Advance Auto Parts 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

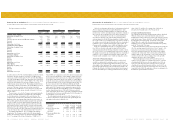

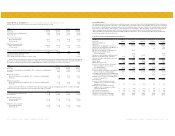

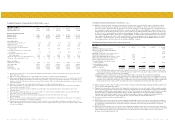

22 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 23

Advance Auto Parts, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 29, 2001, December 30, 2000 and January 1, 2000

(in thousands, except per share data and per store data)

1. Organization and Description of Business:

On November 28, 2001, Advance Holding Corporation (“Holding”) was

merged with and into Advance Auto Parts, Inc. (“Advance”) with Advance

continuing as the surviving entity. Shareholders of Holding received one

share of Advance common stock in exchange for each outstanding share

of Holding common stock. In addition, separate classes of common stock

were eliminated, the par value of each share of common stock and

preferred stock was set at $0.0001 and $0.0001 per share, respectively,

and 100,000 and 10,000 shares of common stock and preferred stock were

authorized, respectively. This transaction was a reorganization among

entities under common control and has been treated in a manner similar to

a pooling of interests. Accordingly, the accompanying financial statements

have been changed to reflect this transaction as if it occurred on January

2, 1999. Advance was created in August 2001 and had no separate

operations. Accordingly, the change resulted only in reclassifications

between common stock and additional paid-in capital.

Advance and its Subsidiaries (the “Company”) maintain a Retail and

Wholesale segment within the United States, Puerto Rico and the Virgin

Islands. The Retail segment operates 2,484 retail stores under the

“Advance Auto Parts”, “Western Auto” and “Discount Auto Parts” trade

names. The Advance Auto Parts stores offer automotive replacement parts,

accessories and maintenance items throughout the Northeastern,

Southeastern and Midwestern regions of the United States, with no

significant concentration in any specific area. The Western Auto stores,

located in Puerto Rico, the Virgin Islands and one Company owned store

in California offer certain home and garden merchandise in addition to

automotive parts, accessories and service. The Discount Auto Parts stores

offer automotive replacement parts, accessories and maintenance items

throughout the Southeast portion of the United States. The Wholesale

segment consists of the wholesale operations, including distribution

services to approximately 470 independent dealers located throughout the

United States, primarily operating under the “Western Auto” trade name.

2. Summary of Significant Accounting Policies:

Accounting Period

The Company’s fiscal year ends on the Saturday nearest the end of December.

Principles of Consolidation

The consolidated financial statements include the accounts of Advance

and its wholly owned subsidiaries. All significant intercompany balances

and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting

principles generally accepted in the United States requires management to

make estimates and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from

those estimates.

Cash, Cash Equivalents and Bank Overdrafts

Cash and cash equivalents consist of cash in banks and money market

funds. Bank overdrafts include net outstanding checks not yet presented to

a bank for settlement.

Vendor Incentives and Change in Accounting Method

The Company receives incentives from vendors related to cooperative

advertising allowances, volume rebates and other miscellaneous

agreements. Many of the incentives are under long-term agreements

(terms in excess of one year), while others are negotiated on an annual

basis. Cooperative advertising revenue restricted by our vendors for

advertising use only requires us to submit proof of advertising. These

restricted cooperative advertising allowances are recognized as a reduction

to selling, general and administrative expenses as advertising expenditures

are incurred. Unrestricted cooperative advertising revenue (i.e. does not

require proof of advertising), rebates and other miscellaneous incentives

are earned based on purchases and/or the turn of inventory. The Company

records unrestricted cooperative advertising and volume rebates earned as

a reduction of inventory and recognizes the incentives as a reduction to

cost of sales as the inventory is sold. The Company recognizes the

incentives earned related to other incentives as a reduction to cost of sales

over the life of the agreement based on the timing of purchases. These

incentives are not recorded as reductions to inventory. The amounts earned

under long-term arrangements not recorded as reduction of inventory are

based on our estimate of total purchases that will be made over the life of

the contracts and the amount of incentives that will be earned. The

incentives are generally recognized based on the cumulative purchases as

a percentage of total estimated purchases over the life of the contract. The

Company’s margins could be impacted positively or negatively if actual

purchases or results differ from our estimates but over the life of the

contract would be the same. Short-term incentives are recognized as a

reduction to cost of sales over the course of the annual agreement term

and are not recorded as reductions to inventory.

Amounts received or receivable from vendors that are not yet earned

are reflected as deferred revenue in the accompanying consolidated

balance sheets. Management’s estimate of the portion of deferred revenue

that will be realized within one year of the balance sheet date has been

included in other current liabilities in the accompanying consolidated

balance sheets. Total deferred revenue is $17,046 and $26,994 at

December 29, 2001 and December 30, 2000. Earned amounts that are

receivable from vendors are included in receivables, net on the

accompanying consolidated balance sheets.

Effective December 31, 2000, the Company changed its method of

accounting for unrestricted cooperative advertising funds received from

certain vendors to recognize these payments as a reduction to the cost of

inventory acquired from these vendors. Previously, these funds were

accounted for in the same manner as restricted cooperative advertising

allowances. The new method was adopted to better align the reporting of

these payments with the Company’s and the vendors’ use of these

payments as reductions to the price of inventory acquired from the

vendors. The effect of the change in fiscal 2001 was to increase income

from continuing operations by $358. The cumulative effect of retroactive

application of the change on the year ended December 29, 2001, was to

reduce income before extraordinary item by approximately $2,065, net of

$1,360 income tax, or $0.07 per share. The pro forma amounts shown on

the statement of operations have been adjusted for the effect of retroactive

application of the new method on net income and related income taxes for

all periods presented

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy

costs, are expensed as incurred.

