Advance Auto Parts 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 39

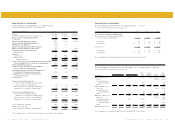

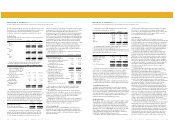

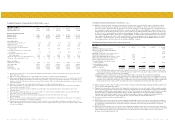

2000 First Second Third Fourth

Net sales $ 677,582 $ 557,650 $ 552,138 $ 500,652

Gross profit 258,975 216,533 223,903 196,484

(Loss) income before extraordinary item (956) 10,381 9,507 (2,306)

Net (loss) income (956) 10,381 12,440 (2,306)

Basic (loss) income per share:

Before extraordinary item $(0.03) $0.37 $0.34 $(0.08)

Net (loss) income (0.03) 0.37 0.44 (0.08)

Diluted (loss) income per share:

Before extraordinary item $ (0.03) $ 0.36 $ 0.33 $ (0.08)

Net (loss) income (0.03) 0.36 0.44 (0.08)

The above fiscal 2000 quarterly information includes non-recurring gains and losses by quarter as follows:

First Second Third Fourth

Non-cash stock option compensation expense $ 352 $ 249 $ (66) $ 194

Impairment on assets held for sale - - - 856

Non-recurring gain from the settlement of a vendor contract - - - (3,300)

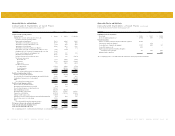

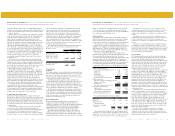

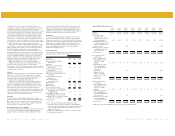

Results of operations for the first three quarters of fiscal 2001 differ from the amounts previously reported in the Company’s 2001 Form 10-Q Quarterly

Reports due to a change in the Company’s method of accounting for cooperative advertising funds received from vendors (Note 2). Results of operations as

previously reported in the Company’s 2001 Form 10-Q Quarterly Reports for the first three quarters of fiscal 2001 were as follows:

2001 First Second Third

Net sales $ 729,359 $ 607,478 $ 598,793

Gross profit 295,939 244,341 244,063

Income before extraordinary item and cumulative effect of a change in accounting principle 4,951 16,453 15,505

Net income 4,951 16,453 15,505

Basic income per share:

Before extraordinary item and cumulative effect of a change in accounting principle $ 0.18 $ 0.58 $ 0.55

Net income 0.18 0.58 0.55

Diluted income per share:

Before extraordinary item and cumulative effect of a change in accounting principle $ 0.17 $ 0.58 $ 0.54

Net income 0.17 0.58 0.54

Results of operations for the fiscal year ended 2000 do not reflect the Company’s change in accounting principle related to cooperative advertising

funds. Fiscal 2000 results of operations on a pro forma basis for this change are as follows:

2000 First Second Third Fourth

(Loss) income before extraordinary item $ (3,714) $ 10,766 $ 10,789 $ (1,450)

Net (loss) income (3,714) 10,766 13,722 (1,450)

Basic (loss) income per share:

Before extraordinary item $ (0.13) $ 0.38 $ 0.38 $ (0.05)

Net (loss) income (0.13) 0.38 0.48 (0.05)

Diluted (loss) income per share:

Before extraordinary item $ (0.13) $ 0.38 $ 0.38 $ (0.05)

Net (loss) income (0.13) 0.38 0.48 (0.05)

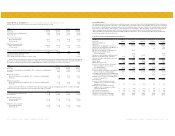

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)

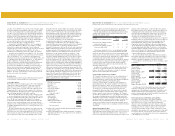

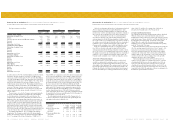

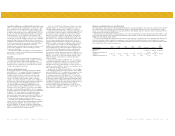

Selected Financial Data

The following table sets forth our selected historical consolidated statement of operations, balance sheet and other operating data. The selected historical

consolidated financial and other data at December 30, 2000 and December 29, 2001 and for the three years ended December 29, 2001 have been derived

from our audited consolidated financial statements and the related notes included elsewhere in this report. The historical consolidated financial and other

data at January 3, 1998, January 2, 1999 and January 1, 2000 and for the years ended January 3, 1998 and January 2, 1999 have been derived from our

audited consolidated financial statements and the related notes that have not been included in this report. You should read this data along with

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and the related

notes of Advance included elsewhere in this report.

Consolidated Statement of Operations Data for Fiscal Year(1):

(in thousands, except per share and selected store data) 1997 1998 1999 2000 2001

Net sales $ 848,108 $ 1,220,759 $ 2,206,945 $ 2,288,022 $ 2,517,639

Cost of sales 524,586 766,198 1,404,113 1,392,127 1,441,613

Supply chain initiatives (2) ----9,099

Gross profit 323,522 454,561 802,832 895,895 1,066,927

Selling, general and administrative expenses (3) 278,039 392,353 740,481 801,521 947,531

Expenses associated with supply chain initiatives (4) ----1,394

Impairment of assets held for sale (5) - - - 856 12,300

Expenses associated with the recapitalization (6) - 14,277 - - -

Expenses associated with the merger

related restructuring (7) - 6,774 - - 3,719

Expenses associated with merger and integration (8) - 7,788 41,034 - 1,135

Expenses associated with private company (9) 3,056 845 - - -

Non-cash stock option compensation expense (10) - 695 1,082 729 11,735

Operating income 42,427 31,829 20,235 92,789 89,113

Interest expense 6,086 35,038 62,792 66,640 61,895

Other income (expense), net (321) 943 4,647 1,012 1,283

Income (loss) before income taxes, extraordinary

items and cumulative effect of a change

in accounting principle 36,020 (2,266) (37,910) 27,161 28,501

Income tax expense (benefit) 14,733 (84) (12,584) 10,535 11,312

Income (loss) before extraordinary item and cumulative

effect of a change in accounting principle 21,287 (2,182) (25,326) 16,626 17,189

Extraordinary item, gain (loss) on debt extinguishment,

net of ($1,759) and $2,424 income taxes, respectively - - - 2,933 (3,682)

Cumulative effect of a change in accounting principle,

net of $1,360 income taxes ----(2,065)

Net income (loss) $ 21,287 $ (2,182) $ (25,326) $ 19,559 $ 11,442

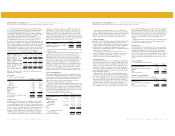

Income (loss) before extraordinary item and

cumulative effect of a change in accounting

principle per basic share $ 0.87 $ (0.12) $ (0.90) $ 0.59 $ 0.60

Income (loss) before extraordinary item and

cumulative effect of a change in accounting

principle per diluted share $ 0.87 $ (0.12) $ (0.90) $ 0.58 $ 0.59

Net income (loss) per basic share $ 0.87 $ (0.12) $ (0.90) $ 0.69 $ 0.40

Net income (loss) per diluted share $ 0.87 $ (0.12) $ (0.90) $ 0.68 $ 0.39

Weighted average basic shares outstanding 24,288 18,606 28,269 28,296 28,637

Weighted average diluted shares outstanding 24,288 18,606 28,269 28,611 29,158