Advance Auto Parts 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 49

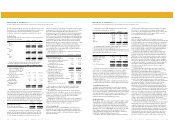

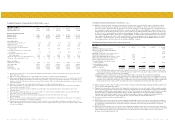

Liquidity and Capital Resources

At December 29, 2001, we had outstanding indebtedness consisting of

$95.4 million of senior discount debentures, $355.4 million of senior

subordinated notes, borrowings of $495.0 million under our senior

credit facility, and $10.0 million of indebtedness under the McDuffie

County Development Authority Taxable Industrial Bonds.

In connection with the Discount acquisition, we entered into the

senior credit facility and issued $200.0 million in face amount of our

senior subordinated notes. Upon consummation of the Discount

acquisition, we used $485 million of borrowings under the new senior

credit facility and net proceeds of $185.6 million from the sale of the

senior subordinated notes to (1) fund the cash portion of the

consideration paid to the Discount shareholders and in-the-money

option holders, (2) repay $204.7 million in borrowings under

Discount’s credit facility (including repayment premiums of $5.8

million), (3) purchase Discount’s Gallman distribution facility from the

lessor for $34.1 million, (4) repay $270.3 million of borrowings under

our prior credit facility, and (5) pay approximately $30 million in

related transaction fees and expenses. At February 28, 2002, we had

approximately $17.4 million in letters of credit outstanding and had no

borrowings under the revolving credit facility, resulting in available

borrowings of $142.6 million under the revolving credit facility.

In 2001, net cash provided by operating activities was $103.5

million. This amount consisted of $11.4 million in net income,

depreciation and amortization of $71.2 million, amortization of

deferred debt issuance costs and bond discount of $14.6 million,

impairment of assets held for sale of $12.3 million, amortization of

stock option compensation of $11.7 million and an increase of $17.7

million of net working capital and other operating activities. Net cash

used for investing activities was $451.0 million and was comprised

primarily of capital expenditures of $63.7 million and cash

consideration of $390.0 million in the Discount and Carport mergers.

Net cash provided by financing activities was $347.6 million and was

comprised primarily of net borrowings and issuance of equity.

In 2000, net cash provided by operating activities was $104.0

million. This amount consisted of $19.6 million in net income,

depreciation and amortization of $66.8 million, amortization of

deferred debt issuance costs and bond discount of $13.1 million and a

decrease of $4.5 million in net working capital and other operating

activities. Net cash used for investing activities was $65.0 million and

was comprised primarily of capital expenditures. Net cash used in

financing activities was $43.6 million and was comprised primarily of

net repayments of long-term debts.

In 1999, net cash used in operating activities was $21.0 million.

This amount consisted of a $25.3 million net loss, offset by

depreciation and amortization of $58.1 million, amortization of

deferred debt issuance costs and bond discount of $12.2 million, and an

increase of $66.0 million in net working capital and other operating

activities. Net cash used for investing activities was $113.8 million and

was comprised primarily of capital expenditures of $105.0 million and

cash consideration of $13.0 million in the Western merger. Net cash

provided by financing activities was $121.3 million and was comprised

primarily of net borrowings.

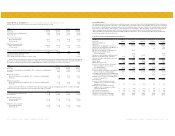

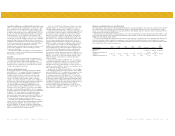

Our primary capital requirements have been the funding of our

continued store expansion program, store relocations and remodels,

inventory requirements, the construction and upgrading of distribution

centers, the development and implementation of proprietary

information systems, the Discount acquisition, the Western merger and

the Carport acquisition. We have financed our growth through a

combination of internally generated funds, borrowings under the credit

facility and issuances of equity.

Our new stores, if leased, require capital expenditures of

approximately $120,000 per store and an inventory investment of

approximately $150,000 per store, net of vendor payables. A portion of

the inventory investment is held at a distribution facility. Pre-opening

expenses, consisting primarily of store set-up costs and training of new

store employees, average approximately $25,000 per store and are

expensed when incurred.

