Advance Auto Parts 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 43

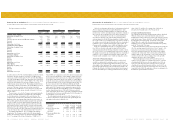

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

The following discussion and analysis of financial condition and results of

operations should be read in conjunction with “Selected Financial Data,”

our consolidated historical financial statements and the notes to those

statements that appear elsewhere in this report. Our fiscal year ends on the

Saturday nearest December 31 of each year. Our first quarter consists of

16 weeks, and the other three quarters consist of 12 weeks. Our discussion

contains forward-looking statements based upon current expectations that

involve risks and uncertainties, such as our plans, objectives, expectations

and intentions. Actual results and the timing of events could differ

materially from those anticipated in these forward-looking statements as a

result of a number of factors, including those set forth under the “Risk

Factors” and “Business” sections of our recently filed annual report on

Form 10-K with the Securities and Exchange Commission.

General

We conduct all of our operations through our wholly owned subsidiary,

Advance Stores Company, Incorporated and its subsidiaries, or Advance

Stores. We were formed in 1929 and operated as a retailer of general

merchandise until the 1980s. In the 1980s, we sharpened our marketing

focus to target sales of automotive parts and accessories to “do-it-

yourself,” or DIY, customers and accelerated our growth strategy. From

the 1980s through the present, we have grown significantly through new

store openings, strong comparable store sales growth and strategic

acquisitions. Additionally, in 1996, we began to aggressively expand our

sales to “do-it-for-me,” or DIFM, customers by implementing a

commercial delivery program that supplies parts and accessories to third

party professional installers and repair providers.

At December 29, 2001, we had 1,775 stores operating under the

“Advance Auto Parts” trade name, in 37 states in the Northeastern,

Southeastern and Midwestern regions of the United States and 669 stores

operating under the “Discount Auto Parts” trade name in the Southeastern

region of the United States. In addition, we had 40 stores operating under

the “Western Auto” trade name primarily located in Puerto Rico and the

Virgin Islands. We are the second largest specialty retailer of automotive

parts, accessories and maintenance items to DIY customers in the United

States, based on store count and sales. We currently are the largest

specialty retailer of automotive products in the majority of the states in

which we operate, based on store count.

Our combined operations are conducted in two operating segments,

retail and wholesale. The retail segment consists of our retail operations

operating under the trade names “Advance Auto Parts” and “Discount Auto

Parts” in the United States and “Western Auto” in Puerto Rico, the Virgin

Islands and one store in California. Our wholesale segment includes a

wholesale distribution network which includes distribution services of

automotive parts and accessories to approximately 470 independently

owned dealer stores in 44 states operating under the “Western Auto” trade

name. Our wholesale operations accounted for approximately 3.9% of our

net sales for the year ended December 29, 2001. The discussion for all

periods presented in this section has been restated to reflect our Western

Auto store located in California in the retail segment.

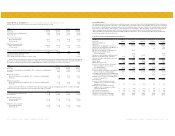

Acquisitions and Recapitalization

Discount Acquisition. On November 28, 2001, we acquired Discount in a

transaction in which Discount’s shareholders received $7.50 per share in

cash (or approximately $128.5 million in the aggregate) plus 0.2577

shares of our common stock for each share of Discount common stock.

We issued approximately 4.3 million shares of our common stock to the

former Discount shareholders, which represented 13.2% of our total

shares outstanding immediately following the acquisition. The acquisition

has been accounted for under the purchase method of accounting.

Accordingly, the results of operations for Discount for the periods from

December 2, 2001 are included in the accompanying consolidated

financial statements. The purchase price has been allocated to assets

acquired and liabilities assumed based on their respective fair values.

Negative goodwill of $75.7 million, resulting from total excess fair value

over the purchase price, was allocated proportionately as a reduction to

non-current assets, primarily property and equipment.

In connection with the Discount acquisition, we issued an additional $200

million face value of 10.25% senior subordinated notes and entered into a

new senior credit facility that provides for (1) a $180 million tranche A term

loan facility and a $305 million tranche B term loan facility and (2) a $160

million revolving credit facility (including a letter of credit sub-facility).

