Xcel Energy 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Obtain stakeholder alignment

Successful execution of our strategy begins with obtaining stakeholder support for long-term decisions and for large investment

initiatives, prior to taking action. To avoid excessive risk, it is critical that Xcel Energy reduce regulatory and legislative

uncertainty before making long-term critical decisions or large capital investments. Stakeholder alignment is achieved by:

• Delivering operational excellence related to reliability, outage performance and customer satisfaction;

• Proactively taking actions to ensure public and employee safety related to our power plants, natural gas pipelines, and

our transmission and distribution system;

• Pursuing environmental leadership by reducing emissions, and expanding renewable energy in a cost-effective manner;

and

• Creating value for our customers by modernizing our infrastructure and reducing our environmental impact at a

reasonable cost, while providing customers with choices like DSM, conservation and renewable energy programs.

Invest in our utility business

After obtaining stakeholder support, the next phase of our strategy is to invest in our regulated utility businesses. Xcel Energy

projects that it will invest approximately $13.4 billion in its utility businesses from 2012 through 2016. Our capital investment

plan is expected to modernize our infrastructure, improve system reliability, reduce our impact on the environment, expand the

amount of renewable energy available to our customers and meet customer demand. We work hard to make sure these

investments provide value to our customers by selecting the most cost effective projects and striving to complete these projects on

time, safely and within established budgets. As a result of these investments, Xcel Energy projects that the rate base, or the

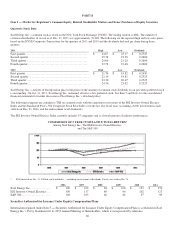

amount on which Xcel Energy earns a return, will grow at a compounded average annual rate of 7 percent through 2016.

Earn a fair return on our utility investment

The third phase of our strategy is to earn a fair return on our utility investments. Xcel Energy’s regulatory strategy is based on

filing reasonable base rate requests designed to provide recovery of costs necessary to operate our business and a reasonable

return on investment, along with obtaining regulatory approval for rate riders and DSM programs. A rate rider is a mechanism

that allows for recovery of certain costs and returns on investments, without the costs and delays of filing a rate case.

Xcel Energy believes that our public utility commissions will provide reasonable and timely recovery, and this is a key

assumption to achieving our financial objectives. Constructive regulatory outcomes over the last several years are evidence of

reasonable regulatory treatment and provide us confidence that we are pursuing the right strategy.

Provide an attractive total return

Successful execution of the corporate strategic plan should allow Xcel Energy to deliver an attractive total return to our

shareholders. Our value proposition is to deliver an attractive total return of about 10 percent through a combination of earnings

growth and dividend yield.

Since 2005, our financial objectives have been to:

• Deliver a long-term annual earnings per share growth rate of 5 percent to 7 percent;

• Deliver an annual dividend increases of 2 percent to 4 percent; and

• Maintain senior unsecured debt credit ratings in the BBB+ to A range.

We have successfully achieved these financial objectives. Our ongoing earnings have grown approximately 7 percent and our

dividend has grown approximately 3 percent annually since 2005. In addition, our current senior unsecured debt credit ratings for

Xcel Energy and it utility subsidiaries are in the BBB+ to A range.

We believe we are positioned to continue earnings growth of 5 percent to 7 percent and dividend growth of 2 percent to 4 percent

at least through 2013. Beyond this timeframe, we anticipate that rate base and earnings growth could moderate. Should this occur,

we anticipate having flexibility to increase the dividend at a faster rate in the future, while ensuring a strong balance sheet.

Therefore, we believe we are positioned to deliver a 10 percent total return.

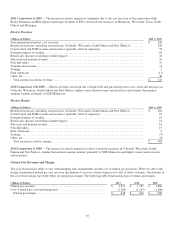

Financial Review

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel Energy’s

financial condition, results of operations and cash flows during the periods presented, or are expected to have a material impact in

the future. It should be read in conjunction with the accompanying consolidated financial statements and the related notes to

consolidated financial statements.