Xcel Energy 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

• NSP-Wisconsin currently has authorization to issue up to $150 million of long-term debt and up to $150 million of short-

term debt.

• NSP-Minnesota has authorization to issue long-term securities provided the equity-to-total capitalization ratio remains

between 47.07 percent and 57.53 percent and to issue short-term debt provided it does not exceed 15 percent of total

capitalization. Total capitalization for NSP-Minnesota cannot exceed $8.25 billion.

Xcel Energy believes these authorizations are adequate and will seek additional authorization when necessary; however, there can

be no assurance that additional authorization will be granted on the timeframe or in the amounts requested.

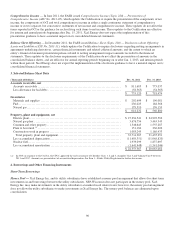

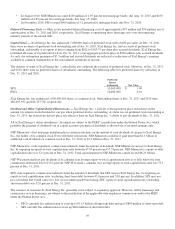

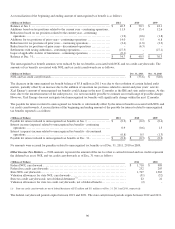

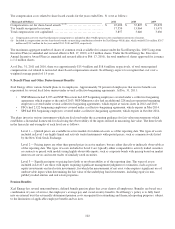

5. Joint Ownership of Generation, Transmission and Gas Facilities

Following are the investments by Xcel Energy Inc.’s utility subsidiaries in jointly owned generation, transmission and gas

facilities and the related ownership percentages as of Dec. 31, 2011:

(Thousands of Dollars) Plant in

Service

Accumulated

Depreciation

Construction

Work in

Progress Ownership %

NSP-Minnesota

Electric Generation:

Sherco Unit 3 ............................................. $

565,832 $

358,907 $

3,731 59.0%

Sherco Common Facilities Units 1, 2 and 3 .................. 138,790 82,229 531 80.0

Sherco Substation ......................................... 4,790 2,621 - 59.0

Electric Transmission:

Grand Meadow Line and Substation......................... 11,204 855 - 50.0

CapX2020 Transmission ................................... 57,856 8,899 74,404 49.6

Total NSP-Minnesota .................................... $

778,472 $

453,511 $

78,666

(Thousands of Dollars) Plant in

Service

Accumulated

Depreciation

Construction

Work in

Progress Ownership %

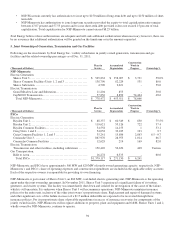

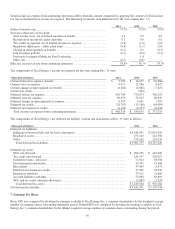

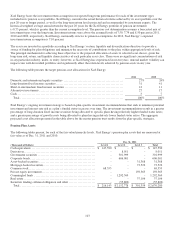

PSCo

Electric Generation:

Hayden Unit 1................................

..............

$

88,337 $

60,549 $

830

75.5

%

Hayden Unit 2................................

..............

119,621 55,126 722

37.4

Hayden Common Facilities................................

..

34,558 14,155 1

53.1

Craig Units 1 and 2 ................................

.........

54,058 33,225 193

9.7

Craig Common Facilities 1, 2 and 3

..........................

35,241 15,896 2,863 6.5 -

9.7

Comanche Unit 3 ................................

...........

867,976 28,973 1,014

66.7

Comanche Common Facilities

...............................

12,628 219 169

82.0

Electric Transmission:

Transmission and other facilities, including substations

........

150,420 56,654 449

Various

Gas Transportation:

Rifle to Avon ................................

..............

16,278 6,333 -

60.0

Total PSCo ................................

..............

$

1,379,117 $

271,130 $

6,241

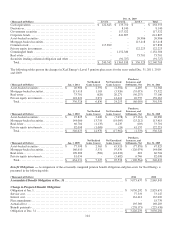

NSP-Minnesota and PSCo have approximately 500 MW and 820 MW of jointly owned generating capacity, respectively. NSP-

Minnesota’s and PSCo’s share of operating expenses and construction expenditures are included in the applicable utility accounts.

Each of the respective owners is responsible for providing its own financing.

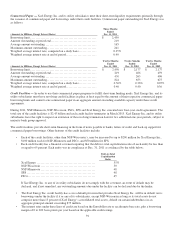

NSP-Minnesota is part owner of Sherco Unit 3, an 860 MW, coal-fueled electric generating unit. NSP-Minnesota is the operating

agent under the joint ownership agreement. In November 2011, Sherco Unit 3 experienced a significant failure of its turbine,

generator, and exciter systems. The facility was immediately shut down and isolated for investigation of the cause of the failure,

which is still uncertain. It is unknown when Sherco Unit 3 will recommence operations. NSP-Minnesota maintains insurance

policies for the entire unit, inclusive of the other joint owner’s proportionate share. Replacement and repair of damaged systems,

and other significant costs of the failure in excess of a $1.5 million deductible are expected to be recovered through these

insurance policies. For its proportionate share of possible expenditures in excess of insurance recoveries for components of the

jointly owned facility, NSP-Minnesota will recognize additions to property, plant and equipment and O&M. Sherco Units 1 and 2,

wholly owned by NSP-Minnesota, continue to operate.