Xcel Energy 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

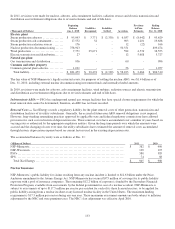

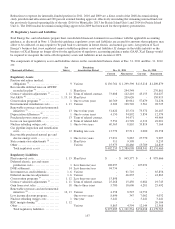

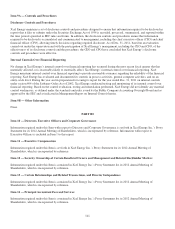

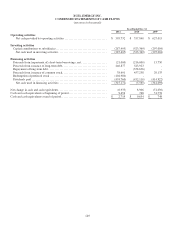

139

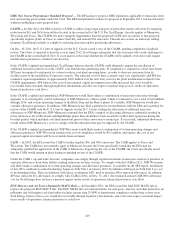

(Thousands of Dollars) Regulated

Electric Regulated

Natural Gas

All

Other Reconciling

Eliminations

Consolidated

Total

2010

Operating revenues from external customers

..........

$

8,451,845 $

1,782,582 $

76,520 $

- $

10,310,947

Intersegment revenues

..............................

1,015 5,653 - (6,668) -

Total revenues ................................

...

$

8,452,860 $

1,788,235 $

76,520 $

(6,668) $

10,310,947

Depreciation and amortization

.......................

$

748,815 $

99,220 $

10,847 $

- $

858,882

Interest charges and financing costs

..................

380,074 49,314 119,233 - 548,621

Income tax expense (benefit)

........................

434,756 59,790 (57,911) - 436,635

Income (loss) from continuing operations

.............

665,155 114,554 (27,753) - 751,956

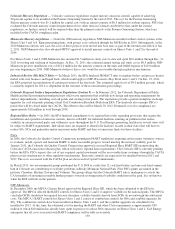

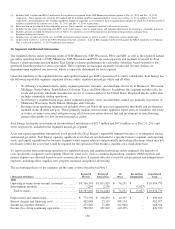

(Thousands of Dollars)

Regulated

Electric

Regulated

Natural Gas

All

Other

Reconciling

Eliminations

Consolidated

Total

2009

Operating revenues from external customers

..........

$

7,704,723 $

1,865,703 $

73,877 $

- $

9,644,303

Intersegment revenues

..............................

816 2,931 - (3,747) -

Total revenues ................................

...

$

7,705,539 $

1,868,634 $

73,877 $

(3,747) $

9,644,303

Depreciation and amortization

.......................

$

711,090 $

95,633 $

11,329 $

- $

818,052

Interest charges and financing costs

..................

371,525 44,572 105,758 - 521,855

Income tax expense (benefit)

........................

357,128 81,956 (67,770) - 371,314

Income (loss) from continuing operations

.............

611,851 108,948 (35,275) - 685,524

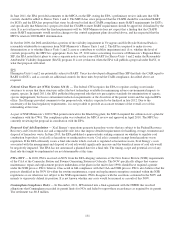

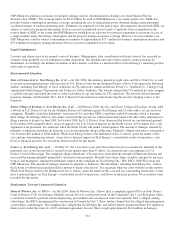

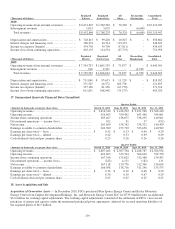

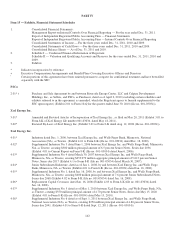

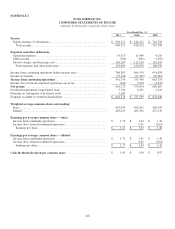

17. Summarized Quarterly Financial Data (Unaudited)

Quarter Ended

(Amounts in thousands, except per share data) March 31, 2011

June 30, 2011

Sept. 30, 2011

Dec. 31, 2011

Operating revenues ................................

.............

$

2,816,540 $ 2,438,222 $ 2,831,598 $ 2,568,410

Operating income................................

...............

426,663 359,442 651,496 344,001

Income from continuing operations

..............................

203,467 158,671 338,295 140,941

Discontinued operations — income (loss)

.........................

102 91 37 (432

)

Net income ................................

....................

203,569 158,762 338,332 140,509

Earnings available to common shareholders

.......................

202,509 157,702 333,658 140,509

Earnings per share total — basic ................................

.

$

0.42 $ 0.33 $ 0.69 $ 0.29

Earnings per share total — diluted

...............................

0.42 0.33 0.69 0.29

Cash dividends declared per common share

.......................

0.25 0.26 0.26 0.26

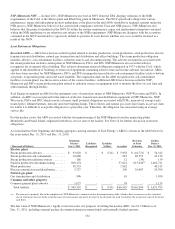

Quarter Ended

(Amounts in thousands, except per share data) March 31, 2010

June 30, 2010

Sept. 30, 2010

Dec. 31, 2010

Operating revenues ................................

.............

$

2,807,462 $ 2,307,764 $ 2,628,787 $ 2,566,934

Operating income................................

...............

403,665 325,304 568,630 322,370

Income from continuing operations

..............................

167,340 135,625 312,488 136,503

Discontinued operations — income (loss)

.........................

(222) 4,151 (182) 131

Net income ................................

....................

167,118 139,776 312,306 136,634

Earnings available to common shareholders

.......................

166,058 138,716 311,246 135,573

Earnings per share total — basic ................................

.

$

0.36 $ 0.30 $ 0.68 $ 0.29

Earnings per share total — diluted

...............................

0.36 0.30 0.67 0.29

Cash dividends declared per common share

.......................

0.25 0.25 0.25 0.25

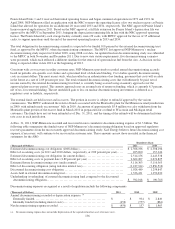

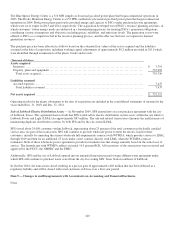

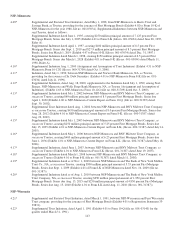

18. Asset Acquisition and Sale

Acquisition of Generation Assets — In December 2010, PSCo purchased Blue Spruce Energy Center and Rocky Mountain

Energy Center from Calpine Development Holdings, Inc. and Riverside Energy Center LLC for $739.0 million plus an additional

$3.0 million for working capital adjustments. The working capital adjustments consisted of the settlement of PSCo’s most recent

purchases of energy and capacity under the terminated purchased power agreements, adjusted for accrued operating liabilities of

the acquired plants of $6.5 million.