Our future capital requirements will depend on the number of new

stores we open and the timing of those openings within a given year.

We opened 140 new stores during 2000 and 80 new stores during 2001

(excluding stores acquired in the Carport and Discount acquisitions). In

addition, we anticipate adding approximately 100 to 125 new stores

through new store openings and selective acquisitions during 2002. Our

capital expenditures were approximately $63.7 million in 2001

(excluding the Carport and Discount acquisitions). These amounts

related to the new store openings, the upgrade of our information

systems (including our new point-of-sale and electronic parts catalog

system) and remodels and relocations of existing stores. In 2002, we

anticipate that our capital expenditures will be approximately $105

million, of which approximately $34 million will involve conversion

and other integration related capital expenditures associated with the

Discount acquisition.

Historically, we have negotiated extended payment terms from

suppliers that help finance inventory growth, and we believe that we

will be able to continue financing much of our inventory growth

through such extended payment terms. We anticipate that inventory

levels will continue to increase primarily as a result of new store

openings.

As part of normal operations, we continually monitor store

performance, which results in our closing certain store locations that do

not meet profitability objectives. In 2001, we closed three stores as part

of 2000 restructuring activities and decided to close or relocate 39

additional stores that did not meet profitability objectives, 27 of which

were closed or relocated at December 29, 2001. In addition, as part of

our ongoing review of our store performance and our focus on

increasing the productivity of our entire store base, we anticipate

closing approximately 25 additional Advance Auto Parts stores in 2002.

As a result of the Carport acquisition, we closed 21 acquired stores not

expected to meet profitability objectives. As part of our integration of

Discount, we expect to close 108 and 27 Discount and Advance stores,

respectively, that are in overlapping markets, as well as Discount stores

that do not meet profitability objectives. In addition, we made the

decision to close a duplicative distribution facility located in

Jeffersonville, Ohio.

The Western merger, Carport acquisition and Discount acquisition

also resulted in restructuring reserves recorded in purchase accounting

for the closure of certain stores, severance and relocation costs and

other facility exit costs. In addition, we assumed certain restructuring

and deferred compensation liabilities previously recorded by Western

and Discount. At December 29, 2001, these reserves had a remaining

balance of $23.6 million. At December 29, 2001, the total liability for

the assumed restructuring and deferred compensation plans was $2.1

million and $4.3 million, respectively, of which $1.2 million and $2.3

million, respectively, is recorded as a current liability. The classification

for deferred compensation is determined by payment terms elected by

plan participants, primarily former Western employees, which can be

changed upon 12 months’ notice.

We expect that funds provided from operations and available

borrowings of approximately $142.6 million under our revolving credit

facility at February 28, 2002, will provide sufficient funds to operate

our business, make expected capital expenditures of approximately

$105 million in 2002, finance our restructuring activities, redeem our

industrial revenue bonds in November 2002 in an aggregate principal

amount of $10 million and fund future debt service on our senior

subordinated notes, our senior discount debentures and our senior credit

facility over the next 12 months.

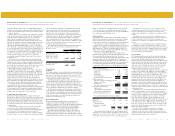

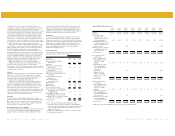

Long Term Debt

Senior Credit Facility. In connection with the Discount acquisition, we

entered into a new senior credit facility consisting of (1) a $180 million

tranche A term loan facility due 2006 and a $305 million tranche B

term loan facility due 2007 and (2) a $160 million revolving credit

facility (including a letter of credit subfacility). The senior credit

facility is jointly and severally guaranteed by all of our domestic

subsidiaries (including Discount and its subsidiaries) and is secured by

substantially all of our assets and the assets of our existing and future

domestic subsidiaries (including Discount and its subsidiaries).

The tranche A term loan facility matures on November 30, 2006 and

provides for amortization of $11.0 million at the end of the first year,

semi-annual amortization aggregating $27.4 million in year two, $43.6

million in year three and $49.0 million in each of years four and five.

