Xcel Energy 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122

SPS

Recently Concluded Regulatory Proceedings — NMPRC and PUCT

Base Rate

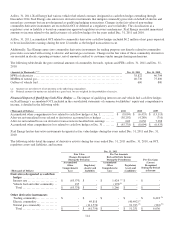

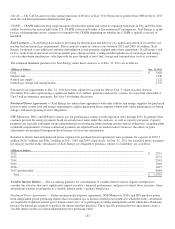

SPS – New Mexico Retail Rate Case — In February 2011, SPS filed a request with the NMPRC seeking to increase New Mexico

electric rates approximately $19.9 million. The rate filing was based on a 2011 test year adjusted for known and measurable

changes for 2012, a requested ROE of 11.25 percent, an electric rate base of $390.3 million and an equity ratio of 51.11 percent.

In December 2011, the NMPRC approved a black box settlement with new rates effective Jan. 1, 2012. The settlement increased

base rates by $13.5 million. SPS agreed not to file another base rate case until Dec. 3, 2012 with new final rates from the result of

such case not going into effect until Jan. 1, 2014 (Settlement Period). However, SPS can request to implement interim rates if the

NMPRC standard for interim rates is met. During the Settlement Period, rates are to remain fixed aside from the continued

operation of the fuel adjustment clause and certain exceptions for energy efficiency, a rider for an approved renewable portfolio

standard regulatory asset, and actual costs incurred for environmental regulations with an effective date after Dec. 31, 2010.

SPS – Texas Retail Rate Case — In May 2010, SPS filed a request with the PUCT seeking to increase Texas electric rates by

approximately $71.5 million inclusive of franchise fees. The rate filing was based on a 2009 test year adjusted for known and

measurable changes, a requested ROE of 11.35 percent, an electric rate base of $1.031 billion and an equity ratio of 51.0 percent.

In November 2010, SPS filed an update to the cost of service to reflect the sale of Lubbock facilities which reduced the total

request to approximately $63.7 million.

Effective Feb. 16, 2011, the parties reached an unopposed settlement to resolve all issues in the case and increase base rates by

$39.4 million, of which $16.9 million is associated with the transfer of two riders, the TCRF and the PCRF, into base rates.

Effective Jan. 1, 2012, base rates increased by an additional $13.1 million.

SPS agreed not to file another rate case until Sept. 15, 2012. In addition, SPS cannot file a TCRF application until 2013, and if

SPS files a TCRF application before the effective date of rates in its next rate case, it must reduce the calculated TCRF revenue

requirement by $12.2 million.

13. Commitments and Contingent Liabilities

Commitments

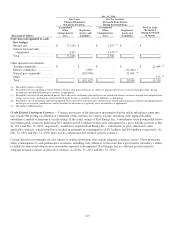

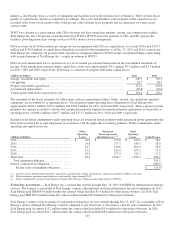

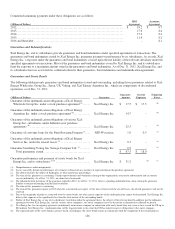

Capital Commitments — Xcel Energy has made commitments in connection with a portion of its projected capital expenditures.

Xcel Energy’s capital commitments primarily relate to the following major projects:

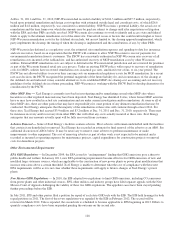

Nuclear Lifecycle Management and Extended Power Uprates — NSP-Minnesota is pursuing improvements to make sure the

plants operate safely until the end of their extended licensed life and is making capacity increases of the Monticello and Prairie

Island generating plants that could total up to approximately 188 MW. The MPUC approved the CON for the extended power

uprate for Monticello in 2008. The license amendment application was filed with the NRC in November 2008, but a concern was

raised by the Advisory Committee on Reactor Safeguards related to containment pressure associated with pump performance. In

October 2011, the Advisory Committee recommended that all licensing actions that credit the use of containment accident

pressure be suspended until the causes and risks of Japan’s Fukushima incident are better understood. NSP-Minnesota has

rescheduled the remaining equipment changes needed to complete the Monticello power uprate projects during the planned spring

2013 refueling outage.

The MPUC approved an extended power uprate for the Prairie Island Units in 2009. Analysis of recent extended power uprate

submittals to the NRC concluded that significant additional design work beyond current schedule and cost plan estimates are now

being required to submit a successful application. As a result, NSP-Minnesota is completing an economic and new project design

analysis to determine project impacts and anticipates submitting a Change in Circumstances filing with the MPUC in the first

quarter of 2012.

CapX2020 — CapX2020 is an alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest,

including Xcel Energy that have proposed several groups of transmission projects to be complete by 2020. Group 1 project

investments consist of four transmission lines. Major construction began in 2010 on the Group 1 transmission lines with an

expected completion date in 2015. NSP System’s investment depends on the routes and configurations approved by affected state

commissions. The remainder of the costs will be born by other utilities in the upper Midwest.