Xcel Energy 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Federal Audit — Xcel Energy files a consolidated federal income tax return. The statute of limitations applicable to Xcel

Energy’s 2008 federal income tax return expired in September 2012. The statute of limitations applicable to Xcel Energy’s 2009

federal income tax return expires in September 2013. In the third quarter of 2012, the IRS commenced an examination of tax

years 2010 and 2011. As of Dec. 31, 2012, the IRS had not proposed any material adjustments to tax years 2010 and 2011.

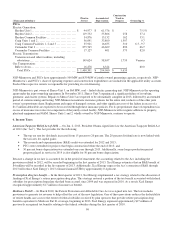

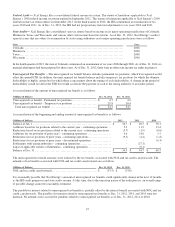

State Audits— Xcel Energy files consolidated state tax returns based on income in its major operating jurisdictions of Colorado,

Minnesota, Texas, and Wisconsin, and various other state income-based tax returns. As of Dec. 31, 2012, Xcel Energy’s earliest

open tax years that are subject to examination by state taxing authorities in its major operating jurisdictions were as follows:

State Year

Colorado................................................................

.................

2006

Minnesota ................................................................

...............

2008

Texas................................................................

....................

2008

Wisconsin ................................................................

...............

2008

In the fourth quarter of 2012, the state of Colorado commenced an examination of tax years 2006 through 2009. As of Dec. 31, 2012, no

material adjustments had been proposed for these years. As of Dec. 31, 2012, there were no other state income tax audits in progress.

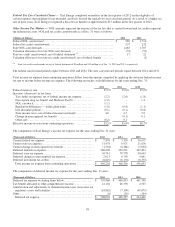

Unrecognized Tax Benefits —The unrecognized tax benefit balance includes permanent tax positions, which if recognized would

affect the annual ETR. In addition, the unrecognized tax benefit balance includes temporary tax positions for which the ultimate

deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. A change in the period of

deductibility would not affect the ETR but would accelerate the payment of cash to the taxing authority to an earlier period.

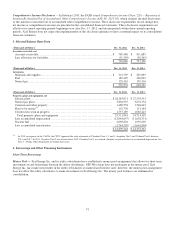

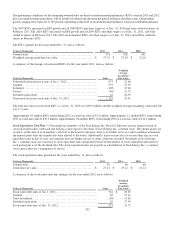

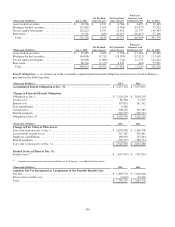

A reconciliation of the amount of unrecognized tax benefit is as follows:

(Millions of Dollars)

Dec. 31, 2012

Dec. 31, 2011

Unrecognized tax benefit - Permanent tax positions

.....................

$

4.7

$

4.3

Unrecognized tax benefit - Temporary tax positions

....................

29.8

30.4

Total unrecognized tax benefit ................................

......

$

34.5

$

34.7

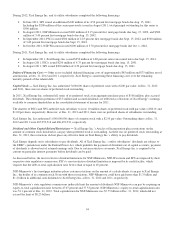

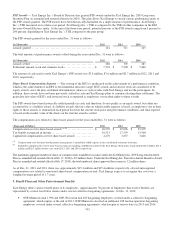

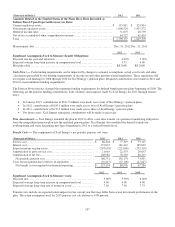

A reconciliation of the beginning and ending amount of unrecognized tax benefit is as follows:

(Millions of Dollars)

2012

2011

2010

Balance at Jan. 1 ...............................................................

$

34.7

$

40.5

$ 30.3

Additions based on tax positions related to the current year - continuing operations...

5.2

11.9

13.4

Reductions based on tax positions related to the current year - continuing operations .

(5.7)

(1.9)

(0.6)

Additions for tax positions of prior years - continuing operations ...................

9.6

14.0

5.5

Reductions for tax positions of prior years - continuing operations ..................

(9.3)

(2.4)

(1.8)

Reductions for tax positions of prior years - discontinued operations ................

-

-

(6.3)

Settlements with taxing authorities - continuing operations .........................

-

(27.3)

-

Lapse of applicable statutes of limitations - continuing operations ..................

-

(0.1)

-

Balance at Dec. 31..............................................................

$

34.5

$

34.7

$ 40.5

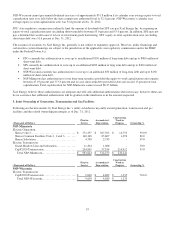

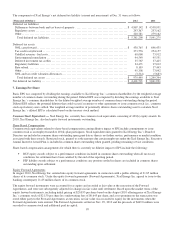

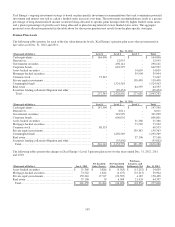

The unrecognized tax benefit amounts were reduced by the tax benefits associated with NOL and tax credit carryforwards. The

amounts of tax benefits associated with NOL and tax credit carryforwards are as follows:

(Millions of Dollars)

Dec. 31, 2012

Dec. 31, 2011

NOL and tax credit carryforwards................................

.....

$

(33.5)

$

(33.6

)

It is reasonably possible that Xcel Energy’s amount of unrecognized tax benefits could significantly change in the next 12 months

as the IRS audit progresses and state audits resume. At this time, due to the uncertain nature of the audit process, an overall range

of possible change cannot be reasonably estimated.

The payable for interest related to unrecognized tax benefits is partially offset by the interest benefit associated with NOL and tax

credit carryforwards. The payables for interest related to unrecognized tax benefits at Dec. 31, 2012, 2011, and 2010 were not

material. No amounts were accrued for penalties related to unrecognized tax benefits as of Dec. 31, 2012, 2011 or 2010.