Advance Auto Parts 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 19

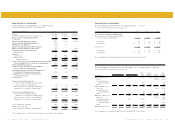

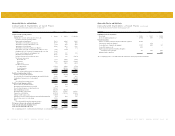

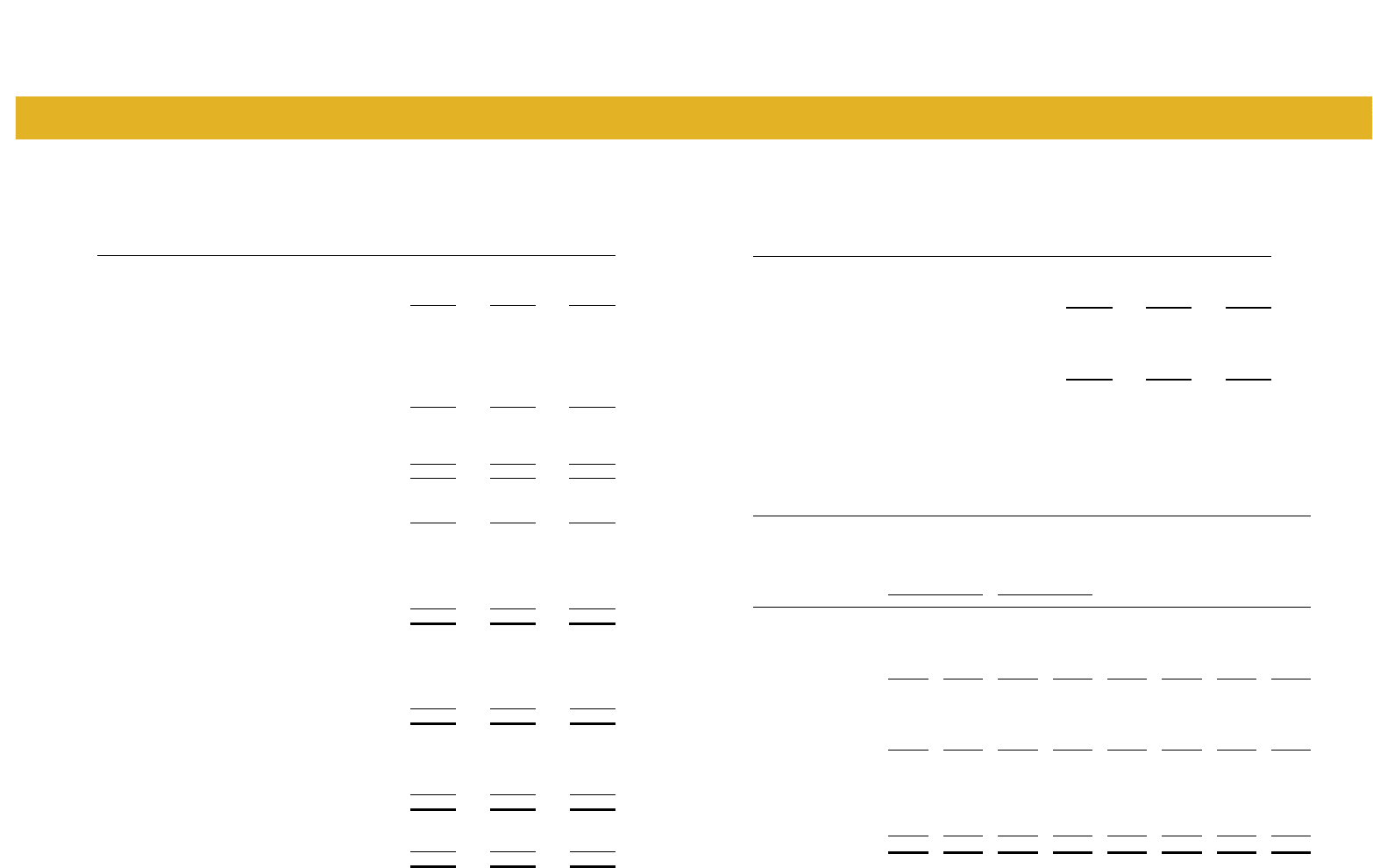

Advance Auto Parts, Inc. and Subsidiaries

Consolidated Statements of Operations

For the Years Ended December 29, 2001, December 30, 2000 and January 1, 2000

(in thousands, except per share data) 2001 2000 1999

Net sales $ 2,517,639 $ 2,288,022 $ 2,206,945

Cost of sales, including purchasing and warehousing costs 1,441,613 1,392,127 1,404,113

