Xcel Energy 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Regulation of Derivatives — In July 2010, financial reform legislation was passed, which provides for the regulation of

derivative transactions amongst other provisions. Provisions within the bill provide the Commodity Futures Trading Commission

(CFTC) and SEC with expanded regulatory authority over derivative and swap transactions. Regulations effected under this

legislation could preclude or impede some types of over-the-counter energy commodity transactions and/or require clearing

through regulated central counterparties, which could negatively impact the market for these transactions or result in extensive

margin and fee requirements. Additionally there may be material increased reporting requirements. The bill contains provisions

that should exempt certain derivatives end users from much of the clearing and margining requirements. However, the CFTC is

still developing the regulatory rules under the act and, it is not clear whether Xcel Energy will qualify for the exemption. In

addition, although the CFTC’s proposed rules would extend the end user exemption to margin requirements, they would impose a

requirement to have credit support agreements in their place. If Xcel Energy does not meet the end user exception, the margin

requirements could be significant. The full implications for Xcel Energy can not yet be determined until the various definitions

and rulemakings are completed.

FERC Order 741 addresses rulemaking addressing the credit policies of organized electric markets and limits the amount of

overall credit available to entities operating and places restrictions on netting of transactions within organized markets unless

certain market protocols are implemented by the RTO. The various RTOs are in the process of filing their proposed market

protocols to satisfy FERC Order 741 and these new market designs may lead to additional margin requirements that could impact

our liquidity.

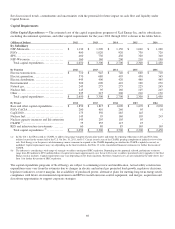

Pension Fund — Xcel Energy’s pension assets are invested in a diversified portfolio of domestic and international equity

securities, short–term to long-duration fixed income securities, and alternative investments, including, private equity, real estate

and commodity index investments. In January 2012, contributions of $190.5 million were made across four of Xcel Energy’s

pension plans. In 2011, contributions of $137.3 million were made across three of Xcel Energy’s pension plans. In 2010,

contributions of $34 million were made to the Xcel Energy Pension Plan. For future years, we anticipate contributions will be

made as necessary. The funded status and pension assumptions are summarized in the following tables:

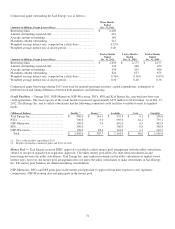

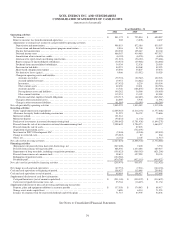

(Millions of Dollars) Dec. 31, 2011

Dec. 31, 2010

Fair value of pension assets................................

...............................

$

2,670 $

2,541

Projected pension obligation (a) ................................

...........................

3,226 3,030

Funded status ................................................................

.........

$

(556) $

(489)

(a) Excludes non-qualified plan of $55 million and $47 million at Dec. 31, 2011 and 2010, respectively.

Pension Assumptions 2012 2011

Discount rate ........................................................................... 5.00% 5.50%

Expected long-term rate of return ........................................................ 7.10 7.50

Capital Sources

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt, common stock

and hybrid securities to maintain desired capitalization ratios.

Short-Term Funding Sources — Xcel Energy uses a number of sources to fulfill short-term funding needs, including operating

cash flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term funding needs depend

in large part on financing needs for construction expenditures, working capital and dividend payments.

Short-Term Investments — Xcel Energy Inc., NSP-Minnesota, NSP-Wisconsin, PSCo and SPS maintain cash operating accounts

with Wells Fargo Bank. At Dec. 31, 2011, approximately $6.1 million of cash was held in these liquid operating accounts.

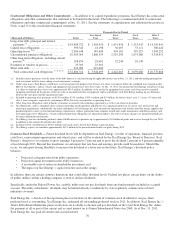

Commercial Paper — Xcel Energy Inc., NSP-Minnesota, NSP-Wisconsin, PSCo and SPS each have individual commercial paper

programs. NSP-Wisconsin received regulatory approval to initiate a commercial paper program beginning in 2011. The

authorized levels for these commercial paper programs are:

• $800 million for Xcel Energy Inc.;

• $700 million for PSCo;

• $500 million for NSP-Minnesota;

• $300 million for SPS; and

• $150 million for NSP-Wisconsin.