Xcel Energy 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

• The commitment fees, also based on applicable long-term credit ratings, are calculated on the unused portion of the lines

of credit at a range of 10 to 35 basis points per year.

• NSP-Wisconsin’s intercompany borrowing arrangement with NSP-Minnesota was subsequently terminated.

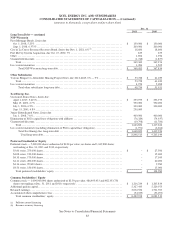

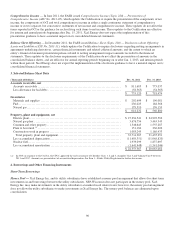

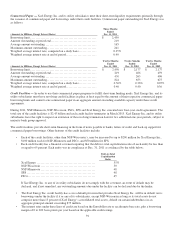

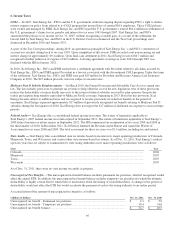

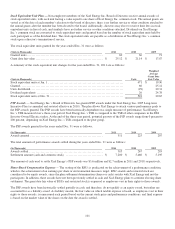

At Dec. 31, 2011, Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available:

(Millions of Dollars) Facility Drawn (a) Available

Xcel Energy Inc. ................................

............................

$

800.0 $

127.1 $

672.9

PSCo ................................................................

.......

700.0 4.9 695.1

NSP-Minnesota ................................

.............................

500.0 33.7 466.3

SPS ................................................................

........

300.0 - 300.0

NSP-Wisconsin ................................

.............................

150.0 66.0 84.0

Total ................................................................

.....

$

2,450.0 $

231.7 $

2,218.3

(a) Includes outstanding commercial paper and letters of credit.

All credit facility bank borrowings, outstanding letters of credit and outstanding commercial paper reduce the available capacity

under the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities

outstanding at Dec. 31, 2011 and 2010.

Letters of Credit — Xcel Energy Inc. and its subsidiaries use letters of credit, generally with terms of one year, to provide

financial guarantees for certain operating obligations. At Dec. 31, 2011 and 2010, there were $12.7 million and $10.1 million of

letters of credit outstanding, respectively, under the credit facilities. An additional $1.1 million of letters of credit not issued under

the credit facilities were outstanding at Dec. 31, 2011 and 2010, respectively. The contract amounts of these letters of credit

approximate their fair value and are subject to fees determined in the marketplace.

Long-Term Borrowings and Other Financing Instruments

Generally, all real and personal property of NSP-Minnesota and NSP-Wisconsin and all real and personal property used in or in

connection with the electric utility business of PSCo and SPS are subject to the liens of their first mortgage indentures.

Additionally, debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums, discounts and

expenses associated with refinanced debt are deferred and amortized over the life of the related new issuance, in accordance with

regulatory guidelines.

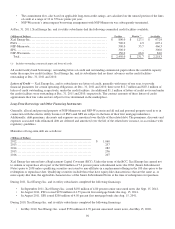

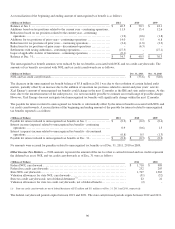

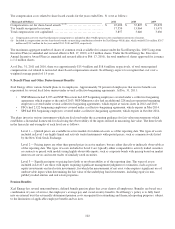

Maturities of long-term debt are as follows:

(Millions of Dollars)

2012................................

...........................

$

1,060

2013................................

...........................

257

2014................................

...........................

282

2015................................

...........................

256

2016................................

...........................

207

Xcel Energy has entered into a Replacement Capital Covenant (RCC). Under the terms of the RCC, Xcel Energy has agreed not

to redeem or repurchase all or part of the $400 million of 7.6 percent junior subordinated notes due 2068 (Junior Subordinated

Notes) prior to 2038 unless qualifying securities are issued to non-affiliates in a replacement offering in the 180 days prior to the

redemption or repurchase date. Qualifying securities include those that have equity-like characteristics that are the same as, or

more equity-like than, the applicable characteristics of the Junior Subordinated Notes at the time of redemption or repurchase.

During 2011, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

• In September 2011, Xcel Energy Inc. issued $250 million of 4.80 percent senior unsecured notes due Sept. 15, 2041.

• In August 2011, PSCo issued $250 million of 4.75 percent first mortgage bonds due Aug. 15, 2041.

• In August 2011, SPS issued $200 million of 4.50 percent first mortgage bonds due Aug. 15, 2041.

During 2010, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

• In May 2010, Xcel Energy Inc. issued $550 million of 4.70 percent unsecured senior notes, due May 15, 2020.