Xcel Energy 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

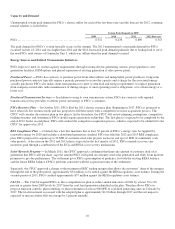

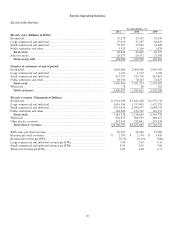

Capacity and Demand

Uninterrupted system peak demand for PSCo’s electric utility for each of the last three years and the forecast for 2012, assuming

normal weather, is listed below.

System Peak Demand (in MW)

2009 2010 2011 2012 Forecast

PSCo .................................................. 6,311

6,436 6,896

6,313

The peak demand for PSCo’s system typically occurs in the summer. The 2011 uninterrupted system peak demand for PSCo

occurred on July 18, 2011 and was higher than 2010 and the 2012 forecasted peak demand primarily due to backup load to serve

the non-PSCo joint owners of Comanche Unit 3, which was offline when the peak demand occurred.

Energy Sources and Related Transmission Initiatives

PSCo expects to meet its system capacity requirements through existing electric generating stations, power purchases, new

generation facilities, DSM options and phased expansion of existing generation at select power plants.

Purchased Power — PSCo has contracts to purchase power from other utilities and independent power producers. Long-term

purchased power contracts typically require a periodic payment to secure the capacity and a charge for the associated energy

actually purchased. PSCo also makes short-term purchases to meet system load and energy requirements, to replace generation

from company-owned units under maintenance or during outages, to meet operating reserve obligations, or to obtain energy at a

lower cost.

Purchased Transmission Services — In addition to using its own transmission system, PSCo has contracts with regional

transmission service providers to deliver power and energy to PSCo’s customers.

PSCo Resource Plan — In October 2011, PSCo filed the 2011 electric resource plan. Beginning in 2017, PSCo is projected to

have relatively low resource needs and has proposed to fill these needs with a competitive resource acquisition process. The

CPUC will consider the resource plan in two phases. In the first phase, the CPUC will review planning assumptions, competitive

bidding structure, and determine if PSCo should acquire generation technology. The first phase is expected to be completed by the

end of 2012. In the second phase, PSCo will conduct the competitive acquisition process, which is expected to be submitted to the

CPUC for approval in 2013.

RES Compliance Plan — Colorado has a law that mandates that at least 30 percent of PSCo’s energy sales be supplied by

renewable energy by 2020 and includes a distributed generation standard. PSCo has filed the 2012 and 2013 RES compliance

plan. PSCo proposed to acquire up to 30 MW of customer-sited solar projects each year and up to 6 MW of community scale

solar projects. A decision on the 2012 and 2013 plan is expected in the first quarter of 2012. PSCo currently recovers any

incentives paid through a combination of the ECA and RESA cost-recovery mechanisms.

Solar*Rewards Program — In March 2011, the CPUC approved a settlement that limits the amount of customer sited solar

generation that PSCo will purchase, caps the amount PSCo will spend on customer sited solar generation and shifts from up-front

payments to pay-for-performance. The settlement gives PSCo a presumption of prudence, for both the existing RESA balance,

and the future RESA balance if PSCo performs consistent with the acquisition terms of the settlement.

Separately, the CPUC approved a change to the treatment of REC trading margins that allows the customers’ share of the margins

through the end of the pilot period, approximately $54 million, to be netted against the RESA regulatory asset balance. During the

second quarter of 2011, PSCo credited approximately $37 million against the RESA regulatory asset balance.

CACJA — The CACJA required PSCo to file a comprehensive plan to reduce annual emissions of NOx by at least 70 to 80

percent or greater from 2008 levels by 2017 from the coal-fired generation identified in the plan. The plan allows PSCo to

propose emission controls, plant refueling, or plant retirement of at least 900 MW of coal-fired generating units in Colorado by

2017. The total investment associated with the adopted plan is approximately $1.0 billion through 2017 and the rate impact is

expected to increase future bills on average by 2 percent annually.