Xcel Energy 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

(b) The accounting guidance for derivatives and hedging permits the netting of receivables and payables for derivatives and related collateral amounts when a

legally enforceable master netting agreement exists between Xcel Energy and a counterparty. A master netting agreement is an agreement between two

parties who have multiple contracts with each other that provides for the net settlement of all contracts in the event of default on or termination of any one

contract.

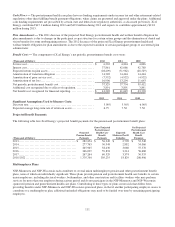

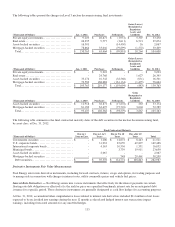

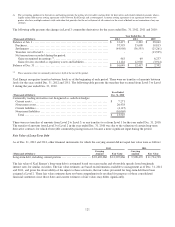

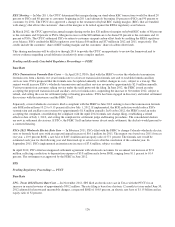

The following table presents the changes in Level 3 commodity derivatives for the years ended Dec. 31, 2012, 2011 and 2010:

Year Ended Dec. 31

(Thousands of Dollars)

2012

2011

2010

Balance at Jan. 1 ................................

.............................

$

12,417

$

2,392

$

28,042

Purchases ................................................................

..

37,595

33,609

10,813

Settlements ................................

................................

(44,950

)

(36,555)

(25,261)

Transfers out of Level 3................................

.....................

-

-

(13,525)

Net transactions recorded during the period:

Gains recognized in earnings (a) ................................

............

463

69

6,237

Gains (losses) recorded as regulatory assets and liabilities

....................

11,124

12,902

(3,914)

Balance at Dec. 31................................

............................

$

16,649

$

12,417

$

2,392

(a) These amounts relate to commodity derivatives held at the end of the period.

Xcel Energy recognizes transfers between levels as of the beginning of each period. There were no transfers of amounts between

levels for the years ended Dec. 31, 2012 and 2011. The following table presents the transfers that occurred from Level 3 to Level

2 during the year ended Dec. 31, 2010.

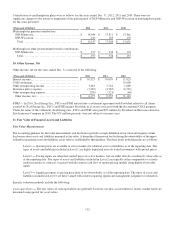

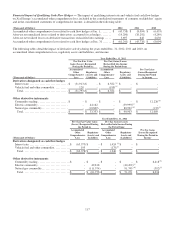

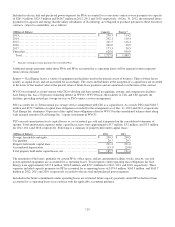

Year Ended

(Thousands of Dollars) Dec. 31, 2010

Commodity trading derivatives not designated as cash flow hedges:

Current assets .............................................................

$

7,271

Noncurrent assets..........................................................

26,438

Current liabilities ..........................................................

(4,115)

Noncurrent liabilities ......................................................

(16,069)

Total ...................................................................

$

13,525

There were no transfers of amounts from Level 2 to Level 3, or any transfers to or from Level 1 for the year ended Dec. 31, 2010.

The transfer of amounts from Level 3 to Level 2 in the year ended Dec. 31, 2010 was due to the valuation of certain long-term

derivative contracts for which observable commodity pricing forecasts became a more significant input during the period.

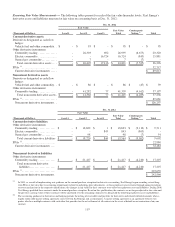

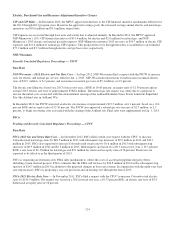

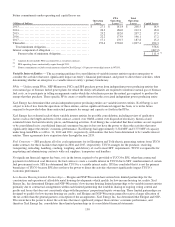

Fair Value of Long-Term Debt

As of Dec. 31, 2012 and 2011, other financial instruments for which the carrying amount did not equal fair value were as follows:

2012

2011

(Thousands of Dollars)

Carrying

Amount

Fair Value

Carrying

Amount

Fair Value

Long-term debt, including current portion

........................

$

10,402,060

$

12,207,866

$

9,908,435

$

11,734,798

The fair value of Xcel Energy’s long-term debt is estimated based on recent trades and observable spreads from benchmark

interest rates for similar securities. The fair value estimates are based on information available to management as of Dec. 31, 2012

and 2011, and given the observability of the inputs to these estimates, the fair values presented for long-term debt have been

assigned a Level 2. These fair value estimates have not been comprehensively revalued for purposes of these consolidated

financial statements since those dates and current estimates of fair values may differ significantly.