Advance Auto Parts 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 25

after June 30, 2001. SFAS No. 142 is effective for the Company’s existing

goodwill and intangible assets beginning on December 30, 2001. SFAS

No. 142 is effective immediately for goodwill and intangibles acquired

after June 30, 2001. For fiscal year 2001, the Company had amortization

expense of approximately $444 related to existing goodwill of $3,251 at

December 29, 2001. Such amortization will be eliminated upon adoption

of SFAS No. 142. Although the Company is currently evaluating the

impact of other provisions of SFAS Nos. 141 and 142, management does

not expect that the adoption of these statements will have a material

impact on its financial position or results of operations.

In August 2001, the FASB issued SFAS No. 143, “Accounting for

Asset Retirement Obligations.” SFAS No. 143 establishes accounting

standards for recognition and measurement of an asset retirement

obligation and an associated asset retirement cost and is effective for fiscal

year 2003. The Company does not expect SFAS No. 143 to have a

material impact on its financial position or the results of its operations.

In August 2001, the FASB also issued SFAS No. 144, “Accounting

for the Impairment or Disposal of Long-Lived Assets”. This statement

replaces both SFAS No. 121, “Accounting for the Impairment of

Long-Lived Assets and for Long-Lived Assets to Be Disposed Of ” and

Accounting Principles Board (APB) Opinion No. 30, “Reporting the

Results of Operations—Reporting the Effects of Disposal of a

Segment of a Business, and Extraordinary, Unusual and Infrequently

Occurring Events and Transactions.” SFAS 144 retains the basic

provisions from both SFAS 121 and APB 30 but includes changes to

improve financial reporting and comparability among entities. The

Company will adopt the provisions of SFAS 144 during the first

quarter of fiscal 2002. Management does not expect the adoption of

SFAS No. 144 to have a material impact on the Company’s financial

position or the results of its operations.

Reclassifications

Certain items in the fiscal 2000 and fiscal 1999 financial statements have

been reclassified to conform with the fiscal 2001 presentation.

3. Discount Acquisition

On November 28, 2001, the Company acquired 100% of the outstanding

common stock of Discount Auto Parts, Inc. (“Discount”). Discount’s

shareholders received $7.50 per share in cash plus 0.2577 shares of

Advance common stock for each share of Discount common stock. The

Company issued 4,310 shares of Advance common stock to the former

Discount shareholders, which represented 13.2% of the Company’s total

shares outstanding immediately following the acquisition.

Discount was the fifth largest specialty retailer of automotive parts,

accessories and maintenance items in the United States with 671 stores

in six states, including the leading market position in Florida, with 437

stores. The Discount acquisition further solidified the Company’s

leading market position throughout the Southeast. The Company also

expects to achieve ongoing purchasing savings and savings from the

optimization of the combined distribution networks and the reduction of

overlapping administrative functions as we convert the Discount stores

to Advance stores.

In connection with the Discount acquisition, the Company issued an

additional $200,000 face value of 10.25% senior subordinated notes and

entered into a new senior credit facility that provides for (1) a $180,000

tranche A term loan facility and a $305,000 tranche B term loan facility

and (2) a $160,000 revolving credit facility (including a letter of credit

sub-facility). Upon the closing of the Discount acquisition, the Company

used $485,000 of borrowings under the new senior credit facility and net

proceeds of $185,600 from the sale of the senior subordinated notes to,

among other things, pay the cash portion of the acquisition consideration,

repay all amounts outstanding under the Company’s then-existing credit

facility, repay all outstanding indebtedness of Discount and purchase

Discount’s Gallman distribution facility from the lessor.

In accordance with SFAS No. 141, the acquisition has been accounted

for under the purchase method of accounting and was effective for

accounting purposes on December 2, 2001. Accordingly, the results of

operations of Discount for the period from December 2, 2001, to December

29, 2001, are included in the accompanying consolidated financial

statements. The purchase price has been allocated to the assets acquired and

liabilities assumed based upon estimates of fair values. Such estimates are

preliminary and subject to the finalization of plans to exit certain activities.

