Advance Auto Parts 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

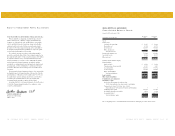

16 ADVANCE AUTO PARTS ANNUAL REPORT 2001 ADVANCE AUTO PARTS ANNUAL REPORT 2001 17

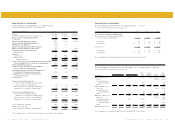

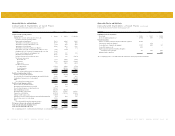

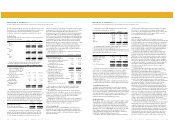

Advance Auto Parts, Inc. and Subsidiaries

Consolidated Balance Sheets

December 29, 2001 and December 30, 2000

December 29, December 30,

(in thousands, except per share data) 2001 2000

Assets

Current assets:

Cash and cash equivalents $ 18,117 $ 18,009

Receivables, net 93,704 80,578

Inventories, net 982,000 788,914

Other current assets 42,027 10,274

Total current assets 1,135,848 897,775

Property and equipment, net 711,282 410,960

Assets held for sale 60,512 25,077

Other assets, net 42,973 22,548

$ 1,950,615 $ 1,356,360

Liabilities and Stockholders’ Equity

Current liabilities:

Bank overdrafts $ 34,748 $ 13,599

Current portion of long-term debt 23,715 9,985

Accounts payable 429,041 387,852

Accrued expenses 176,218 124,962

Other current liabilities 30,027 42,794

Total current liabilities 693,749 579,192

Long-term debt 932,022 576,964

Other long-term liabilities 36,273 43,933

Commitments and contingencies

Stockholders’ equity:

Preferred stock, nonvoting, $0.0001 par value,

10,000 shares authorized; no shares issued or outstanding - -

Common stock, voting, $0.0001 par value; 100,000

shares authorized; 32,692 and 28,289 issued and outstanding 3 3

Additional paid-in capital 496,538 375,209

Stockholder subscription receivables (2,676) (2,364)

Accumulated deficit (205,294) (216,577)

Total stockholders’ equity 288,571 156,271

$ 1,950,615 $ 1,356,360

The accompanying notes to consolidated financial statements are an integral part of these balance sheets.

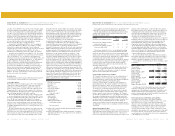

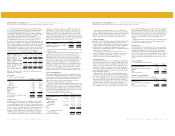

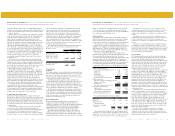

To the Board of Directors and Stockholders of Advance Auto Parts, Inc.:

We have audited the accompanying consolidated balance sheets of

Advance Auto Parts, Inc. (a Delaware company) and subsidiaries (the

Company), as of December 29, 2001, and December 30, 2000, and the

related consolidated statements of operations, changes in stockholders’

equity and cash flows for each of the three years in the period ended

December 29, 2001. These financial statements are the responsibility of

the Company’s management. Our responsibility is to express an opinion

on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards

generally accepted in the United States. Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement. An audit

includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made

by management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis for

our opinion.

In our opinion, the financial statements referred to above present fairly,

in all material respects, the financial position of Advance Auto Parts, Inc.

and subsidiaries as of December 29, 2001, and December 30, 2000, and

the results of their operations and their cash flows for each of the three

years in the period ended December 29, 2001, in conformity with

accounting principles generally accepted in the United States.

As explained in Note 2 to the financial statements, effective December

31, 2000, the Company changed its method of accounting for certain

cooperative advertising funds.

ARTHUR ANDERSEN LLP

Greensboro, North Carolina,

March 5, 2002.

Report of Independent Public Accountants