Xcel Energy 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

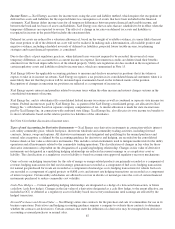

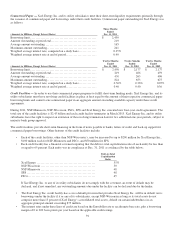

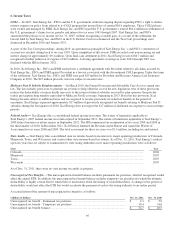

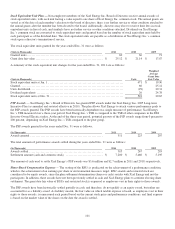

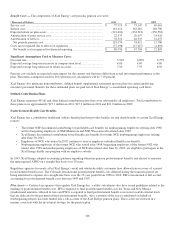

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income

tax rate to income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

2011 2010 2009

Federal statutory rate................................

.........................

35.0% 35.0% 35.0

%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit

..........................

4.2 3.9 4.0

Resolution of income tax audits and other ................................

...

0.3 0.6 0.8

Tax credits recognized, net of federal income tax expense

.....................

(2.6) (1.8) (2.0)

Regulatory differences - utility plant items ................................

...

(0.8) (1.1) (2.0)

Change in unrecognized tax benefits ................................

........

(0.1) 0.1 (0.5)

Life insurance policies ................................

.....................

(0.1) (0.8) (0.2)

Previously recognized Medicare Part D subsidies

.............................

- 1.4 -

Other, net ................................

................................

(0.1) (0.6) -

Effective income tax rate from continuing operations

...........................

35.8% 36.7% 35.1

%

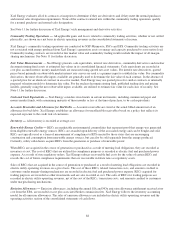

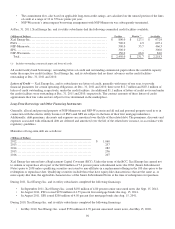

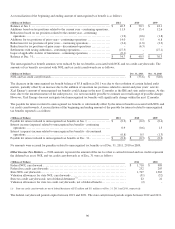

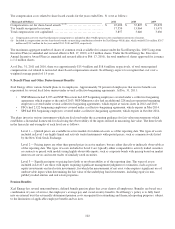

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2011 2010 2009

Current federal tax expense (benefit) ................................

..........

$

3,399 $

16,657 $

(39,886)

Current state tax expense ................................

.....................

9,971 12,580 8,672

Current change in unrecognized tax benefit ................................

....

(8,266) (2,982) (7,627)

Current tax credits ................................

...........................

- (944) -

Deferred federal tax expense................................

..................

410,794 376,073 360,252

Deferred state tax expense................................

....................

80,670 52,543 69,947

Deferred change in unrecognized tax expense ................................

..

6,705 4,641 2,387

Deferred tax credits................................

..........................

(28,763) (15,580) (16,005)

Deferred investment tax credits ................................

...............

(6,194) (6,353) (6,426)

Total income tax expense from continuing operations

.........................

$

468,316 $

436,635 $

371,314

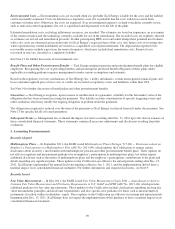

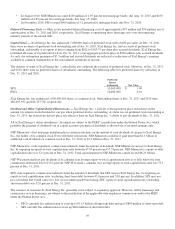

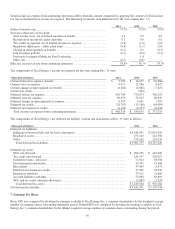

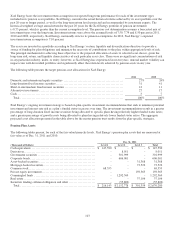

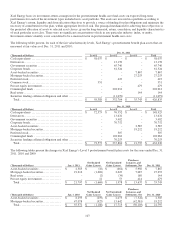

The components of Xcel Energy’s net deferred tax liability (current and noncurrent) at Dec. 31 were as follows:

(Thousands of Dollars) 2011 2010

Deferred tax liabilities:

Differences between book and tax bases of property ................................

........

$

4,558,951 $

3,853,425

Regulatory assets ................................................................

........

253,162 242,760

Other ................................................................

...................

279,162 219,035

Total deferred tax liabilities ................................

............................

$

5,091,275 $

4,315,220

Deferred tax assets:

NOL carryforward................................................................

.......

$

696,435 $

425,620

Tax credit carryforward ................................................................

..

254,157 226,057

Unbilled revenue - fuel costs ................................

.............................

73,912 69,358

Environmental remediation ................................

...............................

45,551 41,696

Rate refund ................................................................

.............

37,443 8,971

Deferred investment tax credits ................................

...........................

37,425 39,916

Regulatory liabilities................................................................

.....

37,012 51,600

Accrued liabilities and other ................................

..............................

73,092 58,891

NOL and tax credit valuation allowances ................................

..................

(5,683) (1,927)

Total deferred tax assets................................

................................

$

1,249,344 $

920,182

Net deferred tax liability ................................................................

...

$

3,841,931 $

3,395,038

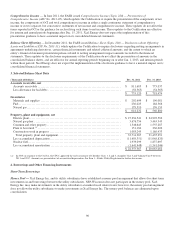

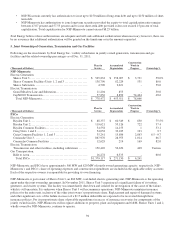

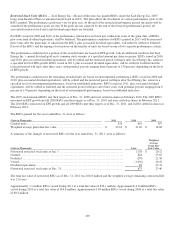

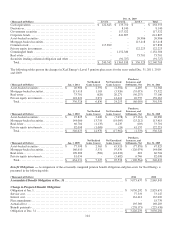

7. Earnings Per Share

Basic EPS was computed by dividing the earnings available to Xcel Energy Inc.’s common shareholders by the weighted average

number of common shares outstanding during the period. Diluted EPS was computed by dividing the earnings available to Xcel

Energy Inc.’s common shareholders by the diluted weighted average number of common shares outstanding during the period.