Upon the closing of the Discount acquisition, we used $485 million of

borrowings under the new senior credit facility and net proceeds of $185.6

million from the sale of the senior subordinated notes to, among other things,

pay the cash portion of the acquisition consideration, repay all amounts

outstanding under our then-existing credit facility, repay $204.7 million of

outstanding indebtedness of Discount, including prepayment penalties, and

purchase Discount’s Gallman distribution facility from the lessor.

At November 28, 2001, Discount had 671 stores in six states,

including the leading market position in Florida, with 437 stores.

Including the acquired Discount stores, we had 2,484 stores at December

29, 2001. On a pro forma basis, our net sales and EBITDA, as adjusted,

for 2001 would have been $3.1 billion and $261.9 million. We expect to

achieve ongoing purchasing savings as a result of the acquisition. In

addition, we expect to achieve significant savings from the optimization of

our combined distribution network, including more efficient capacity

utilization at Discount’s Mississippi distribution center, as well as from the

reduction of overlapping administrative functions. During 2002, we expect

these savings to result in approximately $30 million of incremental

EBITDA, excluding certain one-time integration expenses. We expect

these one-time integration expenses to total approximately $53 million

from the close of the acquisition through the end of 2003, approximately

$41 million of which we expect to incur in 2002.

Carport Acquisition. On April 23, 2001, we completed our acquisition of

the assets used in the operation of Carport Auto Parts, Inc. retail auto parts

stores located throughout Alabama and Mississippi. Based upon store

count, this made us the largest retailer of automotive parts in this market.

Upon the closing of the acquisition, we decided to close 21 Carport stores

not expected to meet long-term profitability objectives. The remaining 30

Carport locations were converted to the Advance Auto Parts store format

within six weeks of the acquisition. The acquisition has been accounted for

under the purchase method of accounting. Accordingly, the results of

operations of Carport for the periods from April 23, 2001 are included in

the accompanying consolidated financial statements. The purchase price of

$21.5 million has been allocated to the assets acquired and the liabilities

assumed, based on their fair values at the date of acquisition. This

allocation resulted in the recognition of $3.7 million in goodwill.

Western Auto Acquisition. On November 2, 1998, we acquired Western

Auto Supply Company, or Western, from Sears. The purchase price

included the payment of 11,474,606 shares of our common stock and

$185.0 million in cash. Certain of our stockholders invested an additional

$70.0 million in equity to fund a portion of the cash portion of the

purchase price, the remainder of which was funded through additional

borrowings under our prior credit facility, and cash on hand. The Western

merger was accounted for under the purchase method of accounting.

Accordingly, the results of operations of Western for the periods from

November 2, 1998 are included in the accompanying consolidated

financial statements. The purchase price has been allocated to assets

acquired and liabilities assumed based on their respective fair values.

Negative goodwill of $4.7 million, resulting from total excess fair value

over the purchase price, was allocated proportionately as a reduction to

non-current assets, primarily property and equipment.

We have achieved significant benefits from the combination with

Western through improved purchasing efficiencies from vendors,

consolidated advertising, distribution and corporate support efficiencies.

The Western merger resulted in the addition of a net 545 Advance Auto

Parts stores, 39 Western Auto stores and the wholesale distribution network.

Recapitalization. On April 15, 1998, we consummated a recapitalization

in which Freeman Spogli & Co. and Ripplewood Partners, L.P. purchased

approximately $80.5 million and $20.0 million of our common stock,

respectively, representing approximately 64% and 16% of our outstanding

common stock immediately following the recapitalization. In connection

with the recapitalization, management purchased approximately $8.0

million, or approximately 6%, of our outstanding common stock. The

purchase of common stock by management resulted in stockholder

subscription receivables. The notes are full recourse and provide for

annual interest payments, at the prime rate, with the entire principal

amount due on April 15, 2003. In addition, on April 15, 1998, we entered

into our prior credit facility and also issued $200 million of senior

subordinated notes and approximately $112 million in face amount of

senior discount debentures. In connection with these transactions, we

extinguished a substantial portion of our existing notes payable and long-

term debt. These transactions collectively represent the “recapitalization.”

