Xcel Energy 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

The performance conditions for the remaining awarded units are based on environmental performance. RSUs issued in 2011 and 2012,

plus associated dividend equivalents, will be settled or forfeited and the restricted period will lapse after three years with potential

payouts ranging from 0 percent to 150 percent, depending on the level of environmental performance, based on established indicators.

The 2007 RSUs measured on EPS growth and all 2008 RSUs met their targets as of Dec. 31, 2010 and were settled in shares in

February 2011. The 2010 RSUs measured on EPS growth and all 2009 RSUs met their targets as of Dec. 31, 2011, and were

settled in shares in February 2012. The 2010 environmental RSUs met their targets as of Dec. 31, 2012 and will be settled in

shares in February 2013.

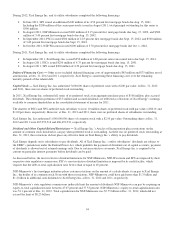

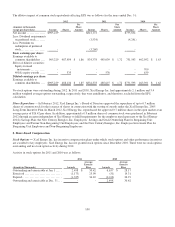

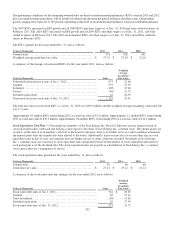

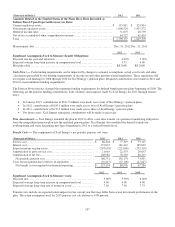

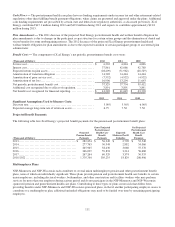

The RSUs granted for the years ended Dec. 31 were as follows:

(Units in Thousands)

2012

2011

2010

Granted units................................

.....................

591

828

601

Weighted average grant date fair value

.............................

$

27.35

$

23.63

$

21.26

A summary of the changes of nonvested RSUs for the year ended 2012, were as follows:

(Units in Thousands)

Units

Weighted

Average

Grant Date

Fair Value

Nonvested restricted stock units at Jan. 1, 2012

.........................

673

$

23.46

Granted................................

.............................

591

27.35

Forfeited................................

............................

(105)

25.26

Vested................................

..............................

(46)

21.57

Dividend equivalents ................................

................

42

24.95

Nonvested restricted stock units at Dec. 31, 2012

.......................

1,155

25.41

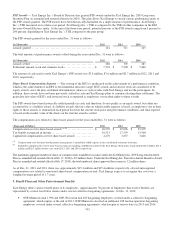

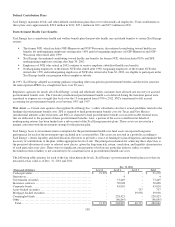

The total fair value of nonvested RSUs as of Dec. 31, 2012 was $30.9 million and the weighted average remaining contractual life

was 1.7 years.

Approximately 0.1 million RSUs vested during 2012 at a total fair value of $1.2 million. Approximately 1.1 million RSUs vested during

2011 at a total fair value of $30.1 million. Approximately 0.6 million RSUs vested during 2010 at a total fair value of $14.8 million.

Stock Equivalent Unit Plan — Non-employee members of the Xcel Energy Inc. Board of Directors receive annual awards of

stock equivalent units, with each unit having a value equal to one share of Xcel Energy Inc. common stock. The annual grants are

vested as of the date of each member’s election to the board of directors; there is no further service or other condition attached to

the annual grants after the member has been elected to the board. Additionally, directors may elect to receive their fees in stock

equivalent units in lieu of cash, and similarly have no further service or other conditions attached. Dividends on Xcel Energy

Inc.’s common stock are converted to stock equivalent units and granted based on the number of stock equivalent units held by

each participant as of the dividend date. The stock equivalent units are payable as a distribution of Xcel Energy Inc.’s common

stock upon a director’s termination of service.

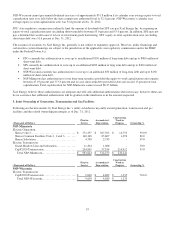

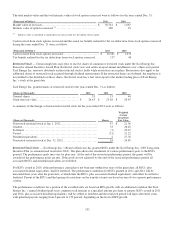

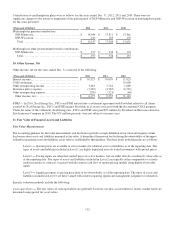

The stock equivalent units granted for the years ended Dec. 31 were as follows:

(Units in Thousands)

2012

2011

2010

Granted units................................

.....................

65

60

66

Grant date fair value ................................

..............

$

27.41

$

25.12

$

21.14

A summary of the stock equivalent unit changes for the year ended 2012 are as follows:

(Units in Thousands)

Units

Weighted

Average

Grant Date

Fair Value

Stock equivalent units at Jan. 1, 2012................................

..

522

$

20.65

Granted................................

.............................

65

27.41

Units distributed................................

.....................

(30)

19.82

Dividend equivalents ................................

................

20

27.59

Stock equivalent units at Dec. 31, 2012

................................

577

21.71