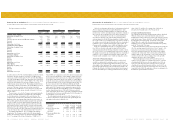

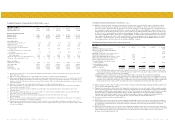

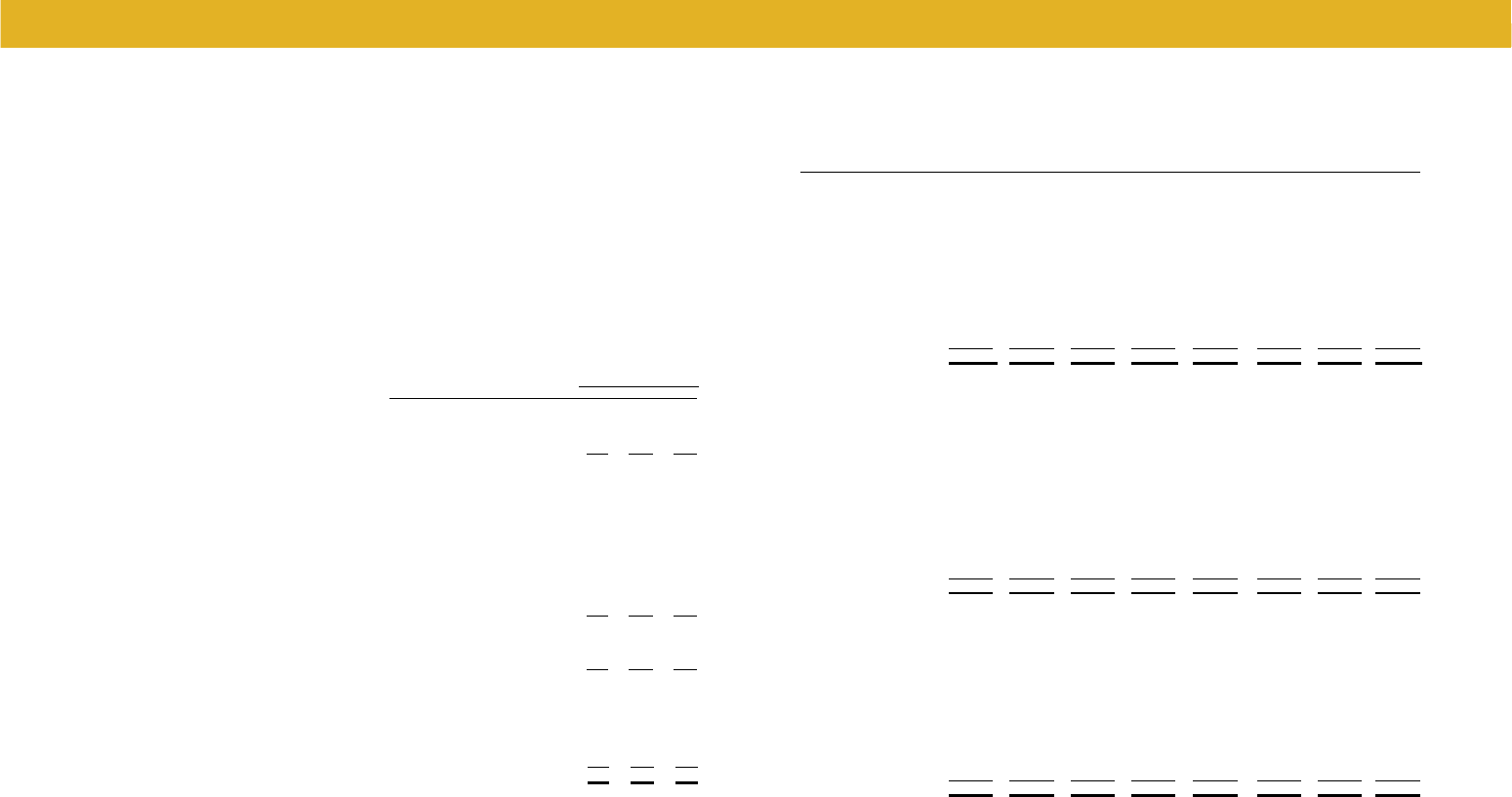

Results of Operations

The following table sets forth certain of our operating data expressed as a

percentage of net sales for the periods indicated.