We have accounted for the recapitalization for financial reporting

purposes as the sale of common stock, the issuance of debt, the

redemption of common and preferred stock and the repayment of notes

payable and long-term debt. In connection with the Discount acquisition,

we repaid all amounts outstanding under our prior credit facility and

entered into our senior credit facility.

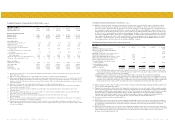

Non-recurring Charges

During the fourth quarter of 2001, we recorded the following non-recurring

charges, net of tax: $0.7 million in integration expenses associated with the

Discount acquisition; $2.2 million in lease termination expenses resulting

from the planned closure of approximately 27 Advance Auto Parts stores

that overlap with Discount stores; $5.2 million in stock option

compensation charges described below; $6.3 million in supply chain

initiatives described below; $6.5 million to reduce the book value of certain

excess property currently held for sale described below; $2.1 million to

implement an accounting change associated with the reclassification of

cooperative income from selling, general and administrative expense to

gross margin described below; and $3.7 million in charges related to the

write-off of deferred debt issuance costs associated with refinancing our

credit facility in connection with the Discount acquisition.

The $5.2 million, net of tax, in stock option compensation charges

resulted from variable provisions of our employee stock option plans that

were in place when we were a private company, and that we since have

eliminated. Under the modified plan, option exercise prices are fixed and

therefore will not result in future compensation expense. No additional

common shares or options were issued as a result of these modifications.

The $6.3 million, net of tax, in expenses relating to supply change

initiatives is related to our recent review of our supply chain and logistics

operations, including our distribution costs and inventory stocking levels.

As part of this review, we have identified a portion of our inventory and

expect to identify additional inventory that we may offer in the future only

in certain store locations or regions. The expenses related to this initiative

are primarily related to restocking and inventory handling charges. We

may generate significant cash proceeds as a result of this initiative by

reducing our inventory investment while continuing to maintain high

levels of customer service and in-stock positions.

The reduction of book value of certain properties of $6.5 million, net

of tax, is related to the revaluation of certain excess properties currently

held for sale. In addition, we have closed and may explore the future

possibility of closing additional distribution facilities and may write-down

the value of such facilities in connection with our supply chain initiative.

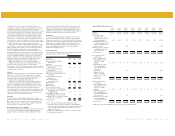

The expense of $2.1 million, net of tax, to implement an accounting

change results from a change in our method of accounting for certain

cooperative advertising funds received from vendors. Previously, we

accounted for these funds as a reduction to advertising expense as the

related advertising expenses were incurred. In order to better align the

reporting of these payments with the sale of the associated product, we

decided to recognize these payments as a reduction to the cost of

inventory acquired from vendors, which results in a lower cost of sales for

the products sold. We believe this is a preferable method of accounting.

The change will result in a slightly more conservative recognition of

income in future periods. This change in accounting principle has been

applied in our 2001 financial statements as if the change occurred at the

beginning of our 2001 fiscal year, and has been recognized as a

cumulative effect of the change in accounting principle. This change

results in lower cost of sales with corresponding increases in selling,

general and administrative expenses.

Critical Accounting Policies

Our financial statements have been prepared in accordance with

accounting policies generally accepted in the United States. Our

discussion and analysis of the financial condition and results of operations

are based on these financial statements. The preparation of these financial

statements requires the application of these accounting policies in addition

to certain estimates and judgments by our management. Our estimates and

judgments are based on currently available information, historical results

and other assumptions we believe are reasonable. Actual results could

differ from these estimates.

The following critical accounting policies are used in the preparation

of the financial statements as discussed above.

Vendor Incentives

We receive incentives from vendors related to cooperative advertising

allowances, volume rebates and other miscellaneous agreements. Many of

the incentives are under long-term agreements (terms in excess of one

year), while others are negotiated on an annual basis. Our vendors require

us to use certain cooperative advertising allowances exclusively for