Xcel Energy 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

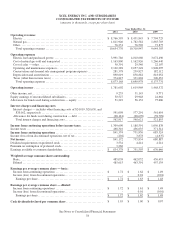

See discussion of trends, commitments and uncertainties with the potential for future impact on cash flow and liquidity under

Capital Sources.

Capital Requirements

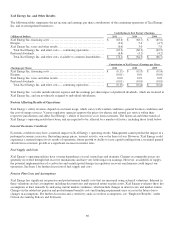

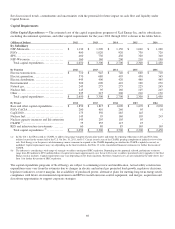

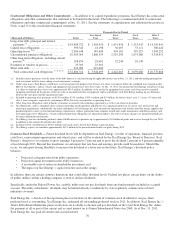

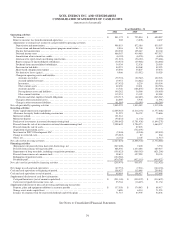

Utility Capital Expenditures — The estimated cost of the capital expenditure programs of Xcel Energy Inc. and its subsidiaries,

excluding discontinued operations, and other capital requirements for the years 2012 through 2016 is shown in the tables below.

(Millions of Dollars)

2012 2013 2014 2015 2016

By Subsidiary

NSP-Minnesota ..........................

$

1,130 $

1,390 $

1,150 $

1,040 $

1,200

PSCo ....................................

900 1,020 920 730 720

SPS .....................................

460 730 430 320 340

NSP-Wisconsin ..........................

160 160 200 210 190

Total capital expenditures ...............

$

2,650 $

3,300 $

2,700 $

2,300 $

2,450

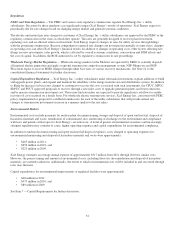

By Function

2012 2013 2014 2015 2016

Electric transmission......................

$

710 $

945 $

740 $

660 $

710

Electric generation........................

570 680 495 450 345

Electric distribution .......................

445 400 420 460 465

Environmental ...........................

300 690 410 190 270

Natural gas...............................

245 275 275 225 245

Nuclear fuel..............................

145 95 160 105 245

Other ....................................

235 215 200 210 170

Total capital expenditures ...............

$

2,650 $

3,300 $

2,700 $

2,300 $

2,450

By Project 2012 2013 2014 2015 2016

Base and other capital expenditures ........

$

1,850 $

1,815 $

1,690 $

1,670

$

2,030

PSCo CACJA ............................

200 410 260

95

10

CapX2020 ...............................

175 350 285

145

-

Nuclear fuel..............................

145 95 160

105

245

Nuclear capacity increases and life extension

145 295 105

95

-

CSAPR (a)................................

75 255 115

25

-

RES and infrastructure investments ........

60 80 85

165

165

Total capital expenditures (b) .............

$

2,650 $

3,300 $

2,700 $

2,300

$

2,450

(a) In July 2011, the EPA issued its CSAPR, to address long range transport of particulate matter and ozone by requiring reductions in SO2 and NOx from

utilities located in the eastern half of the U.S. On Dec. 30, 2011, the D.C. Circuit issued a stay of the CSAPR, pending completion of judicial review of the

rule. Xcel Energy is in the process of determining various scenarios to respond to the CSAPR depending on whether the CSAPR is upheld, reversed, or

modified. Capital requirements may vary depending on the final resolution. See Note 13 to the consolidated financial statements for further discussion of

CSAPR.

(b) The industry is considering a wide range of strategies to address anticipated NRC regulation. Depending on the approach selected, preliminary estimates

range from $20 million to $250 million dollars of capital investment approximately over the next five years to address postulated safety upgrades to the Xcel

Energy nuclear facilities. Capital requirements may vary depending on the final regulation, therefore estimated costs are not included in the table above. See

Item 1 for further discussion of NRC regulation.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions,

legislative initiatives, reserve margins, the availability of purchased power, alternative plans for meeting long-term energy needs,

compliance with future environmental requirements and RPS to install emission-control equipment, and merger, acquisition and

divestiture opportunities to support corporate strategies.