Fiscal Year

1999 2000 2001

Net sales 100.0% 100.0% 100.0%

Cost of sales (1) 63.6 60.8 57.2

Expenses associated with supply

chain initiatives - - 0.4

Gross profit 36.4 39.2 42.4

Selling, general and administrative

expenses (1) (2) 33.5 35.0 37.6

Expenses associated with supply

chain initiatives - - 0.1

Impairment of assets held for sale - - 0.5

Expenses associated with merger related

restructuring - - 0.1

Expenses associated with merger

and integration 1.9 - 0.0

Non-cash stock option

compensation expense 0.1 0.1 0.5

Operating income 0.9 4.1 3.5

Interest expense 2.8 2.9 2.5

Other income, net 0.2 0.0 0.1

Income tax (benefit) expense (0.6) 0.5 0.4

Income (loss) before extraordinary item

and cumulative effect of a change in

accounting principle (1.1) 0.7 0.7

Extraordinary item, gain (loss) on debt

extinguishment, net of income taxes - 0.1 (0.1)

Cumulative effect of a change in accounting

principle, net of income taxes - - (0.1)

Net income (loss) (1.1)% 0.8% 0.5%

(1) Cost of sales and selling, general and administrative expenses

presented for fiscal 2001 reflect the change in accounting principle

related to cooperative advertising funds. This change resulted in lower

cost of sales with corresponding increases in selling, general and

administrative expenses.

(2) Selling, general and administrative expenses are adjusted for certain

non-recurring and other items.

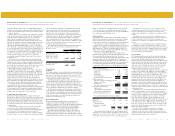

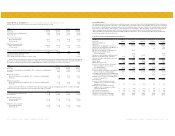

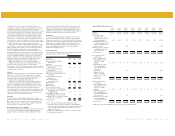

Quarterly Financial Results (unaudited)

16-Weeks 12-Weeks 12-Weeks 12-Weeks 16-Weeks 12-Weeks 12-Weeks 12-Weeks

Ended Ended Ended Ended Ended Ended Ended Ended

(in thousands, except per share data) 4/22/2000 7/15/2000 10/7/2000 12/30/2000 4/21/2001(a) 7/14/2001(a) 10/6/2001(a) 12/29/2001(a)

Net sales $ 677,582 $ 557,650 $ 552,138 $ 500,652 $ 729,359 $ 607,478 $ 598,793 $ 582,009

Gross profit 258,975 216,533 223,903 196,484 311,450 257,228 256,734 241,515

(Loss) income before

extraordinary item and

cumulative effect of a change

in accounting principle (956) 10,381 9,507 (2,306) 3,873 14,124 15,232 16,040)

Extraordinary item, gain (loss)

on debt extinguishment, net of

($1,759) and $2,424 income

taxes, respectively - - 2,933 - - - - (3,682)

Cumulative effect of a change in

accounting principle, net of

$1,360 income taxes ----- --(2,065)

Net (loss) income $ (956) $ 10,381 $ 12,440 $ (2,306) $ 3,873 $ 14,124 $ 15,232 $ (21,787)

Basic earnings (loss) per

common share:

Before extraordinary item

and cumulative effect of a

change in accounting

principle $ (0.03) $ 0.37 $ 0.34 $ (0.08) $ 0.14 $ 0.50 $ 0.54 $ (0.54)

Extraordinary item, gain on

debt extinguishment, net

of ($1,759) and $2,424

income taxes,

respectively - - 0.10 - - - - (0.12)

Cumulative effect of a

change in accounting

principle, net of $1,360

income taxes ----- --(0.07)

Net (loss) income $ (0.03) $ 0.37 $ 0.44 $ (0.08) $ 0.14 $ 0.50 $ 0.54 $ (0.73)

Diluted earnings (loss) per

common share:

Before extraordinary item

and cumulative effect of a

change in accounting

principle $ (0.03) $ 0.36 $ 0.33 $ (0.08) $ 0.14 $ 0.49 $ 0.53 $ (0.54)

Extraordinary item, gain on

debt extinguishment, net of

($1,759) and $2,424 income

taxes, respectively - - 0.10 - - - - (0.12)

Cumulative effect of a change

in accounting principle,

net of $1,360 income taxes ----- --(0.07)

Net (loss) income $ (0.03) $ 0.36 $ 0.44 $ (0.08) $ 0.14 $ 0.49 $ 0.53 $ (0.73)

(a) Reflects the change in accounting principle related to the cooperative advertising funds.