Xcel Energy 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.126

REC Sharing — In May 2011, the CPUC determined that margin sharing on stand-alone REC transactions would be shared 20

percent to PSCo and 80 percent to customers beginning in 2011 and ultimately becoming 10 percent to PSCo and 90 percent to

customers by 2014. The CPUC also approved a change to the treatment of hybrid REC trading margins (RECs that are bundled

with energy) that allows the customers’ share of the margins to be netted against the RESA regulatory asset balance.

In March 2012, the CPUC approved an annual margin sharing on the first $20 million of margins on hybrid REC trades of 80 percent

to the customers and 20 percent to PSCo. Margins in excess of the $20 million are to be shared 90 percent to the customers and 10

percent to PSCo. The CPUC authorized PSCo to return to customers unspent carbon offset funds by crediting the RESA regulatory

asset balance. PSCo credited the RESA regulatory asset balance $46 million and $37 million in 2012 and 2011, respectively. The

credits include the customers’ share of REC trading margins and the customers’ share of carbon offset funds.

This sharing mechanism will be effective through 2014 to provide the CPUC an opportunity to review the framework and to

review evidence regarding actual deliveries in relatively more complex markets.

Pending and Recently Concluded Regulatory Proceedings — FERC

Base Rate

PSCo Transmission Formula Rate Cases — In April 2012, PSCo filed with the FERC to revise the wholesale transmission

formula rates from a historic test year formula rate to a forecast transmission formula rate and to establish formula ancillary

services rates. PSCo proposed that the formula rates be updated annually to reflect changes in costs, subject to a true-up. The

request would increase PSCo’s wholesale transmission and ancillary services revenue by approximately $2.0 million annually.

Various transmission customers taking service under the tariff protested the filing. In June 2012, the FERC issued an order

accepting the proposed transmission and ancillary services formula rates, suspending the increase to November 2012, subject to

refund, and setting the case for settlement judge or hearing procedures. PSCo has been engaged in discovery and initial settlement

discussions with the intervenors and the FERC Staff.

Separately, several wholesale customers filed a complaint with the FERC in June 2012 seeking to have the transmission formula

rate ROE reduced from 10.25 to 9.15 percent effective July 1, 2012. If implemented, the ROE reduction would reduce PSCo

transmission and ancillary rate revenues by approximately $1.8 million annually. In October 2012, the FERC issued an order

accepting the complaint, consolidating the complaint with the April 2012 formula rate change filing, establishing a refund

effective date of July 1, 2012, and setting the complaint for settlement judge and hearing procedures. The consolidated dockets

are now in settlement discussions. If PSCo, the FERC Staff and intervenors do not reach settlement, the dockets would proceed to

a contested hearing.

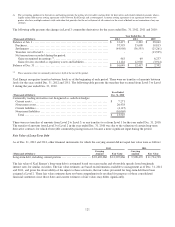

PSCo 2011 Wholesale Electric Rate Case — In February 2011, PSCo filed with the FERC to change Colorado wholesale electric

rates to formula based rates with an expected annual increase of $16.1 million for 2011. The request was based on a 2011 forecast

test year, a 10.9 percent ROE, a rate base of $407.4 million and an equity ratio of 57.1 percent. The formula rate would be

estimated each year for the following year and then trued-up to actual costs after the conclusion of the calendar year. In

September 2011, PSCo implemented an interim rate increase of $7.8 million, subject to refund.

In April 2012, PSCo filed an unopposed settlement agreement with wholesale customers for an annual rate increase of $7.8

million, reflecting a reduction to depreciation expense of $5.8 million and a lower ROE, ranging from 10.1 percent to 10.4

percent. The settlement was approved by the FERC in June 2012.

SPS

Pending Regulatory Proceedings — PUCT

Base Rate

SPS - Texas 2012 Electric Rate Case — In November 2012, SPS filed an electric rate case in Texas with the PUCT for an

increase in annual revenue of approximately $90.2 million. The rate filing is based on a historic 12 month test year ended June 30,

2012 adjusted for known and measurable changes, a requested ROE of 10.65 percent, an electric rate base of $1.15 billion and an

equity ratio of 52 percent.