Xcel Energy 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

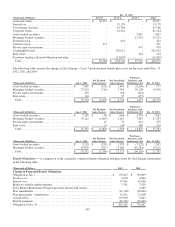

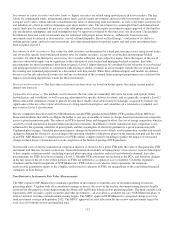

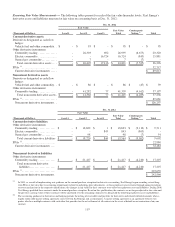

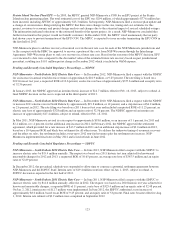

Recurring Fair Value Measurements — The following tables present for each of the fair value hierarchy levels, Xcel Energy’s

derivative assets and liabilities measured at fair value on a recurring basis at Dec. 31, 2012:

Dec. 31, 2012

Fair Value

Fair Value

Counterparty

(Thousands of Dollars)

Level 1

Level 2

Level 3

Total

Netting (b)

Total

Current derivative assets

Derivatives designated as cash flow

hedges:

Vehicle fuel and other commodity.. $

-

$ 95

$

-

$

95

$

-

$

95

Other derivative instruments:

Commodity trading ...............

-

26,303

692

26,995

(6,675

)

20,320

Electric commodity ...............

-

-

16,724

16,724

(843

)

15,881

Natural gas commodity ............

-

7

-

7

(7

)

-

Total current derivative assets .... $

-

$ 26,405

$

17,416

$

43,821

$

(7,525

)

36,296

PPAs (a) ............................

32,717

Current derivative instruments .....

$

69,013

Noncurrent derivative assets

Derivatives designated as cash flow

hedges:

Vehicle fuel and other commodity.. $

-

$ 86

$

-

$

86

$

(47

)

$

39

Other derivative instruments:

Commodity trading ...............

-

41,282

77

41,359

(4,162

)

37,197

Total noncurrent derivative assets.$

-

$ 41,368

$

77

$

41,445

$

(4,209

)

37,236

PPAs (a) ............................

89,061

Noncurrent derivative instruments ..

$

126,297

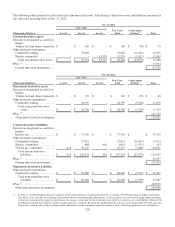

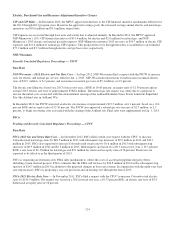

Dec. 31, 2012

Fair Value

Fair Value

Counterparty

(Thousands of Dollars)

Level 1

Level 2

Level 3

Total

Netting (b)

Total

Current derivative liabilities

Other derivative instruments:

Commodity trading ..............

$

-

$ 18,622

$ 1

$ 18,623

$ (9,112)

$ 9,511

Electric commodity ..............

-

-

843

843

(843)

-

Natural gas commodity ...........

-

98

-

98

(7)

91

Total current derivative liabilities

$

-

$ 18,720

$ 844

$ 19,564

$ (9,962)

9,602

PPAs (a) ...........................

22,880

Current derivative instruments ....

$ 32,482

Noncurrent derivative liabilities

Other derivative instruments:

Commodity trading ..............

$

-

$ 21,417

$ -

$ 21,417

$ (4,210)

$ 17,207

Total noncurrent derivative

liabilities.....................

$

-

$ 21,417

$ -

$ 21,417

$ (4,210)

17,207

PPAs (a) ...........................

225,659

Noncurrent derivative instruments .

$ 242,866

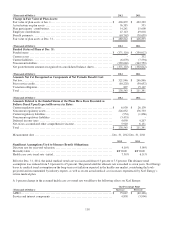

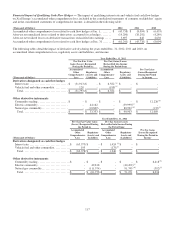

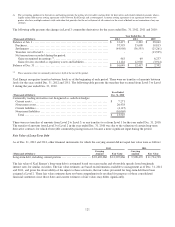

(a) In 2003, as a result of implementing new guidance on the normal purchase exception for derivative accounting, Xcel Energy began recording several long-

term PPAs at fair value due to accounting requirements related to underlying price adjustments. As these purchases are recovered through normal regulatory

recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts were offset by regulatory assets and liabilities. During 2006,

Xcel Energy qualified these contracts under the normal purchase exception. Based on this qualification, the contracts are no longer adjusted to fair value and

the previous carrying value of these contracts will be amortized over the remaining contract lives along with the offsetting regulatory assets and liabilities.

(b) The accounting guidance for derivatives and hedging permits the netting of receivables and payables for derivatives and related collateral amounts when a

legally enforceable master netting agreement exists between Xcel Energy and a counterparty. A master netting agreement is an agreement between two

parties who have multiple contracts with each other that provides for the net settlement of all contracts in the event of default on or termination of any one

contract.