Negative goodwill of $75,724, resulting from excess fair value over the

purchase price, was allocated proportionately as a reduction to certain

noncurrent assets, primarily property and equipment. The purchase price

was $480,977, primarily including the issuance of 4,310 shares of Advance

common stock and 575 options to purchase shares of Advance common

stock, cash consideration for $7.50 per share and the “in the money” stock

options of $128,479, repayment of Discount’s existing debt and prepayment

penalties of $204,711 and the purchase of Discount’s Gallman distribution

facility from the lessor for $34,062. The cost assigned to the 4,310 shares of

common stock is $106,025 and was determined based on the market price

of Discount’s common stock on the approximate announcement date of the

acquisition. The cost assigned to the 575 options to purchase common stock

is $1,104 and was determined using the Black-Scholes option-pricing model

with the following assumptions: (i) risk-free interest rate of 3.92%; (ii) an

expected life of two years; (iii) a volatility factor of .40; (iv) a fair value of

common stock of $24.60; and (v) expected dividend yield of zero. The

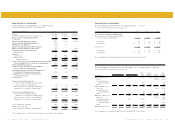

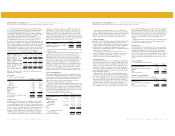

following table summarizes the amounts assigned to assets acquired and

liabilities assumed at the date of the acquisition.

December 2, 2001

Current assets:

Cash and cash equivalents $ 6,030

Receivables, net 15,591

Inventories 192,402

Other current assets 34,590

Property and equipment 316,784

Assets held for sale 38,546

Other assets (a) 9,269

Total assets acquired 613,212

Current liabilities:

Bank overdrafts (15,470)

Accounts payable (58,852)

Current liabilities (b) (56,828)

Other long-term liabilities (b) (1,085)

Total liabilities assumed (132,235)

Net assets acquired $ 480,977

(a) Includes $1,652 assigned to the Discount trade dress with a useful life

of approximately 3 years.

(b) Includes restructuring liabilities established in purchase accounting of

approximately $11,397 for severance and relocation costs, facility and

other exit costs (Note 4).

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

Total acquisition costs related to the transaction were approximately $8,804,

of which $1,555 is reflected in accrued liabilities at December 29, 2001.

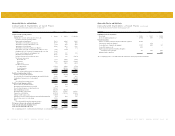

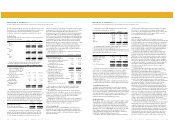

The following unaudited pro forma information presents the results of

operations of the Company as if the acquisition had taken place at the

beginning of the applicable period:

2001 2000

Net sales $ 3,144,694 $ 2,928,036

Net income from continuing operations 26,011 33,858

Net income from continuing operations

per proforma basic share $ 0.80 $ 1.04

Net income from continuing operations

per proforma diluted share $ 0.78 $ 1.03

The proforma amounts give effect to certain adjustments, including

changes in interest expense, depreciation and amortization and related

income tax effects. These amounts are based on certain assumptions and

estimates and do not reflect any benefit from economies, which might be

achieved from combined operations. Additionally, these results include the

non-recurring items separately disclosed in the accompanying

consolidated statements of operations. The proforma results of operations

have been prepared for comparative purposes only and do not purport to

be indicative of the results of operations which actually would have

resulted had the Discount acquisition occurred on the date indicated, or

which may result in the future.

In addition to the acquisition costs, the Company incurred $20,803 of

costs and fees, of which $20,140 has been recorded as deferred debt

issuance costs and $663 as stock issuance costs related to registering

shares in connection with the Discount acquisition.

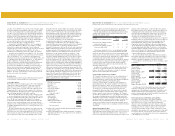

4. Restructuring and Closed Store Liabilities:

The Company’s restructuring activities relate to the ongoing analysis of

the profitability of store locations and the settlement of restructuring

activities undertaken as a result of mergers and acquisitions, including the

fiscal 1998 merger with Western Auto Supply Company

(“Western”)(“Western Merger”), and the fiscal 2001 acquisitions of

Carport Auto Parts, Inc. (the “Carport Acquisition”) (See Note 8) and

Discount. The Company recognizes a provision for future obligations at

the time a decision is made to close a facility, primarily store locations.

