Xcel Energy 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

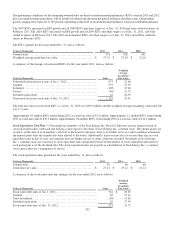

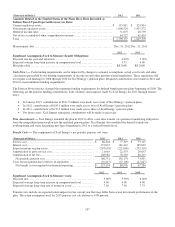

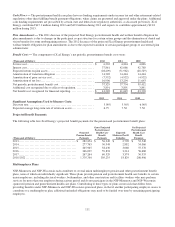

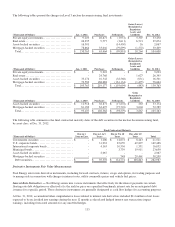

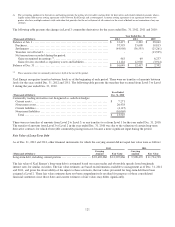

Contributions to multiemployer plans were as follows for the years ended Dec. 31, 2012, 2011 and 2010. There were no

significant changes to the nature or magnitude of the participation of NSP-Minnesota and NSP-Wisconsin in multiemployer plans

for the years presented:

(Thousands of Dollars)

2012

2011

2010

Multiemployer pension contributions:

NSP-Minnesota................................

......

$ 14,984

$ 17,811

$ 13,461

NSP-Wisconsin................................

......

163

169

170

Total ................................

..............

$ 15,147

$ 17,980

$ 13,631

Multiemployer other postretirement benefit contributions:

NSP-Minnesota................................

......

$ 197

$ 336

$ 153

Total ................................

..............

$ 197

$ 336

$ 153

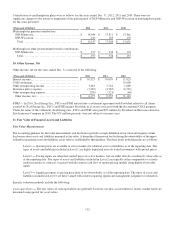

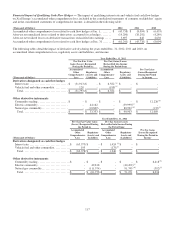

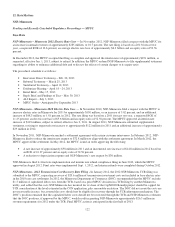

10. Other Income, Net

Other income, net for the years ended Dec. 31 consisted of the following:

(Thousands of Dollars)

2012

2011

2010

Interest income ................................

.......

$

10,327

$

10,639

$

11,023

COLI settlement................................

......

-

-

25,000

Other nonoperating income

............................

3,483

3,722

1,689

Insurance policy expense

..............................

(7,365

)

(4,785

)

(6,529

)

Other nonoperating expense

...........................

(270

)

(321

)

(40

)

Other income, net ................................

...

$

6,175

$

9,255

$

31,143

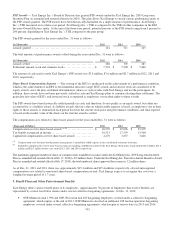

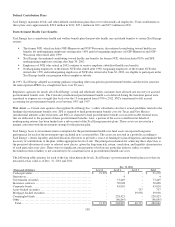

COLI — In 2010, Xcel Energy Inc., PSCo and PSRI entered into a settlement agreement with Provident related to all claims

asserted by Xcel Energy Inc., PSCo and PSRI against Provident in a lawsuit associated with the discontinued COLI program.

Under the terms of the settlement, Xcel Energy Inc., PSCo and PSRI were paid $25 million by Provident and Reassure America

Life Insurance Company in 2010. The $25 million proceeds were not subject to income taxes.

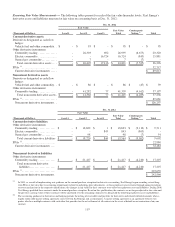

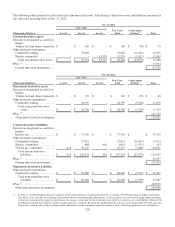

11. Fair Value of Financial Assets and Liabilities

Fair Value Measurements

The accounting guidance for fair value measurements and disclosures provides a single definition of fair value and requires certain

disclosures about assets and liabilities measured at fair value. A hierarchical framework for disclosing the observability of the inputs

utilized in measuring assets and liabilities at fair value is established by this guidance. The three levels in the hierarchy are as follows:

Level 1 — Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. The

types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted prices.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as

of the reporting date. The types of assets and liabilities included in Level 2 are typically either comparable to actively

traded securities or contracts, or priced with discounted cash flow or option pricing models using highly observable

inputs.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets and

liabilities included in Level 3 are those valued with models requiring significant management judgment or estimation.

Specific valuation methods include the following:

Cash equivalents — The fair values of cash equivalents are generally based on cost plus accrued interest; money market funds are

measured using quoted net asset values.