Expenses associated with supply chain initiatives 9,099 - -

Gross profit 1,066,927 895,895 802,832

Selling, general and administrative expenses 947,531 801,521 740,481

Expenses associated with supply chain initiatives 1,394 - -

Impairment of assets held for sale 12,300 856 -

Expenses associated with merger-related restructuring 3,719 - -

Expenses associated with merger and integration 1,135 - 41,034

Non-cash stock option compensation expense 11,735 729 1,082

Operating income 89,113 92,789 20,235

Other, net:

Interest expense 61,895 66,640 62,792

Other income, net 1,283 1,012 4,647

Total other expense, net 60,612 65,628 58,145

Income (loss) before provision (benefit) for income taxes, extraordinary

items, and cumulative effect of a change in accounting principle 28,501 27,161 (37,910)

Provision (benefit) for income taxes 11,312 10,535 (12,584)

Income (loss) before extraordinary items and cumulative

effect of a change in accounting principle 17,189 16,626 (25,326)

Extraordinary items, (loss) gain on debt extinguishment, net

of $2,424 and ($1,759) income taxes, respectively (3,682) 2,933 -

Cumulative effect of a change in accounting principle,

net of $1,360 income taxes (2,065) - -

Net income (loss) $ 11,442 $ 19,559 $ (25,326)

Net income (loss) per basic share from:

Income (loss) before extraordinary items and cumulative

effect of a change in accounting principle $ 0.60 $ 0.59 $ (0.90)

Extraordinary items, (loss) gain on debt extinguishment (0.13) 0.10 -

Cumulative effect of a change in accounting principle (0.07) - -

$ 0.40 $ 0.69 $ (0.90)

Net income (loss) per diluted share from:

Income (loss) before extraordinary items and

cumulative effect of a change in accounting principle $ 0.59 $ 0.58 $ (0.90)

Extraordinary items, (loss) gain on debt extinguishment (0.13) 0.10 -

Cumulative effect of a change in accounting principle (0.07) - -

$ 0.39 $ 0.68 $ (0.90)

Average common shares outstanding 28,637 28,296 28,269

Dilutive effect of stock options 521 315 -

Average common shares outstanding - assuming dilution 29,158 28,611 28,269

The accompanying notes to consolidated financial statements are an integral part of these statements.

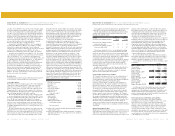

Advance Auto Parts, Inc. and Subsidiaries

Consolidated Statements of Operations (continued)

For the Years Ended December 29, 2001, December 30, 2000 and January 1, 2000

(in thousands, except per share data) 2001 2000 1999

Pro forma effect of change in accounting principle:

Income (loss) before extraordinary items and cumulative

effect of a change in accounting principle $ 17,189 $ 16,391 $ (25,776)

Per basic share $ 0.60 $ 0.58 $ (0.91)

Per diluted share $ 0.59 $ 0.57 $ (0.91)

Net income (loss) $ 13,507 $ 19,324 $ (25,776)

Per basic share $ 0.47 $ 0.68 $ (0.91)

Per diluted share $ 0.46 $ 0.68 $ (0.91)

The accompanying notes to consolidated financial statements are an integral part of these statements.

Consolidated Statements of Changes in Stockholders’ Equity

For the Years Ended December 29, 2001, December 30, 2000 and January 1, 2000

Additional Stockholder Total

Preferred Stock Common Stock Paid-in Subscription Accumulated Stockholders’

(in thousands) Shares Amount Shares Amount Capital Receivables Deficit Equity

Balance, January 2, 1999 - $ - 28,262 $ 3 $ 371,580 $ (2,526) $(209,966) $ 159,091

Net loss - - - - - - (25,326) (25,326)

Non-cash stock option

compensation expense - - - - 1,082 - - 1,082

Other - - (118) - (908) 518 (503) (893)

Balance, January 1, 2000 - - 28,144 3 371,754 (2,008) (235,795) 133,954

Net income - - - - - - 19,559 19,559

Non-cash stock option

compensation expense - - - - 729 - - 729

Other - - 145 - 2,726 (356) (341) 2,029

Balance, December 30, 2000 - - 28,289 3 375,209 (2,364) (216,577) 156,271

Net income - - - - - - 11,442 11,442

Discount acquisition (Note 3) - - 4,310 - 107,129 - - 107,129

Non-cash stock option

compensation expense - - - - 11,735 - - 11,735

Other - - 93 - 2,465 (312) (159) 1,994

Balance, December 29, 2001 - $ - 32,692 $ 3 $ 496,538 $ (2,676) $ (205,294) $ 288,571

The accompanying notes to consolidated financial statements are an integral part of these statements.