The provision for closed facilities includes the present value of the

remaining lease obligations, reduced by the present value of estimated

revenues from subleases, and management’s estimate of future costs of

insurance, property tax and common area maintenance. The Company

uses discount rates ranging from 6.5% to 7.7%. Expenses associated with

the ongoing restructuring program are included in selling, general and

administrative expenses in the accompanying consolidated statements of

operations. From time to time these estimates require revisions that affect

the amount of the recorded liability. The effect of these changes in

estimates is netted with new provisions and included in selling, general

and administrative expenses on the accompanying consolidated statements

of operations.

Ongoing Restructuring Program

During fiscal 2001, the Company closed three stores included in the fiscal

2000 restructuring activities and made the decision to close or relocate 39

additional stores not meeting profitability objectives, of which 27 have

been closed as of December 29, 2001. The remaining stores will be closed

during fiscal 2002. Additionally, as a result of the Discount acquisition,

the Company decided to close 27 Advance Auto Parts stores that were in

overlapping markets with certain Discount Auto Parts stores. Expenses

associated with restructuring include estimated exit costs of $3,271 and

write-offs of related leasehold improvements of $448. All 27 stores are

scheduled to be closed during the first quarter of fiscal 2002.

On July 27, 2001, the Company made the decision to close a duplicative

distribution facility located in Jeffersonville, Ohio. This 382,000 square foot

owned facility opened in 1996 and served stores operating in the retail

segment throughout the mid-west portion of the United States. The

Company has operated two distribution facilities in overlapping markets

since the Western Merger, in which the Company assumed the operation of

a Western distribution facility in Ohio. The decision to close this facility

allows the Company to utilize the operating resources more productively in

other areas of the business. The Company has established restructuring

reserves for the termination of certain team members and exit costs in

connection with the decision to close this facility.

In connection with the Western merger and the Discount acquisition,

the Company assumed the restructuring reserves related to the acquired

operations. As of December 29, 2001, these restructuring reserves relate

primarily to ongoing lease obligations for closed store locations.

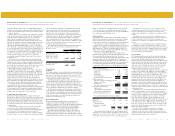

A reconciliation of activity with respect to these restructuring accruals

is as follows. Other Exit

Severance Costs Total

Balance, January 2, 1999 $ 682 $ 14,773 $ 15,455

New provisions - 1,307 1,307

Change in estimates - (1,249) (1,249)

Reserves utilized (664) (4,868) (5,532)

Balance, January 1, 2000 18 9,963 9,981

New provisions - 1,768 1,768

Change in estimates - (95) (95)

Reserves utilized (18) (4,848) (4,866)

Balance, December 30, 2000 - 6,788 6,788

New provisions 475 8,285 8,760

Change in estimates - 11 11

Reserves utilized (475) (5,441) (5,916)

Balance, December 29, 2001 $ - $ 9,643 $ 9,643

As of December 29, 2001, this liability represents the current value

required for certain facility exit costs, which will be settled over the

remaining terms of the underlying lease agreements. This liability, along

with those related to mergers and acquisitions, is recorded in accrued

expenses (current portion) and other long-term liabilities (long-term) in the

accompanying consolidated balance sheets.

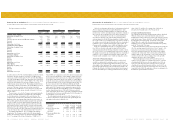

Restructuring Associated with Mergers and Acquisitions

As a result of the Western Merger, the Company established

restructuring reserves in connection with the decision to close certain

Parts America stores, to relocate certain Western administrative

functions, to exit certain facility leases and to terminate certain team

members of Western. Additionally, the Carport acquisition resulted in

restructuring reserves for closing 21 acquired stores not expected to

meet long-term profitability objectives and the termination of certain

administrative team members of the acquired company. As of December

29, 2001, the other exit costs represent the current value required for

certain facility exit costs, which will be settled over the remaining terms

of the underlying lease agreements.

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)