Advertising Costs

The Company expenses advertising costs as incurred. Advertising expense

incurred was approximately $56,698, $53,658, and $65,524 in fiscal 2001,

2000 and 1999, respectively.

Merger and Integration Costs

As a result of the Western Merger (Note 4) and the Discount acquisition

(Note 3), the Company incurred, and will continue to incur through fiscal

2002 in connection with the Discount acquisition, costs related to, among

other things, overlapping administrative functions and store conversions

that have been expensed as incurred. These costs are presented as

expenses associated with the merger and integration in the accompanying

statements of operations.

Warranty Costs

The Company’s vendors are primarily responsible for warranty claims.

Warranty costs relating to merchandise and services sold under warranty,

which are not covered by vendors’ warranties, are estimated based on the

Company’s historical experience and are recorded in the period the

product is sold.

Revenue Recognition and Trade Receivables

The Company recognizes merchandise revenue at the point of sale to a

retail customer and point of shipment to a wholesale customer, while

service revenue is recognized upon performance of service. The majority

of sales are made for cash; however, the Company extends credit to

certain commercial customers through a third-party provider of private

label credit cards. Receivables under the private label credit card program

are transferred to the third-party provider on a limited recourse basis. The

Company provides an allowance for doubtful accounts on receivables sold

with recourse based upon factors related to credit risk of specific

customers, historical trends and other information. This arrangement is

accounted for as a secured borrowing. Receivables and the related secured

borrowings under the private label credit card were $16,400 and $15,666

at December 29, 2001 and December 30, 2000, respectively, and are

included in accounts receivable and other current liabilities, respectively,

in the accompanying consolidated balance sheets. Additionally, at

December 29, 2001, Discount had $3,457 in trade receivables under their

commercial credit program.

Change in Accounting Estimate

In July of fiscal 2000, the Company adopted a change in an accounting

estimate to reduce the depreciable lives of certain property and equipment

on a prospective basis. The effect on operations was to increase

depreciation expense by $2,458 for fiscal 2000. At December 29, 2001,

the effected assets were fully depreciated.

Earnings Per Share of Common Stock

Basic earnings per share of common stock has been computed based on

the weighted-average number of common shares outstanding during the

period. Diluted earnings per share of common stock reflects the increase

in the weighted-average number of common shares outstanding assuming

the exercise of outstanding stock options, calculated on the treasury stock

method. The number of outstanding stock options considered antidilutive

for either part or all of the fiscal year and not included in the calculation

of diluted net income (loss) per share for the fiscal years ended December

29, 2001, December 30, 2000 and January 1, 2000 were 509, 1,566 and

230, respectively.

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board (““FASB”)

issued Statement of Financial Accounting Standards (“SFAS”) No. 133,

“Accounting for Derivative Instruments and Hedging Activities”. This

Statement establishes accounting and reporting standards for derivative

instruments, including certain derivative instruments embedded in other

contracts (collectively referred to as derivatives) and for hedging activities.

It requires companies to recognize all derivatives as either assets or

liabilities in their statements of financial position and measure those

instruments at fair value. In September 1999, the FASB issued SFAS No.

137, “Accounting for Derivative Instruments and Hedging Activities—

Deferral of the Effective Date of FASB Statement No. 133,” which

delayed the effective date of SFAS No. 133 to fiscal years beginning after

June 15, 2000. The FASB issued also SFAS No. 138, “Accounting for

Derivative Instruments and Certain Hedging Activities—an Amendment

of SFAS No. 133,” which amended the accounting and reporting standards

for certain risks related to normal purchases and sales, interest and foreign

currency transactions addressed by SFAS No. 133. The Company adopted

SFAS No. 133 on December 31, 2000 with no material impact on

financial position or results of its operations.

In September 2000, the FASB issued SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishment of

Liabilities—a Replacement of FASB Statement No. 125”. This statement

replaces SFAS No. 125, but carries over most of the provisions of SFAS

No. 125 without reconsideration. The Company implemented SFAS No.

140 during the first quarter of fiscal 2001. The implementation had no

impact on the Company’s financial position or results of operations.

In June 2001, the FASB issued SFAS No. 141, “Business

Combinations” and No. 142, “Goodwill and Other Intangible Assets”.

SFAS No. 141 addresses accounting and reporting for all business

combinations and requires the use of the purchase method for business

combinations. SFAS No. 141 also requires recognition of intangible assets

apart from goodwill if they meet certain criteria. SFAS No. 142

establishes accounting and reporting standards for acquired goodwill and

other intangible assets. Under SFAS No. 142, goodwill and intangibles

with indefinite useful lives are no longer amortized but are instead subject

to at least an annual assessment for impairment by applying a fair-value

based test. SFAS No. 141 applies to all business combinations initiated

Advance Auto Parts, Inc. and Subsidiaries Notes to Consolidated Financial Statements (continued)

December 29, 2001, December 30, 2000 and January 1, 2000 (in thousands, except per share data and per store data)