Xcel Energy 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Equity financing for these entities has been provided by Eloigne and NSP-Wisconsin and the general partner of each limited

partnership, and Xcel Energy’s risk of loss is limited to its capital contributions, adjusted for any distributions and its share of

undistributed profits and losses; no significant additional financial support has been, or is in the future, required to be provided to

the limited partnerships by Eloigne or NSP-Wisconsin. Mortgage-backed debt typically comprises the majority of the financing at

inception of each limited partnership and is paid over the life of the limited partnership arrangement. Obligations of the limited

partnerships are generally secured by the housing properties of each limited partnership, and the creditors of each limited

partnership have no significant recourse to Xcel Energy Inc. or its subsidiaries. Likewise, the assets of the limited partnerships

may only be used to settle obligations of the limited partnerships, and not those of Xcel Energy Inc. or its subsidiaries.

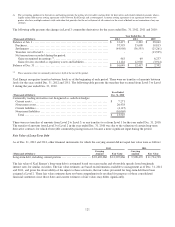

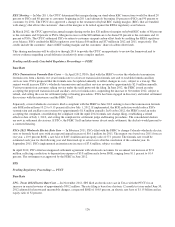

Amounts reflected in Xcel Energy’s consolidated balance sheets for the Eloigne and NSP-Wisconsin low-income housing limited

partnerships include the following:

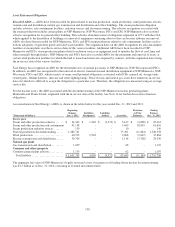

(Thousands of Dollars)

Dec. 31, 2012

Dec. 31, 2011

Current assets ................................

.......................

$

3,380

$

4,034

Property, plant and equipment, net ................................

....

72,489

90,914

Other noncurrent assets ................................

..............

6,044

8,053

Total assets ................................

.........................

$

81,913

$

103,001

Current liabilities ................................

....................

$

8,458

$

12,297

Mortgages and other long-term debt payable

...........................

37,720

48,863

Other noncurrent liabilities ................................

...........

7,678

8,278

Total liabilities ................................

......................

$

53,856

$

69,438

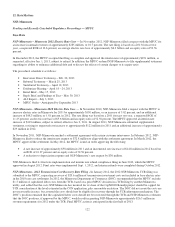

Technology Agreements — Xcel Energy has an amended contract that extends through June 30, 2019 with International Business

Machines Corp. (IBM) for information technology services. The contract is cancelable at Xcel Energy’s option, although Xcel

Energy would be obligated to pay 50 percent of the contract value for early termination. Xcel Energy capitalized or expensed

$86.5 million, $93.6 million and $95.6 million associated with the IBM contract in 2012, 2011, and 2010, respectively.

Xcel Energy’s contract with Accenture for information technology services extends through Jan. 31, 2017. The contract is

cancelable at Xcel Energy’s option, although there are financial penalties for early termination. Xcel Energy capitalized or

expensed $18.3 million, $15.2 million and $22.7 million associated with the Accenture contract in 2012, 2011 and 2010,

respectively.

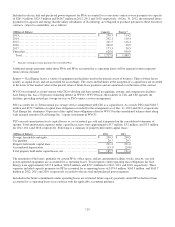

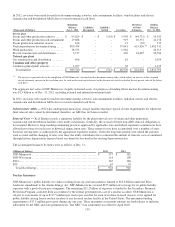

Committed minimum payments under these obligations are as follows:

IBM

Accenture

(Millions of Dollars)

Agreement

Agreement

2013................................

................................

$

36.0

$

9.0

2014................................

................................

34.6

8.8

2015................................

................................

31.5

8.7

2016................................

................................

30.7

8.7

2017................................

................................

30.9

-

Thereafter................................

...........................

45.4

-

Guarantees and Indemnifications

Xcel Energy Inc. and its subsidiaries provide guarantees and bond indemnities under specified agreements or transactions. The

guarantees and bond indemnities issued by Xcel Energy Inc. guarantee payment or performance by its subsidiaries. As a result,

Xcel Energy Inc.’s exposure under the guarantees and bond indemnities is based upon the net liability of the relevant subsidiary

under the specified agreements or transactions. Most of the guarantees and bond indemnities issued by Xcel Energy Inc. and its

subsidiaries limit the exposure to a maximum amount stated in the guarantees and bond indemnities. As of Dec. 31, 2012 and

2011, Xcel Energy Inc. and its subsidiaries had no assets held as collateral related to their guarantees, bond indemnities and

indemnification agreements.