Xcel Energy 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

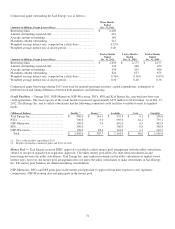

Registration Statements — Xcel Energy Inc.’s Articles of Incorporation authorize the issuance of one billion shares of $2.50 par

value common stock. As of Dec. 31, 2011 and 2010, Xcel Energy Inc. had approximately 486 million shares and 482 million

shares of common stock outstanding, respectively. In addition, Xcel Energy Inc.’s Articles of Incorporation authorize the issuance

of seven million shares of $100 par value preferred stock. Xcel Energy Inc. had no shares of preferred stock outstanding on Dec.

31, 2011 and approximately one million shares of preferred stock outstanding on Dec. 31, 2010. Xcel Energy Inc. and its

subsidiaries have the following registration statements on file with the SEC, pursuant to which they may sell, from time to time,

securities:

• Xcel Energy Inc. has an effective automatic shelf registration statement that does not contain a limit on issuance

capacity. However, Xcel Energy Inc.’s ability to issue securities is limited by authority granted by the Board of

Directors, which currently authorizes the issuance of up to an additional $1.75 billion of debt and common equity

securities.

• NSP-Minnesota has a shelf registration statement filed in January 2011. NSP-Minnesota’s ability to issue securities is

limited by authority granted by its Board of Directors, which currently authorizes the issuance of up to $1.5 billion of

debt securities.

• PSCo has an automatic shelf registration statement filed in October 2010 that does not contain a limit on issuance

capacity. However, PSCo’s ability to issue securities is limited by authority granted by its Board of Directors, which

currently authorizes the issuance of up to $1.15 billion of debt securities.

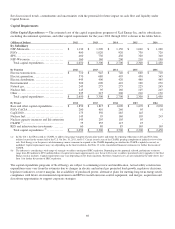

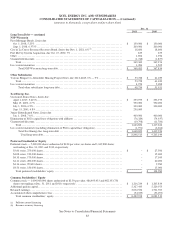

Long-Term Borrowings — See the consolidated statements of capitalization and a discussion of the long-term borrowings in

Note 4 to the consolidated financial statements.

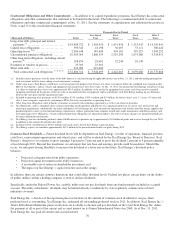

During 2011, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

• In August 2011, PSCo issued $250 million of 30-year first mortgage bonds with a coupon of 4.75 percent. PSCo used a

portion of the net proceeds from the sale of the first mortgage bonds to repay short-term debt borrowings incurred to

fund daily operational needs. The balance of the net proceeds was used for general corporate purposes.

• In August 2011, SPS issued $200 million of 30-year first mortgage bonds with a coupon of 4.5 percent. SPS used a

portion of the net proceeds from the sale of the first mortgage bonds to repay short-term debt borrowings incurred to

fund daily operational needs and to redeem $57.3 million of the outstanding 5.75 percent pollution control revenue

refunding bonds in September 2011. The balance of the net proceeds was used for general corporate purposes.

• In September 2011, Xcel Energy Inc. issued $250 million of 30-year unsecured bonds with a coupon of 4.8 percent. Xcel

Energy Inc. added the net proceeds from the sale of the notes to its general funds and used the proceeds to repay short-

term debt and for general corporate purposes.

• In October 2011, Xcel Energy Inc. redeemed all series of its preferred stock, which had a par value of $105 million.

Financing Plans — Xcel Energy issues debt and equity securities to refinance retiring maturities, reduce short-term debt, fund

construction programs, infuse equity in subsidiaries, fund asset acquisitions and for other general corporate purposes.

During 2012, Xcel Energy Inc. and its utility subsidiaries anticipate issuing following:

• NSP-Minnesota may issue approximately $800 million of first mortgage bonds in the third quarter of 2012.

• PSCo may issue approximately $750 million of first mortgage bonds in the third quarter of 2012.

• SPS may issue approximately $100 million of first mortgage bonds in the first half of 2012.

• NSP-Wisconsin may issue approximately $100 million of first mortgage bonds in the second half of 2012.

Financing plans are subject to change, depending on capital expenditures, internal cash generation, market conditions and other

factors.

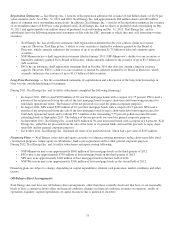

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements, other than those currently disclosed, that have or are reasonably

likely to have a current or future effect on financial condition, changes in financial condition, revenues or expenses, results of

operations, liquidity, capital expenditures or capital resources that is material to investors.