The tranche B term loan facility matures on November 30, 2007 and

amortizes in semi-annual installments of $2.5 million for five years

commencing on November 30, 2002, with a final payment of $280.0

million due in year six. The revolving credit facility matures on

November 30, 2006. The interest rate on the tranche A term loan

facility and the revolving credit facility is based, at our option, on either

an adjusted LIBOR rate, plus a margin, or an alternate base rate, plus a

margin. From July 14, 2002, the interest rates under the tranche A term

loan facility and the revolving credit facility will be subject to

adjustment according to a pricing grid based upon our leverage ratio (as

defined in the senior credit facility). The initial margins are 3.50% and

2.50% for the adjusted LIBOR rate and alternate base rate borrowings,

respectively, and can step down incrementally to 2.25% and 1.25%,

respectively, if our leverage ratio is less than 2.00 to 1.00. The interest

rate on the tranche B term loan facility is based, at our option, on either

an adjusted LIBOR rate with a floor of 3.00% plus 4.00% per annum

or an alternate base rate plus 3.00% per annum. A commitment fee of

0.50% per annum will be charged on the unused portion of the

revolving credit facility, payable quarterly in arrears.

Borrowings under the senior credit facility are required to be

prepaid, subject to certain exceptions, in certain circumstances.

The senior credit facility contains covenants restricting our ability

and the ability of our subsidiaries to, among others things, (i) pay cash

dividends on any class of capital stock or make any payment to

purchase, redeem, retire, acquire, cancel or terminate capital stock, (ii)

prepay, redeem, retire, acquire, cancel or terminate debt, (iii) incur liens

or engage in sale-leaseback transactions, (iv) make loans, investments,

advances or guarantees, (v) incur additional debt (including hedging

arrangements), (vi) make capital expenditures, (vii) engage in mergers,

acquisitions and asset sales, (viii) engage in transactions with affiliates,

(ix) enter into any agreement which restricts the ability to create liens

on property or assets or the ability of subsidiaries to pay dividends or

make payments on advances or loans to subsidiaries, (x) change the

nature of the business conducted by us and our subsidiaries, (xi) change

our passive holding company status and (xii) amend existing debt

agreements or our certificate of incorporation, by-laws or other

organizational documents. We are also required to comply with

financial covenants in the credit facility with respect to (a) limits on

annual aggregate capital expenditures, (b) a maximum leverage ratio,

(c) a minimum interest coverage ratio and (d) a ratio of current assets

to funded senior debt. We were in compliance with the above covenants

under the senior credit facility at December 29, 2001.

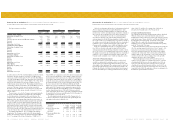

Senior Subordinated Notes. On October 31, 2001, in connection with

the Discount acquisition, we sold an additional $200.0 million in senior

subordinated notes at an issue price of 92.802%, yielding gross

proceeds of approximately $185.6 million, the accreted value of which

was $185.9 million at December 29, 2001. These senior subordinated

notes were an addition to the $200.0 million face amount of existing

senior subordinated notes that we issued in connection with the

recapitalization in April 1998, of which $169.5 million was outstanding

at December 29, 2001. All of the notes mature on April 15, 2008 and

bear interest at 10.25%, payable semi-annually on April 15 and October

15. The notes are fully and unconditionally guaranteed on an unsecured

senior subordinated basis by each of our existing and future restricted

subsidiaries that guarantees any indebtedness of us or any restricted

subsidiary. The notes are redeemable at our option, in whole or in part,

at any time on or after April 15, 2003, in cash at certain redemption

prices plus accrued and unpaid interest and liquidating damages, if any,

at the redemption date. The indentures governing the notes also contain

certain covenants that limit, among other things, our and our

subsidiaries’ ability to incur additional indebtedness and issue preferred

stock, pay dividends or make certain other distributions, make certain

investments, repurchase stock and certain indebtedness, create or incur

liens, engage in transactions with affiliates, enter into new businesses,

sell stock of restricted subsidiaries, redeem subordinated debt, sell

assets, enter into any agreements that restrict dividends from restricted

subsidiaries and enter into certain mergers or consolidations.