Xcel Energy 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

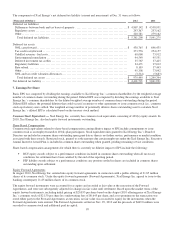

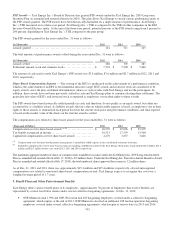

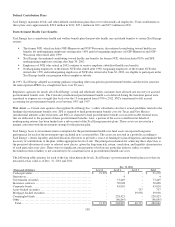

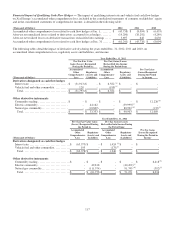

109

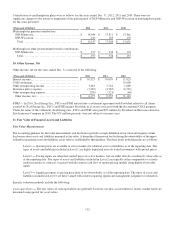

Dec. 31, 2011

(Thousands of Dollars)

Level 1

Level 2

Level 3

Total

Cash equivalents ................................

...............

$

58,037

$

-

$

-

$

58,037

Derivatives................................

.....................

-

13,178

-

13,178

Government securities ................................

..........

-

65,746

-

65,746

Corporate bonds ................................

................

-

61,524

-

61,524

Asset-backed securities ................................

.........

-

-

7,867

7,867

Mortgage-backed securities................................

......

-

-

27,253

27,253

Preferred stock ................................

.................

-

423

-

423

Common stock ................................

.................

351

-

-

351

Private equity investments................................

.......

-

-

479

479

Commingled funds ................................

.............

-

202,912

-

202,912

Real estate ................................

.....................

-

-

144

144

Securities lending collateral obligation and other

..................

-

(11,079

)

-

(11,079)

Total................................

.........................

$

58,388

$

332,704

$

35,743

$

426,835

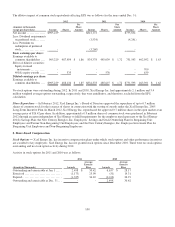

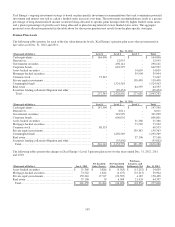

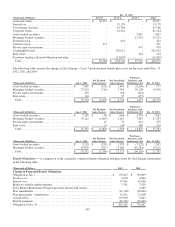

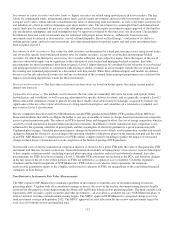

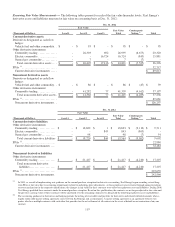

The following tables present the changes in Xcel Energy’s Level 3 postretirement benefit plan assets for the years ended Dec. 31,

2012, 2011 and 2010:

Purchases,

Net Realized

Net Unrealized

Issuances, and

(Thousands of Dollars)

Jan. 1, 2012

Gains (Losses)

Gains (Losses)

Settlements, Net

Dec. 31, 2012

Asset-backed securities

..........................

$ 7,867

$ (331

)

$

1,481

$

(8,260

)

$

757

Mortgage-backed securities

.......................

27,253

(724

)

3,301

10,128

39,958

Private equity investments

........................

479

-

(65

)

(414

)

-

Real estate ................................

......

144

-

35

(179

)

-

Total................................

..........

$ 35,743

$ (1,055

)

$

4,752

$

1,275

$

40,715

Purchases,

Net Realized

Net Unrealized

Issuances, and

(Thousands of Dollars)

Jan. 1, 2011

Gains (Losses)

Gains (Losses)

Settlements, Net

Dec. 31, 2011

Asset-backed securities

..........................

$ 2,585

$ (10

)

$

(664

)

$

5,956

$

7,867

Mortgage-backed securities

.......................

19,212

(1,669

)

2,623

7,087

27,253

Private equity investments

........................

-

12

53

414

479

Real estate ................................

......

-

(2

)

(34

)

180

144

Total................................

..........

$ 21,797

$ (1,669

)

