Xcel Energy 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Fuel Supply and Costs

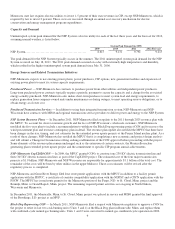

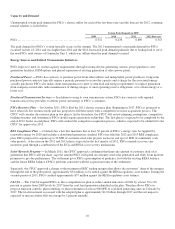

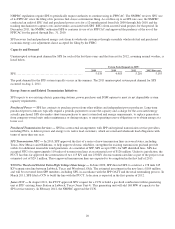

The following table shows the delivered cost per MMBtu of each significant category of fuel consumed for electric generation,

the percentage of total fuel requirements represented by each category of fuel and the total weighted average cost of all fuels.

Coal* Nuclear

Natural Gas

NSP System Generating Plants

Cost Percent Cost Percent Cost Percent

Weighted

Average

Fuel Cost

2011

.....................

$

2.06 55% $

0.89 40% $ 6.56

5

% $ 1.82

2010

.....................

1.89 51 0.83 42 6.29

7

1.73

2009

.....................

1.78 57 0.70 39 7.36

4

1.61

* Includes refuse-derived fuel and wood.

See Items 1A and 7 for further discussion of fuel supply and costs.

Fuel Sources

Coal — The NSP System normally maintains approximately 40 days of coal inventory. Coal supply inventories at Dec. 31, 2011

and 2010 were approximately 48 and 39 days usage, respectively. NSP-Minnesota’s generation stations use low-sulfur western

coal purchased primarily under contracts with suppliers operating in Wyoming and Montana. During 2011 and 2010, coal

requirements for the NSP System’s major coal-fired generating plants were approximately 9.5 million tons. The estimated coal

requirements for 2012 are approximately 8 million tons, including adjustments to account for Sherco Unit 3, which was shut

down in November 2011 after experiencing a significant failure of its turbine, generator, and exciter systems. It is uncertain when

Sherco Unit 3 will recommence operations.

NSP-Minnesota and NSP-Wisconsin have contracted for coal supplies to provide 99 percent of their coal requirements in 2012,

and a declining percentage of the requirements in subsequent years. The NSP System’s general coal purchasing objective is to

contract for approximately 100 percent of requirements for the following year, 67 percent of requirements in two years, and 33

percent of requirements in three years. Remaining requirements will be filled through the procurement process or over-the-

counter transactions.

NSP-Minnesota and NSP-Wisconsin have a number of coal transportation contracts that provide for delivery of 100 percent of

their coal requirements in 2012 and 2013. Coal delivery may be subject to short-term interruptions or reductions due to operation

of the mines, transportation problems, weather and availability of equipment.

Nuclear — To operate NSP-Minnesota’s nuclear generating plants, NSP-Minnesota secures contracts for uranium concentrates,

uranium conversion, uranium enrichment and fuel fabrication. The contract strategy involves a portfolio of spot purchases and

medium and long-term contracts for uranium concentrates, conversion services and enrichment services with multiple producers

and with a focus on diversification to minimize potential impacts caused by supply interruptions due to geographical and world

political issues.

• Current nuclear fuel supply contracts cover 100 percent of uranium concentrates requirements through 2017 and

approximately 66 percent of the requirements for 2018 through 2025.

• Current contracts for conversion services cover 100 percent of the requirements through 2017 and approximately 78

percent of the requirements for 2018 through 2025.

• Current enrichment service contracts cover 100 percent of the requirements through 2016 and approximately 95 percent

of the requirements for 2017 through 2025.

Fabrication services for Monticello and Prairie Island are 100 percent committed through 2025 and 2014, respectively. A contract

for fuel fabrication services for Prairie Island is currently being negotiated for 2015 and beyond.

NSP-Minnesota expects sufficient uranium concentrates, conversion services and enrichment services to be available for the total

fuel requirements of its nuclear generating plants. Some exposure to spot market price volatility will remain due to index-based

pricing structures contained in some of the supply contracts.