$

1,978

$

13,637

$

35,743

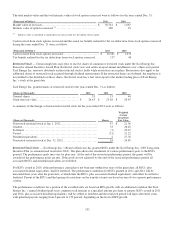

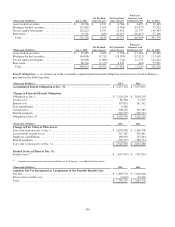

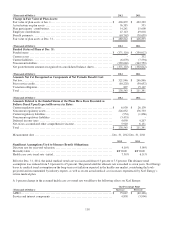

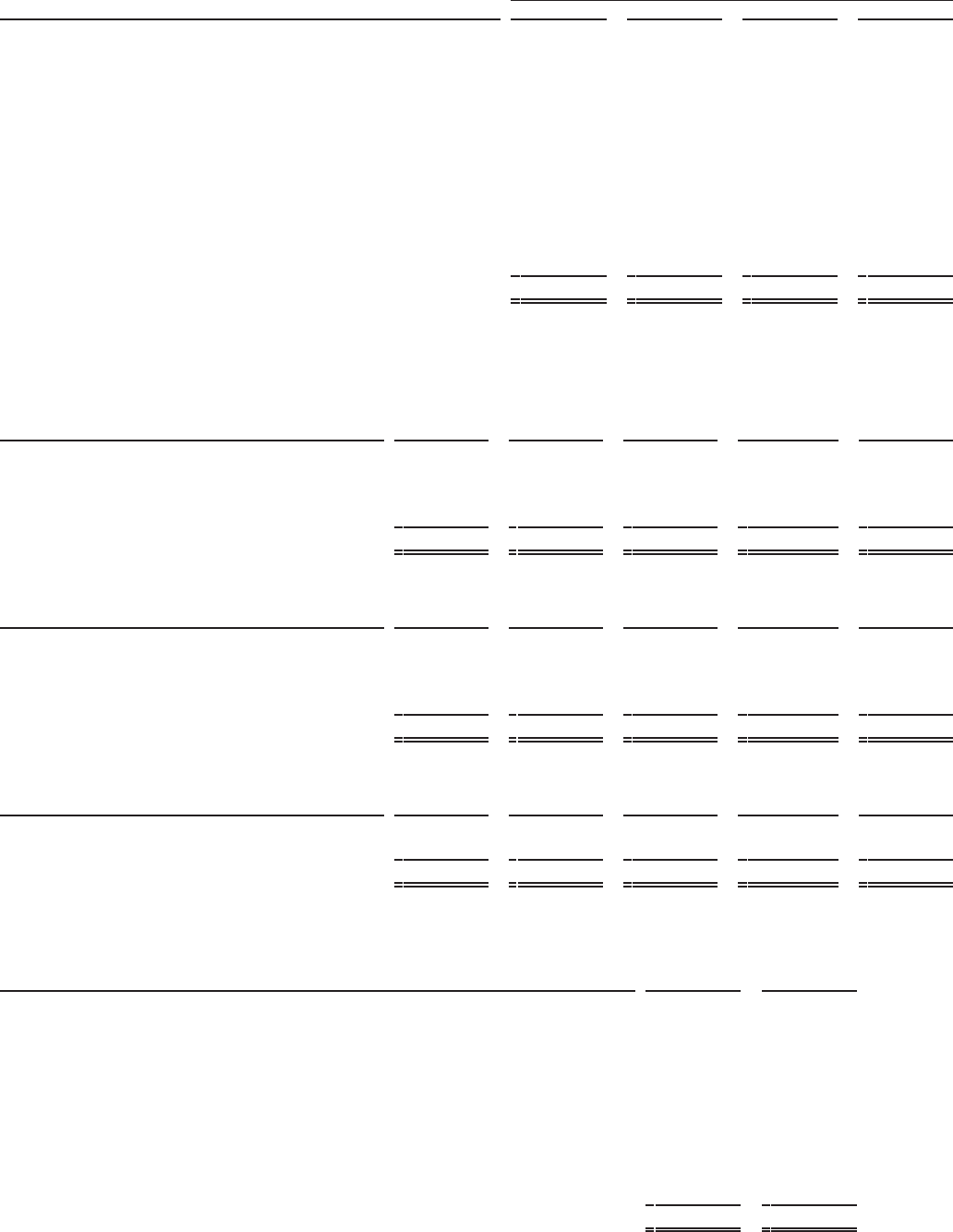

Purchases,

Net Realized

Net Unrealized

Issuances, and

(Thousands of Dollars)

Jan. 1, 2010

Gains (Losses)

Gains (Losses)

Settlements, Net

Dec. 31, 2010

Asset-backed securities

..........................

$ 8,293

$ (259

)

$

2,073

$

(7,522

)

$

2,585

Mortgage-backed securities

.......................

47,078

(927

)

15,642

(42,581

)

19,212

Total................................

..........

$ 55,371

$ (1,186

)

$

17,715

$

(50,103

)

$

21,797

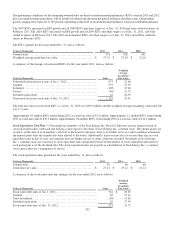

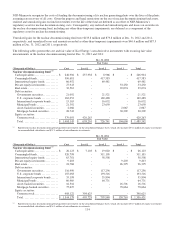

Benefit Obligations — A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy is presented

in the following table:

(Thousands of Dollars)

2012

2011

Change in Projected Benefit Obligation:

Obligation at Jan. 1 ................................

..............................

$

776,847

$

794,905

Service cost ................................................................

.....

4,203

4,824

Interest cost ................................................................

.....

37,861

42,086

Medicare subsidy reimbursements ................................

................

3,741

3,518

Early Retiree Reinsurance Program proceeds shared with retirees

....................

-

4,269

Plan amendments ................................

................................

(41,128)

(26,630

)

Plan participants’ contributions ................................

...................

14,241

15,690

Actuarial loss ................................................................

...

119,949

8,823

Benefit payments ................................

................................

(63,762)

(70,638

)

Obligation at Dec. 31 ................................

............................

$

851,952

$

776,847